Sumatec - What is the end game of TSHS?

Random Trading

Publish date: Sat, 30 Aug 2014, 07:31 PM

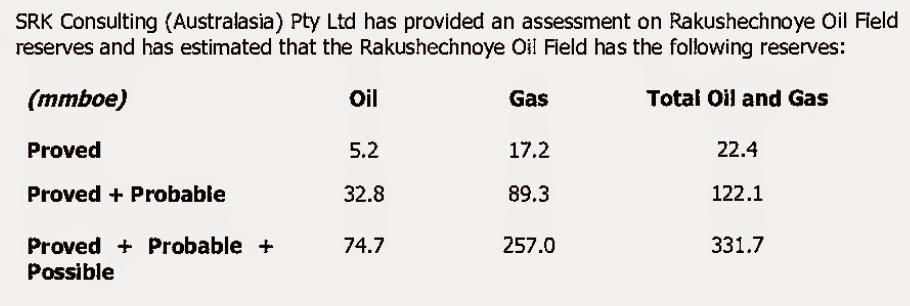

So, how good is this oil field? Here is the estimated oil reserves :

Proved reserves: 22.4 mmboe, Probable reserves: 99.7 mmboe, Possible reserves: 209.6 mmboe

He is not selling but someone does :

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Random Trading

Discussions

This is most appropriate for stayer : http://www.youtube.com/watch?v=MpGgCrcfWBg

Enjoy !

2014-08-30 23:38

Honestly, my intention of this article is not to say whether Sumatec is worth investing or not because I can never know what is TSHS motive in his investment. I think only he knows about it. This article is just my way of putting all the facts that I can get about how this counter become what it is today from some 2 years back. Often times we trade stocks just looking at its current state because we are too close to it but forget about the bigger picture about the history of it. Here is how I try to remind myself about what had happened to this counter for the last 2 yrs. Whether to invest or not is up to individual investor. But the facts remains the facts.

2014-08-30 23:49

Rt, this sumatec story to hype up n keep doing right is to fund the methanol plant which is a real asset. Not some 10 yr leased of probable.

2014-08-31 00:03

:) haiya most of scandal begin with accounting mislead... youngman read many2 case study before making any story :) take time to understand ...why TSHS making such move, gen-y still a lot to learn ^^

2014-08-31 00:12

@Random Trading.... some points for your info and to fill up your "jigsaw puzzle".

1. CSAM founder is Datuk Shireen Ann. She is the only Malaysian in the list of 2014 Forbes Asia Most Influential Businesswoman. CSAM mostly invest in equities, IPO and pre-IPO. She was proposed to be appointed as director for Sumatec (refer to Sumatec corporate brochure). In the same brochure also proposed Datuk Johari Razak for director (accepted the position some 2 month ago).

2. Tekad Mulia, Chan Yok Peng & Wan Kamaruddin - they are from Sumatec old management, and the deal is for them to reduce their share holding in Sumatec. That's why their names in the Bursa announcement on director disposal. The proceeds..... please check CNASIA.

3. By convention, an oilfield/reservoir is valued by its 2P, Proved + Probable reserves. In layman term, use car as an analogy, standard performance stated in catalogue as PROVED, ie once you drilled, then you got the oil. The car engine is added with turbo system, that is PROBABLE, ie to enhance the oil production rate (by well intervention, workover, infill drilling etc. like what Sumatec is doing now to increase to 2000bpd by year end). Engine overhaul as POSSIBLE. Worth to note another term C, CONTINGENT. With the advance of drilling technology, the C can be upgraded to P.

4. The risk of Sumatec business - apart from world oil price fluctuation, is the drilling enhancement activity (workover programme). The real/true characteristic of the well can only be progressively studied/known during drilling/production. This is evidence as shown in the Q2 report where Sumatec is facing a hiccup in workover program. The advantage of this is it serves as learning curve for Sumatec as stated in the report, the action taken to mitigate the hic-cup. This experience is useful in dealing with well and/or Buzachi field.

