StallionInvestment : Ranhill - Koon Yew Yin one of stock that he own

StallionInvestment

Publish date: Wed, 29 Aug 2018, 03:46 PM

Let talk about Energy issue first before we go further on Ranhill.

As we know our PowerPlant is heavily depend on coal to generate electricty and it is not environmental friendly at all. So, our newly appointed Minister Yeo Bee Yin is going to focus on renewable energy.

Below is some of the content which i copy from TheStar.

Malaysia is heavily dependent on coal-fired power plants, with Yeo saying that the dependence has increased to 42.5% in 2016 compared with 8.3% in 1996.

"If we do not stop this, there will be more to come. Some people say that because it’s cheap, we should be allowed to go ahead," she said.

"But I want to tell you that because we do not produce coal in Malaysia, our country will be in trouble because we are reliant on something that we do not have.

"That is the reason why renewable energy is something the Government wants to move forward to," said Yeo.

In the Pakatan Harapan manifesto, the coalition pledged to increase renewable energy from the current 2% to 20% by 2025.

Pakatan also pledged to reduce the dependence on coal-fired power plants which is one of the power generation methods that has a serious impact on CO2 emissions.

Read more at https://www.thestar.com.my/news/nation/2018/07/12/ministry-to-review-ipp-contracts-four-cancelled/#B5y4P6yEYso6bIXf.99

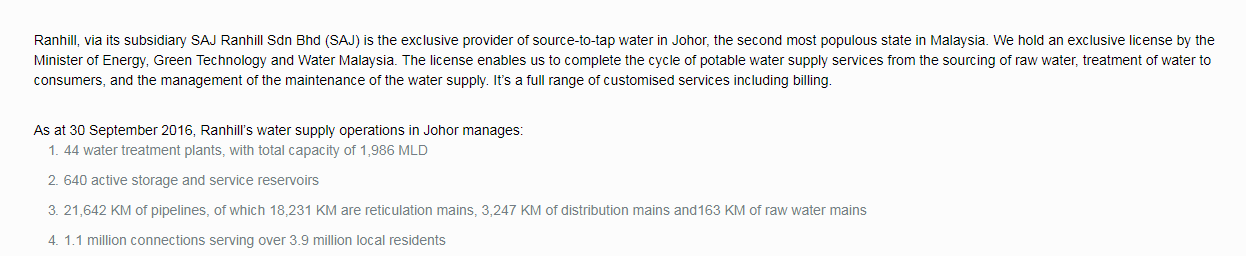

So what does RANHILL DO?

As people said, picture tell thousand word. So, i just printscreen what is Ranhill doing.

So, this tell us the broad picture of the direction of Minister of The Energy, Green Technology, Science and Climate Change.

So, let us look other perspective of Ranhill from several point which i stated below :

