Feb. Trading Idea : MBL (5152) - Plantation related counter with PE under 10

Triple

Publish date: Thu, 02 Feb 2017, 03:37 PM

INTRODUCTION

MBL is a world-leading palm oil machinery manufacturer specializes in oil seed crushing machinery. Recently they diversify into upstream oil palm business by acquired 2 Indonesian companies called PT Serdang Jaya Perdana and PT Banyuasin Nusantara Sejahtera which run edible oil milling.

MBL is different with other plantation companies. They don't have any landbank to plant palm oil trees. Actually they have one or two but there is no huge impact on their profit or loss.

WHY MBL IS A GOOD BUY?

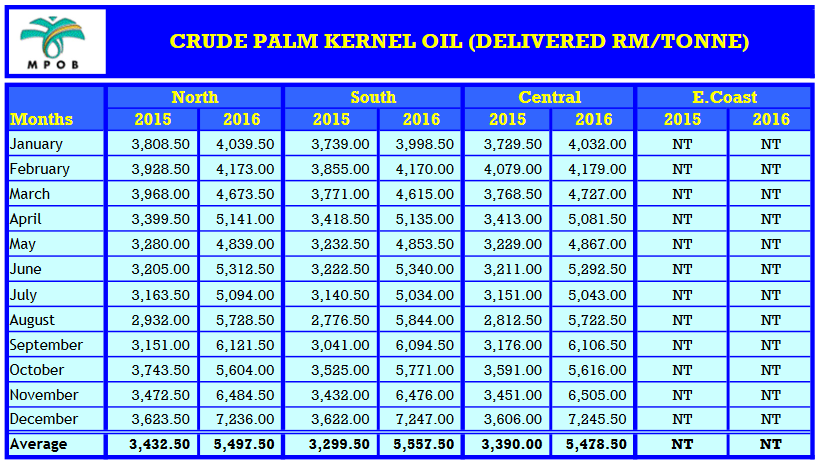

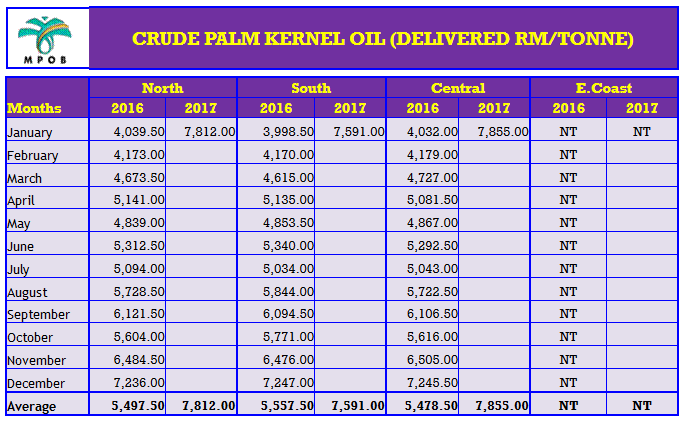

1 GOOD CPKO PRICE

Crude palm kernel oil price has increased more than 20% since September 2016 to December 2016. Currently CPKO is trading at RM8400 per tonne. Click here to check the latest price.

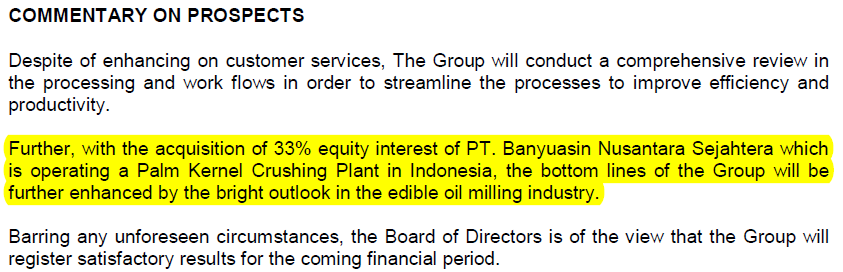

2 NEW CONTRIBUTION FROM NEW ASSOCIATE COMPANY

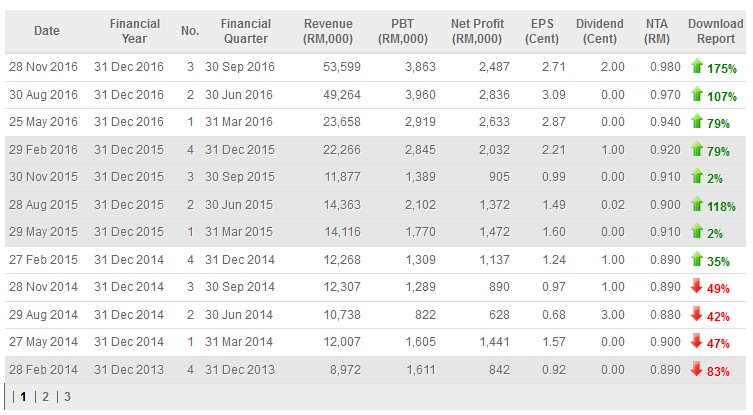

MBL acquired 51% of PT Serdang Jaya Perdana on 28 September 2015. After 3 months, MBL's revenue and PBT increased more than 100% contribution from this new subsidiary.

Few months ago, MBL acquired another associate company called PT Banyuasin Nusantara Sejahtera which will make new contribution in next quarter and result should be released in the end of Feb 2017.

3 GOOD FUNDAMENTAL : SUSTAINABLE PROFITABILITY

Look at its revenue, almost grew 5 times within a year. The group is eyeing merger and acquisition (M&A) from time to time to make sure that there is enhancement in their future earnings. Their edible oil milling business allows them to generate a recurring income stream instead of just manufacturing and trading oil seed crushing machinery.

4 PERFORMANCE OF SHARE PRICE : TA IS COMING.

Though crude palm kernel oil (CPKO) price has gained significantly in these few months but there is no rally in MBL's share price. Its share price is hovering around RM1 since August 2016 till end of Jan 2017. In this few days we can see MBL and MBL-WA are in trending now. Hence I think it is time to buy this good bargain stock and then wait for its quarter result.

Some useful links.

- http://www.mbl.com

- http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5152

- http://bepi.mpob.gov.my/index.php/en

- http://www.theedgemarkets.com/en/node/231724 September 28, 2015

- http://www.theedgemarkets.com/en/node/249572 December 21, 2015

- http://www.kwongwah.com.my/?p=145375 May 25, 2016

(Buy at your own risk)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Triple's Blog

Created by Triple | Feb 27, 2017

Discussions

No. They also operate edible oil milling by acquired 2 Indonesian companies.

1) Acquired 51% of PT Serdang Jaya Perdana on 28 September 2015

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4877593

2) Acquired 33% of PT Banyuasin Nusantara Sejahtera on 25 October 2016.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5240577

That's why their profit has jumped significantly since QR which released on 29 February 2016.

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5152

2017-02-02 21:53

PT Banyuasin Nusantara will make contribution to MBL's bottom line in next QR.

2017-02-02 22:00

Is the subsidiary selling Crude Palm Kernel? Is MBL Benefit from higher Palm Kernel price?

2017-02-03 17:00

firehawk

thks for sharing ... mbl is new to me. May i ask, for time being, it only making crushing m/c, but not operates oil extracting factory, right?

2017-02-02 21:22