5. The Gas Development & Production Agreement, GDPA was not bundled together in regularisation plan. It was an additional agreement for gas development and production, 2014 to 2016 with a fee of USD 45M (3 years ie USD 15M per year). That is a guaranteed profit quaterly (eventhough there is a hiccup in oil production). An arrangement crafted to ensure 2 consecutive quarterly profit for PN17 upliftment.

6. News on TSHS and Kenmakmur plus another one (forget the name) signed MOU in Kazakhstan during PM Najib visit, to build methane plant (TSHS), LPG plant (Kenmakmur) and another guy (orchard farming???). Kenmakmur (owned by CYP & WK) sign a Framework Agreement with CNASIA in June 2014, to design, build and operate the LPG plant. The plant will be the off-taker for Sumatec/CaspiOil gas from Rakushenoye field. Reckon that CNASIA will do the cash call (bonus, enlarge capital, Right Issues, Warrant & RCPS) as the estimated cost would be USD 200M. In return, CNASIA will get profit guarantee of USD 55M/year for 5 years after full operation, estimated end 2017.

7. Since Kenmakmur is buying 100 MMSCF of 120 MMSCF from Rakushenoye field, which means only left 20 MMSCF for TSHS methane plant. Therefore, the raw material (gas) for methane plant should be from Buzachi field.

_______________________

Ok, now for the wishful thinking (this is a disclaimer).

Some rumours going around that linking Petronas with Sumatec.

Actually Petronas want to have foothold in Kazakhstan, but cannot since TSHS is already here. TSHS & the gang is a big "taiko" in Kazakhstan (do you know that due to TSHS, Malaysian do not require a visa to visit kazakhstan). The only way is for Petronas to invest through TSHS. So Petronas need to take up some stakes in these LPG & methane plant and in return TSHS will get some portion of investment in Turkmenistan.

So there you go.... the sinister plan of TSHS revealed.... (another disclaimer)

--------------------------------------

2014-08-31 08:22

Hi ogre, really thanks for your input. It really enlighten me on certain issues. As for sinister, I do agree with Rahim3088 that being smart doesn't mean he is sinister at least innocent until proven guilty right. I always stated that I'm not saying the whole Sumatec thing is a scam because so far he did deliver his promise by injecting O&G assets and successfully lifted PN17 from the company albeit made a killing out of it. But if he is going to bring Sumatec to become a serious O&G player with partners like Petronas and bring sustainable profit to the company and shareholder then I will have to say he deserved the money he earned. Let's us see what is his next move and whether Sumatec can really be transformed into a great O&G player. It is going to be very interesting.

2014-08-31 08:49

Posted by SANG-JERO > Aug 30, 2014 10:08 PM | Report Abuse X

No need to argue....Fund managers/Institution will look at the numbers stated below plus

forecasted numbers before putting in their money.....

I f you think good ..BUY....If you think lousy and you cannot make money....keep your money in the bank or ASB etc.....period..

Let's see what happen on tuesday onwards.

Real time TA also looks fine barring any unforeseen circumstances.

Revenue ('000) 27,488

Profit Attb. to SH ('000) 105,629

EPS (Cent) 16.26

PE 2.86

DPS (Cent) 0.00

NAPS 0.1460

ROE (%) 111.37

--------------------------------------------------------------------------------------------------------------------

P/s: Solly ahh..my england and matematic no good.....I good in Tunnnnnnnnnngguuu only

2014-08-31 11:21

Hi s123445, act the 280M is not exact figure. Is derived from the initial payment from Sumatec of total 418.5M minus his share of placement plus rights issues total amount to 134.25 M. So the act amount is around 280M.

2014-08-31 20:26

@Random Trading, thank you for your good effort in putting up the pieces/puzzles behind Old and New Suma.

