[TRV] LIIHEN – Benefiting from strong US economy.

TRV Stock Analyzer

Publish date: Sun, 08 Mar 2020, 02:44 PM

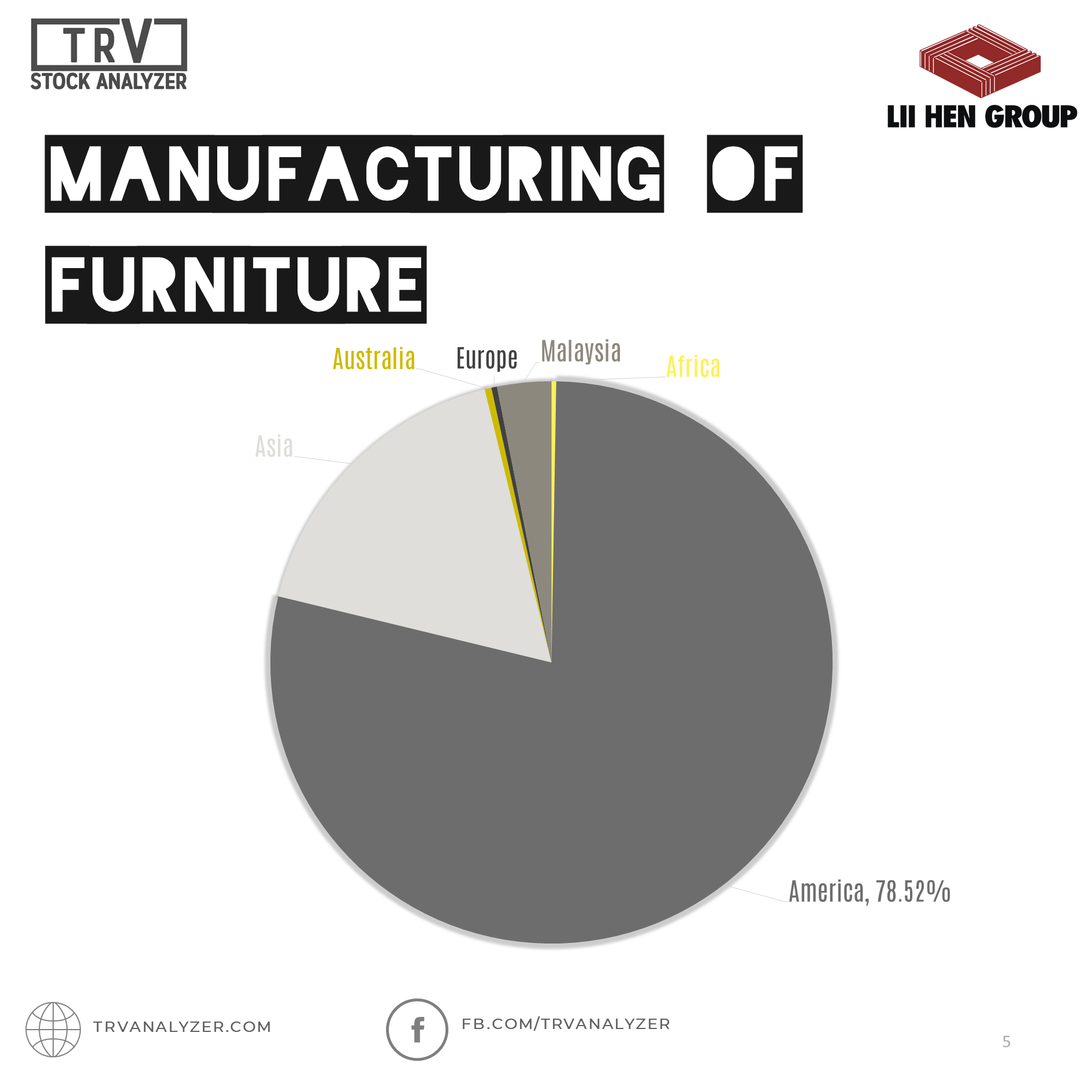

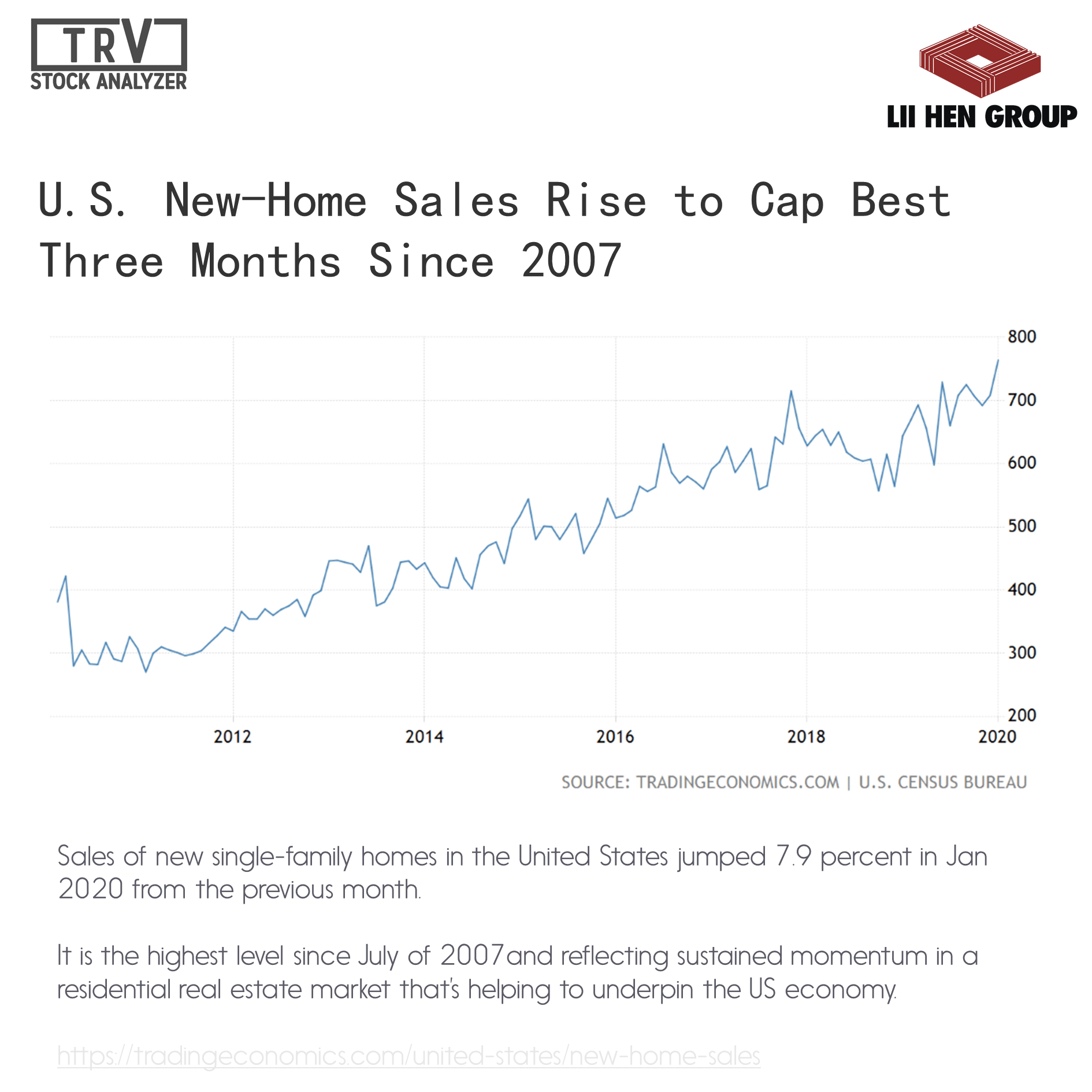

The US furniture industry has been on a steady growth curve driven by a strong economy, with consumer spending on furniture reaching USD114.2 billion in 2018, up 6.7% from 2017, according to the US Bureau of Economic Analysis (BEA). While high GDP growth in 2018 is positive for the housing and household spending, the US-China trade tension and global indicate a looming correction. The impositions of tariffs on imported materials and finished goods would impact both manufacturing and retailers in the US as this would trickle down to the consumer as higher retail prices. In the recent round of talks, the reduced threat of a trade war with China is however a positive sign for the country and furniture retail at large.

Employment trends in the US remained strong with 4% unemployment rate, the lowest in decades. Employment opportunities equal money in consumer pockets. Consumer spending makes up two-thirds of the U.S. economy, which translates directly to retail sales.

Another encouraging economic indicator for home furnishings is the expected mini-housing boom as millennials, who are now staying with their parents, are due to enter the real-estate market in the next few years. This ramp up in new household will drive increased demand for furniture and home decors.

View the complete analysis of LIIHEN here:

http://bit.ly/32WxkOo

View the complete analysis of LIIHEN here:

http://bit.ly/32WxkOo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on TRV Stock Analyzer

Created by TRV Stock Analyzer | May 24, 2022

Created by TRV Stock Analyzer | Feb 28, 2021

Created by TRV Stock Analyzer | Jan 11, 2021

Created by TRV Stock Analyzer | Dec 08, 2020

Created by TRV Stock Analyzer | Oct 21, 2020

Created by TRV Stock Analyzer | Oct 05, 2020

Created by TRV Stock Analyzer | Sep 13, 2020

kakashit

agree, probably the best furniture counter in term of forex win, us market amid us-china tradewar, and the runner up is Pohuat

2020-03-08 16:20