RHBBANK - Will we see a breakout soon?

DividendGuy67

Publish date: Tue, 16 Jul 2024, 12:43 AM

If the tea leaves hold true, I think we may see a breakout soon over the next month or next few months.

There's a lot of naysayers, rejecting RHBBANK for valid reasons as the stock has spent over a decade consolidating inside that triangle. Many position traders and investors have lost patience. This is a laggard where the strong move up over the past 3 days surprised many participants, going from 5.53 to nearly 5.70 in such a short time.

I was already fully positioned (slightly overweighted) prior to that move, at an average buy price of 5.50, or 5.30 after dividends. The stock has paid 40 sen dividend yield the past 3 years which translated to a generous payout of 7% per annum dividend yield. Just a small price gain is enough to provide me with a 9% CAGR total return, and very likely, if there's a breakout, substantially beat that.

The monthly chart below says a thousand words to me. I won't be surprised if over the next 1-3 years, we'll see prices in the green zone indicated (ranging 6.6 to 7.4 or around RM7 say). That thick strong uptrend line since 1998 is very nice to see. Lower prices is a buy in my book.

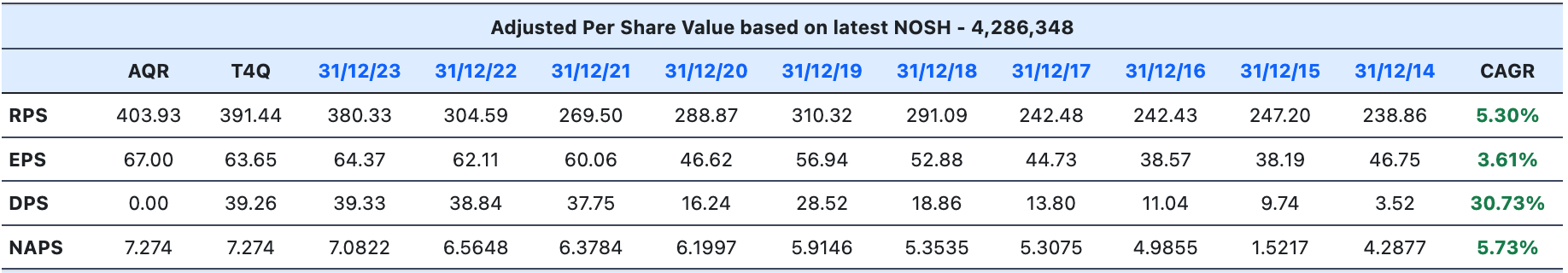

Past 10 years fundamentals (B)

DPS solid rise past 3 years. 40 sen per share equates to around 7% per annum dividend yield. What's not to like?

Investing and position trading doesn't have to be that difficult. Wish us luck!

Disclaimer: As always, you alone are fully responsible for your trading and investment decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Feb 02, 2025

Created by DividendGuy67 | Jan 25, 2025

Created by DividendGuy67 | Jan 24, 2025

Created by DividendGuy67 | Jan 22, 2025