While chasing for more profits, many fail to see the ugly side. They will brash aside any negative info or fact (intentionally or unintentionally) to achieve their objectives and continue to denies any warning signals be it good or ugly.

Appreciate your openness in sharing info. Love to hear more from you.

Happy Investing!

Rich Dad: Money Don't Grows on Tree.

2014-08-31 20:55

Hi smartinv, in the market for any stock there must be some people bullish and some people bearish about it that's how we got seller and buyer so the transaction can happen. Buy or sell, bullish or bearish are just individual investment decision. The thing is some take it too personally and became very hostile if there is any info or comments that they don't like. Once a wise man told me that don't take any particular investment too personally, it will cloud your judgement. I believe this is one of the best advice I ever had.

You too Happy Investing!

2014-08-31 21:38

Rt, I guess as much but the numbers were 284.25 so thought I missed out something

2014-08-31 21:52

@Random Trading.

Agree with you on "Once a wise man told me that don't take any particular investment too personally, it will cloud your judgement".

Thank you for the sharing.

2014-09-01 07:30

Good morning,

@Random Trading

I love to follow some facts. Very interesting and logical.

Yet this is business world. Old adage.. business and pleasure do not mix..

Keep it up your analysis. Good game anyway.

2014-09-01 07:59

This just the beginning of TSHS game... Sumatec is his stepping stone for the come back...

You should read into CN Asia MOU with KenMakmore as well...

Then you will get a bigger picture of what he is planning to do...

2014-09-01 13:15

Cheers for such an informative article for people interested in Sumatec but not interested enough to do such a lengthy research. Keep up the good work, appreciate it!

2014-09-01 15:47

Sumatec + PDZ will be bigger than Malaysia Petronas after the share increase to RM 20...

2014-09-01 17:23

"akh731 Sumatec + PDZ will be bigger than Malaysia Petronas after the share increase to RM 20... "

Blind faith without substance!

2014-09-01 18:30

TSHS reportedly making a come back with a Bang! More counters is connected to him like Sumatec, CN Asia, Borneo Oil, PDZ and more to come. Look like he is buiding his Listed Empire again similar to the Renong Group back in the 90s?

He is the prodigy of TDZ and could have strong financial backing by TDZ.

Retailers frenzy provide good support to his coming back story. Lets see institutional funds willing to join the wagon after upliftment of Suma from PN17.

Happy Investing Everyone!

Rich Dad: Money dont grows on trees.

2014-09-01 19:18

Haha, smartinv, the renong saga still not fully solved and the public still don't know (someone knows I guess) exactly what happened then and now another renong is in the making already! Is interesting. If Sumatec, PDZ and the others are going to become part of the new 'renong' group then we shouldn't wait anymore to jump on the bandwagon! Looks like RM 20 a share is not too far away I guess...

2014-09-01 19:41

Imagination run wild.... all the more on low iq ppl...in an absive country

2014-09-01 19:44

Random Trading, thank you for sharing, I really appreciate your good effort.

2014-09-01 20:11

thank you random trading for sharing the detailed history of sumatec and the big names involved. the upliftment of suma from PN17 is not certain yet, any news on the upliftment??

2014-09-02 00:30

Bro.. Tekad Mulia is part of the old management of Sumatec...Under the agreement with the new Suma management ( Which you can say is their White Knight) they are supposed to dispose their shares after a certain period...So nothing alarming there...

You should put in more effort to do more research on the matter rather than just speculating in bad faith as some investors may be spooked as they would think that there's something funny going on there when actually its not (on this matter)...Otherwise to me your article is fine and informative...(However your credibility and accuracy is somewhat spoilt by that negative bit about CYP & Wan from Tekad Mulia disposing their shares)....

2014-09-02 00:53

Hi Aladdin, as I said, I only stated the facts. Those directors selling their shares is a fact and I didn't mentioned anything that it is not a good sign or alarming sign. I simply stated that they are disposing. So to take the info as positive sign or negative sign is up to individual reader. So if anyone think is negative sign then is their own discretion. Sorry if it spook you away from this counter. You should just ignore the article and proceed with your trading plan.

