Stallion - HengYuan Outlook 8 April 2018

StallionInvestment

Publish date: Sun, 08 Apr 2018, 10:04 AM

After my earlier posting on the drop of HengYuan, some followers were asking me how do I see in HengYuan. So, I am here to provide in depth analysis on this stock.

As I said earlier, I did warn that it is ridiculous when it was trading at the price near to 19. It justify my view by the drop from 19 to 6. So, now is the rebound phase and this has trigger the interest of the followers. Especially when Mr. Koon said he is coming back into HengYuan, this give the retail trader a confident booster.

I will see HengYuan from two different angles which I will elaborate at below.

Let see from Fundamental point of view :

Fourth Quarter result release showing that a small improvement of revenue but profit drop approximately 50% which you can see earlier quarter EPS was 120.59 compare to the most recent quarter which is only 61.18. So, from this we notice the business remain the same but what is curious is the drop of nearly 50% of the profit which require you dig out more info from the quarterly report. So, coming quarter most likely will be release on 24 May 2018 base on the historical release date. Unless you are pretty confident which HengYuan will resume the growth momentum for the revenue and profit, else it will be risky to hold on your position unless got more than 20% PROFIT as your buffer.

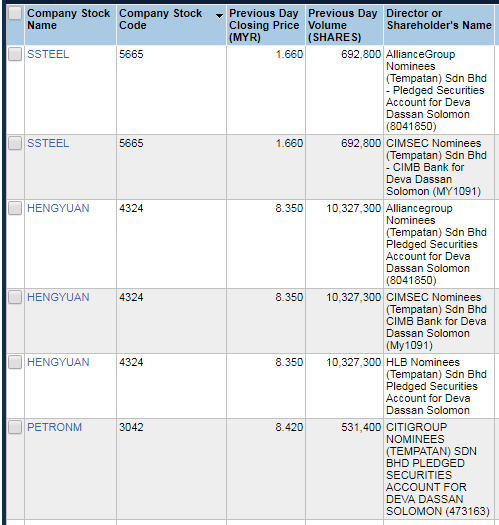

From the top 30 major shareholders which we notice Solomon holders name do appear very frequent as I printscreen attach as below. Name such as Deva Dassan Solomon, Helina Shanti Solomon, John Devaraj Solomon, Selina Sharmalar Solomon. Beside, Mr Koon Yew Yin, we should watch out closely Solomon family transaction.

Below I provide the screen capture of using Insage Professional showing Deva Dassan Solomon shareholding we could find the stock he is holding is SSteel, HengYuan and Petronm.

On top of that, we do notice actively disposal of HengYuan by Amanahraya Trustee Berhad – Amanah Saham Bumiputra. When the shareholding go below 5%, then it can move wild. Early alert for fellow HengYuan Trader. Technically speaking, the game is not over even with such huge drop from 19 to 6.

Technical Point of View :

- HengYuan started the rally early year 2017 from the level 1.98 till 19.16. So, I am plotting the chart using Fibonacci Retracement which show you each support resistance if you have the basic knowledge how to read this. So, the first resistance level peg at 8.54. When it able to penetrate this level then we shall look at the psychological resistance at 10. If able to breakout with strong volume together with buying interest, then I am at 10.50 as the next resistance. From this level onward, I think anything go above will be extra for you. There is such thing in technical reading call cover gap. So, if would to cover previous gap down, then it is likely to rebound as high as 14. I would not expect it break above 15.48 level because if break this level. Then we can see bullish momentum and this definitely need to come together with a good revenue and profit. If this don’t happen, to me. 14 is more than enough. Nothing more than that. Anyone making more than 14 is crazy profit. You are rewarded for holding longer position than other.

It fulfill my 1 Cross 4 criteria ( Do attend M+Online Technical 101 course ) to capture the entry level detection.

Conclusion : if there is no external factor such as TRADE WAR getting serious, my personal view is HengYuan should ride on the uptrend then don’t hold when near to next quarter result date. That is my personal opinion.

Disclaimer : Trade at your own risk and do consult your dealer/trader for any investment decision.

Do follow my FB and Telegram,

Trade with the beat dancing in the stock market

Learning Non stop together

Capture the bull and bear

https://www.facebook.com/stevent.hee.33

https://t.me/steventhee628

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

CharlesT

Fm yr previous posts nothing to shout abt...not impressive at all

I only believe Jack Kong in TA readings on Hengyuan

2018-04-08 12:53