Stock Of The Day

Stock Of The Day - TDM(2054)

wecan2088

Publish date: Thu, 12 Jan 2017, 09:53 AM

TDM - Seeing Stronger Earnings In 4Q

Author: PublicInvest | Publish date: Tue, 29 Nov 2016, 09:19 AM

TDM 9MFY16 reported a core net profit of RM36.1m, making up 55% of our full year earnings forecasts after stripping out unrealized gain on the foreign exchange in fixed income securities amounting to RM8.4m and impairment loss on receivable, RM1.3m. Though it fell below our expectations, we think that it will be able to catch up in 4Q given the recovery in FFB production and sharp increase in CPO prices. Hence, our earnings forecasts remain unchanged. No dividend was declared for the quarter. We maintain our Outperform call with an unchanged TP of RM0.85.

- 3QFY16 revenue (QoQ: -0.3%, YoY: +4.3%). 3QFY16 revenue increased 4.2% YoY to RM102.8m, led by an improved revenue from healthcare segment while plantation sales remained steady. During the quarter, plantation sales fell slightly to RM57.9m as weaker FFB production (-26.7% YoY) was cushioned by stronger CPO prices (+25.2% YoY). Average CPO prices jumped from RM2,102/mt to RM2,631/mt while palm kernel prices surged from RM1,417/mt to RM2,288/mt. Healthcare sales registered a 14% YoY increase on the back of a 10% growth in the number of both inpatients and outpatients.

- 3QFY16 core earnings (QoQ: +76%, YoY: +85.2%). Though healthcare earnings dropped 26% YoY to RM1.7m, the Group’s earnings rose 85.2% YoY, boosted by plantation earnings after stripping out the RM2.1m unrealized FX gain in fixed income securities. Plantation earnings surged 130% YoY to RM19m, driven by stronger palm kernel price, which helped lower the production cost and lower start-up losses in Indonesian operation. On the other hand, healthcare earnings weakened due to higher admin costs as a result of higher staff costs and pre-operating costs at Kuala Terengganu Medical Specialist, which is scheduled to open soon.

- Maintain Outperform call. Though 9-month earnings met only 55% of our full-year forecasts, we remain upbeat on the 4Q earnings outlook, led by recovery of FFB production and stronger CPO prices. Healthcare arm is likely to register better earnings on the back of new hospital contribution.

异军突起 - TDM - 阿Boon

Author: Tan KW | Publish date: Fri, 6 Jan 2017, 09:27 AM

Friday, January 6, 2017

TDM 另类2月之星

最近由于油棕价格大幅度走高,因此有许多投资者也开始关注跟油棕种植相关的种植股,而一些种植股因受投资者的追捧而走高。

投资者追捧种植股并非没有道理,因为7月至9月份时,CPO价格介于2200令吉至2600令吉之间;可是迈入2016年10月份后,CPO的价格已经从2600令吉走高至目前的3100令吉以上。

以下为2016年CPO每个月的均价:-

然而,棕油价格一片大好的时刻,却有很多种植公司在这个时候面对产量下跌的窘境。所以CPO走高未必会惠及所有油棕种植公司, 产量下跌或许还会抵消CPO价格上扬所带来的好处。

因此在挑选种植股的时候,必须特别留意产量和价格这两个因素。

目前,在众多种植股当中,我只留意一家种植公司,那就是TDM(嘉隆发展,2054,主板种植股)。

我会关注它的原因其实很简单,因为这家公司最近的产量提升。在大多数种植公司都面对产量下跌的时候,TDM的产量不仅没有下跌,反而还大幅度提升。

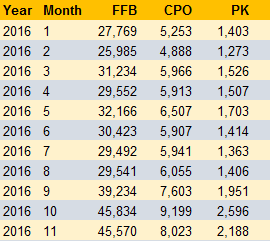

先来看看以下TDM截至2016年11月30日的油棕产量数据:

接着,再将以上数据按季来整理:

2016年第一季:FFB 84987吨,CPO 16107吨,PK 4203吨

2016年第二季:FFB 92141吨,CPO 18327吨,PK 4625吨

2016年第三季:FFB 98267吨,CPO 19598吨,PK 4720吨

2016年第四季:FFB 91404吨,CPO 17223吨,PK 4784吨

注:第四季数据只有10月和11月,12月的数据还没公布

从以上的整理后的数据来看,第四季虽然只公布了两个月的数据,但是无论在FFB、CPO及PK都已经接近,甚至超越第三季度的产量。

个人觉得只要12月份的产量不出差错,那么第四季总产量铁定会超越第三季。但要12月发生产量突发性暴跌的可能性几乎是不可能,

TDM第四季的业绩将会在2017年2月份公布,因此可留意该股的走势并且部署至2月业绩公布的时候。

More articles on Stock Of The Day

Discussions

Be the first to like this. Showing 0 of 0 comments