2014-09-02 08:43

what's the reason for the complicated exchange of shares, rights, just so to confuse us further? Thus before I actually put in my hard earned money, I want to fully understand the reason for these cross dealings. Thanks to Random Trading for the sharing and research. We are one step better informed.

2014-09-02 09:24

Looks like road blocks slightly clearing. Hope there will be showtime and fireworks in 2nd session haha.

2014-09-02 10:34

petikan...

17.5 sen a share and all WB for free. harga sekarang dah banyak untung....

2014-09-02 15:37

Interesting criminal thought and some good comments.

From my experience, I don't think they will be able to cash out with this kind of movement. If this is a scam, it's not attractive yet to pull the net. There are more to come..

2014-09-04 17:42

Hi DumbnDumbe, ya, I do think that if this is really just a pump and dump thing, it is not yet the time to pull the net. This counter will probably be the most speculative and highly traded stock for quite awhile. If it is really a real growth story, it will certainly be the most exciting stock in recent history. If it is a scam then it still has the rights issue to play out so the end game won't be so soon. As for some investors that believe that as long as TSHS is not selling then there is no reason to do so themselves, they should recall what happen to stocks such as Mtronic, Harvest, AGlobal (now rename Nextnat) and Scomnet. Raymond Chan, the center figure of these stocks only sold his shares at 'loss' after the share price collapsed. But we all know that he is certainly not losing money for his 'investment' in those stocks. So if you follow the 'I only sell if he sells' strategy, I afraid it could be too late.

2014-09-04 20:19

Nice article. fact help us to think clearly. Do you know where we can dig more info about sumatec? in term number of human resources, the breakdown of where they put the money and to whom?

2014-09-05 09:05

Haha..Thanks for bringing up Raymond Chan.

I would say that is a classic example on how cashing out is done. Create the hype. Spiked it up and distribute it all the way down. Trouble with people is that they always sees it this way- how much it has fallen from the peak and not how much it has risen from the bottom. One can never maximize profit but able to maximize the loss.

After saying that, you can't really compare apples to oranges. If I were to compare tshs case with another company, I would liken this to Ekran case by looking at its modus operandi. And not Tenggara Capital in year 2000 as that scam lasted only 2 and half months from a low of 1.45 to peaked at 8.70 in that short period.

Just my 2 sen thought here. Applying disclaimer just like you. Haha!

2014-09-07 14:45

what is the end game of Tan Sri Halim Saad?

i know! it is to build up Sumatec to be a big, respectable, profitable and fearful world class O&G player.

2014-09-07 16:46

RT......your article definitely has enlightened many ppl regarding Sumatec......but many can see only the trees but not the forest.......its very difficult to TSHS to remove the stigma as "con man" he is trying to prove his innocence thru Suma & fulfilled his promises......everybody shd be given a second chance.........it would be interesting to know what actually you think of HS & Sumatec besides laying out the facts.......

2014-09-07 17:04

Hi Noraini, to be honest, I don't really trust him or any well connected tycoon for that matter. As I mentioned above, to be smart like him as indicated in this article doesn't mean he is a 'con man'. He could be seriously looking to build something or a legacy for himself since we all know he doesn't really needs the money or the fame and so far he did lived up to his promises. So as I said, only he knows what is his plan. If he is serious about it and build it in good faith then honestly it is good for the shareholders, if not then we all know how it will ends. Let's see!