1. LOW P/E RATIO : 5.73

2. High Dividend Yield : 6.10%

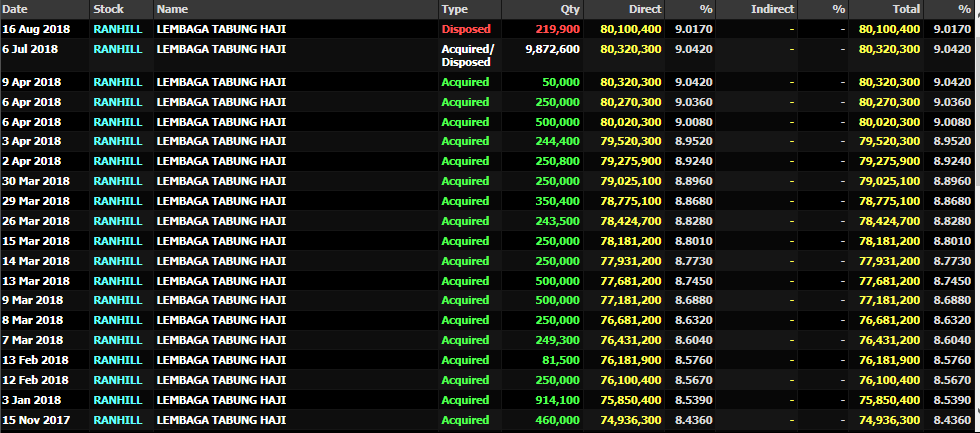

3. Heavy accumulation activity by Lembaga Tabung Haji

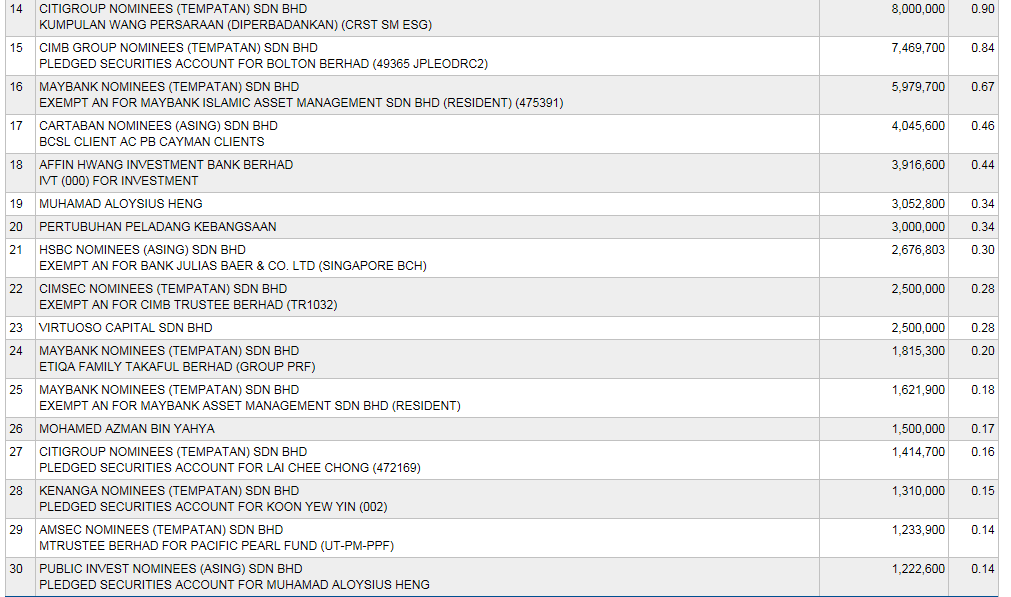

4. Famous Investor - Mr. Koon Yew Yin ( source obtain from Insage )

5. Improving cummulative EPS for the first 2 quarter financial year 2018 which is 3.78 compare to first 2 quarter financial year 2017 which is 3.40

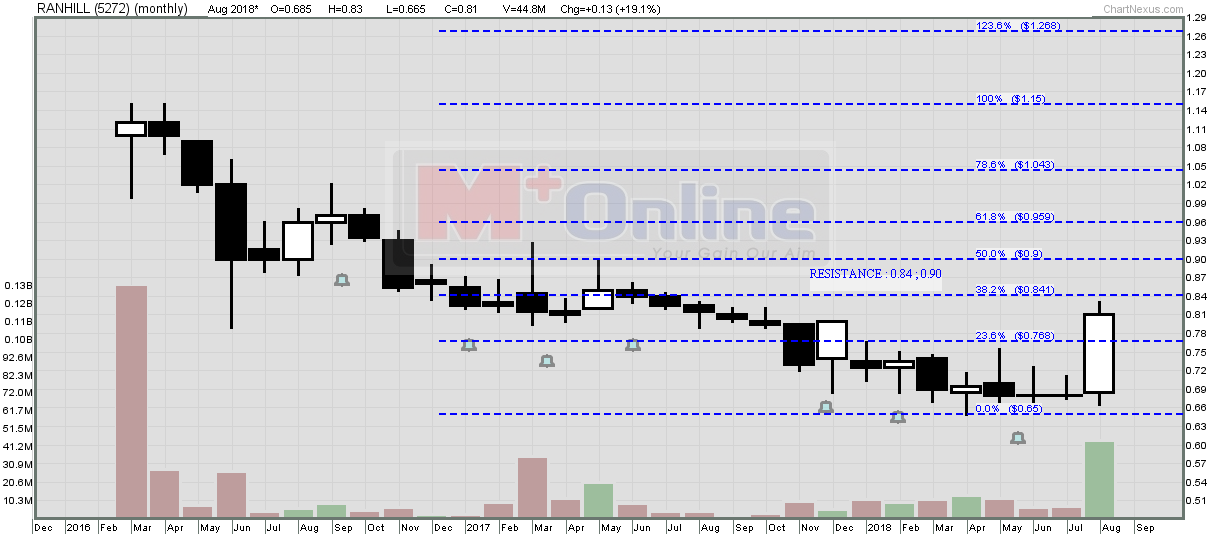

So, let look from technical perspective.

On top , this is the recent news which publish on TheEdge.

Ranhill said it targets to own and operate power plants that deliver clean energy of 1,000 megawatts (MW), and 3,000 million litres per day (MLD) of water and wastewater treatment capacity, 700 MLD from the international segment by 2022, particularly in China and Thailand.

"Growth in the local environment segment is expected to be supported by the increasing demand in water for the state of Johor, especially with the development of new housing and industrial areas," it said in a Bursa Malaysia filing today, adding that its domestic capacity is expected to grow 3% to 4% annually.

"We are bullish in securing more industrial water and wastewater treatment projects, with an additional treatment capacity not only from Amata Industrial park, but other industrial parks in Thailand," the filing added.

Complete article can be obtain by clicking below linkage.

http://www.theedgemarkets.com/article/ranhill-2q-net-profit-improves-slightly-higher-water-consumption

Disclaimer : Trade at your own risk. Above is merely for educational sharing purpose. Kindly consult your dealer/remisier for any investment decision.

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-16

RANHILL2024-08-16

RANHILL2024-08-15

RANHILL2024-08-15

RANHILL2024-08-15

RANHILL2024-08-15

RANHILL2024-08-15

RANHILL2024-08-12

RANHILL2024-08-12

RANHILL2024-08-12

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-09

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL2024-08-08

RANHILL

.png)

.png)