The Proposition of MBL (5152) In The Current Palm Oil Sector Landscape

100Mark

Publish date: Thu, 12 Oct 2023, 08:02 PM

The trajectory for Malaysia's palm oil industry is currently under scrutiny, with mixed indicators on the horizon. There's an observable increase in palm oil production, which has its benefits but also presents potential challenges. Expert projections estimate crude palm oil (CPO) prices to remain within the RM3,700 to RM4,000 per tonne bracket for 2023 to 2024.

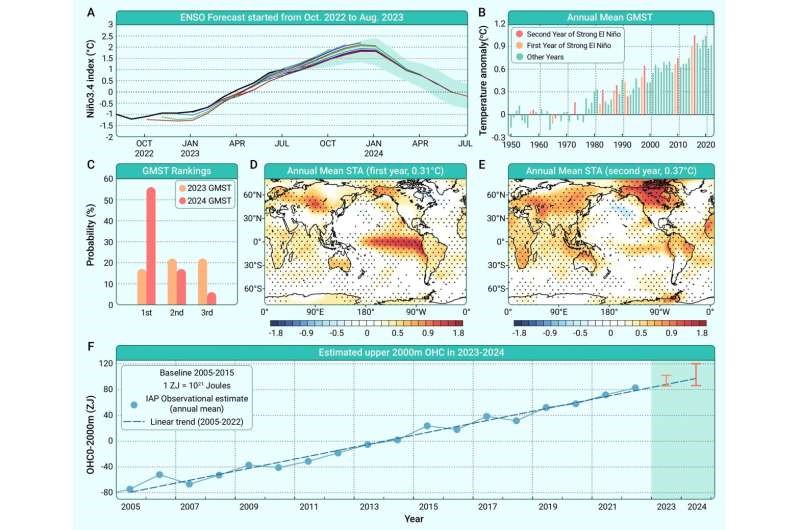

Factors like El Nino weather patterns and regional haze conditions are amongst the considerations influencing the sector. Despite current high production rates, these conditions could influence price adjustments by the second half of 2024.

From a wider lens, regional dynamics offer a more tempered view of this growth narrative. For palm oil to hold its market position, pricing strategies will be crucial, especially when stacked against other oils. While a price moderation is anticipated for the current period, a shift is projected by early 2024.

Now, let’s look into something more interesting.

Transitioning to MBL Group: Beginning its journey as a modest workshop in the 1980s, MBL now occupies a position in Bursa Malaysia. Their operations span from manufacturing oil seed equipment to managing palm and durian plantations.

A detailed look into MBL reveals a manufacturing division that has garnered international attention, particularly for its prowess in establishing Palm Kernel Crushing Plants. Their oil milling section remains focused on extracting palm oil, although there have been strategic changes with the recent sale of a significant branch. MBL's agricultural footprint can be found in Kelantan and Muar, Johor, with the latter also cultivating premium durian variants.

On the financial front, MBL has displayed consistency. Even amidst challenges, including those posed by the Covid-19 pandemic, they have navigated towards maintaining a level of profitability. With the stabilising palm oil market, MBL's projected financial trajectory mirrors their performance in FYE2021, though it remains to be seen how external factors influence these outcomes.

MBL's recent PE ratio of 2.09 times mirrors a significant profit in Q4FY2022, predominantly from the sale of Theron Holdings Sdn Bhd, which holds a substantial share in Symphony Life Berhad, another Malaysian listed entity.

Taking RM19.2 million PAT as a yardstick, this asset-heavy (NTA of RM0.930 versus the current share price of RM0.495) palm oil stalwart is trading at a PE of 6.34 times. This is significantly lower than its manufacturing counterparts which typically trade at double-digit PEs.

For those with a keen eye on dividends, it's noteworthy that MBL had a consistent dividend payout pattern before the Covid-19 era. In this post-pandemic phase, it's highly probable that they'll resume their dividend distributions.

In conclusion, MBL currently represents an undervalued opportunity in the market, especially considering the looming El Nino-driven palm oil trends. Investors would do well to consider this potential goldmine.

Disclaimer:

The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. All opinions expressed here are based on the author's personal research and experience, and they do not reflect the views of any organisations, affiliates, or partners. Before making any investment decisions, readers are advised to conduct their own research and consult with a qualified financial advisor. The author and publisher are not liable for any decisions made based on the content of this article.