2014-09-07 17:48

sumatec npdz belum berakhir,next week is second chance spt yg dikatakan oleh puan noraini...friday siapa sangka boleh up terutamanya pdz..inilah malaysia market,,hanya siapa yg berani saja dapat beli harga rendah..pergerakan diluar jangka..saya mengambil pengalaman pdz ketika harga 27c dua tiga minggu lepas tiba2 melonjak 34n dan seterus ke 42bsebelum jatuh minggu lepas .begitu juga sumatec..mari kita renong ,org yg beli suma harga 50,52 dan keatas mesti mengharap harga naik lagi dgn pelbagai cerita tentangnya.kesimpulannya suma n pdz masih relevan next week n bergerak positif

2014-09-07 18:05

1st round made plenty of money by swapping JIA of Raku oilfileld with cash and shares

What happen?? Cant even deliver the projected profit for 2014??

2nd round to make plenty more money by swapping lost making companies which owns the new oilfields even when these oilfieds are already producing oil??

2rounds and to make plenty also??

With toned down profit projection for 2014??For investors :What happened to Suma shares when it reached 60+sen?

2ndround and future profit projection ammounting to rm billions based on what??

Definitely cannot be based on the 1st round swapped assets which cant even delver as projected in 2014

Based on the newly acquired assets owned by two companies losing money even when these assets are alredy producing oil??

What is the end game??

Any substance to back all this projections when a mere rm60+ cant be achieved for 2014??

More questions than answers??

Any good news for.......

..........Investment or Entertainment........??

2014-09-23 13:45

I go along with randomtrading and appreciate his articles for me to make an informed decision as an investor and i also have heard few times before where money is concerned.......TRUST is a fool 's CURRENCY........anyway i agree ........lets see

2014-09-23 14:31

The sell down of the counter before the RI is quite surprising especially it is currently trading so close to the indicative price. 40 sen is a quite an important support so if it breaks then things might get very ugly. For those bought the mother share near the peak already loss one third of their investment. It is even worse for the warrant holders that see half of their investment gone. Of course, as long as you don't cut loss it is still only a paper loss, but how long one can hold? Can you afford not to have any cut loss point at all? Is up to individual investor to decide.

2014-09-23 18:14

WOW! This is an excellent post of very high quality. I was doing some research on beaten down oil & gas counters and making a list of companies "with potential" to invest/speculate in. Sumatec is one of them. Your post here has helped A LOT towards my understanding. Thanks for your great effort. I will be reading your other posts too, that's for sure. It's very difficult to find quality analysis and posts concerning Bursa Malaysia but I'm encouraged after reading this.

By the way, the Corston-Smith Asset Management Managing Director in Malaysia is Datuk Shireen Muhiudeen who writes "Governance Matters" in StarBizWeek on Saturdays. For what it's worth, my wife was her classmate at BBGS in the 70s and she knows what type of person Datuk Shireen is. I'm very sure she had done a lot of research on Sumatec before approving the purchase for the client, whoever this may be.

And the involvement of people like Halim Saad and also Chua Ma Yu - they have the experience and credibility. This isn't a group of market manipulators out to hype and chase up a counter... and then selling off for huge profits after retail investors had piled in. I believe they are after genuine projects with potential. I'm going to put Sumatec at the top of my list regardless of the O&G turmoil, crude oil prices etc. The present low price presents an opportunity for those who have holding power.

Thanks again for this very informative post.

2014-12-08 14:50

I think the guys at sumatec are as bewildered as every one else out there. How will they navigate through the current environment?? I cannot help thinking that THS has made a booboo...and as proven in the past his so called expert team of managers are not particulary expert. He has a history of not succeeding outside of Malaysia.

2014-12-21 22:13

rikki

@randomtrading....thank you again for the excellent report. Looks like all the money was/are coming from investors. Sumatec is also putting all the eggs in one basket. Khazastan, how's the country risk & ratings ? Don't think any of our Malaysian banks interested.

Sumatec also managed to get for the approval to uplift from PN17 super fast. How long did Ho Hup took ?

By the way, why are there no Investment Bank research on this Sumatec even though already profitable 8 months ago? Why was Sona already covered by HLIB & and given loan by BNP eventhough still reporting losses? I leave the question for our investors to answer.

2014-08-30 23:32