好股稳中求(二):中钢大马(CSC Steel)和聚美钢铁厂(Choo Bee)

Trader

Publish date: Fri, 16 Sep 2016, 05:49 PM

中钢大马,CSC Steel

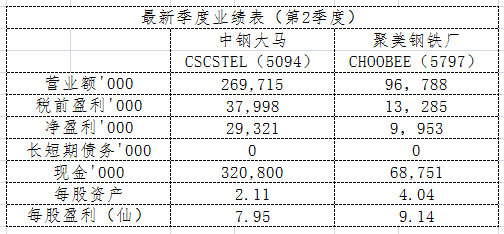

我国最大冷轧钢卷的制造商,目前的本益比仍低于10,零负债和握有3.2亿的现金。和大部分背负庞大债务、很少派发股息的同行相比,确实一流,归功于优秀的管理层,是价值投资人喜欢的类型。

中钢大马每年可生产62万4000公吨冷轧钢卷,众所周知,冷轧钢卷的原材料是热轧钢卷,美佳钢铁的停止营运促使前者可以以更低廉的价格从母公司买进原材料,从中赚取更高的盈利赚幅。

过去一个月当中,CSCSTEL最低价为1.41,最高价为1.89,上升48仙或34%,表现较为平稳。目前股价还有很大的上升空间,因之前有位大股东在市场抛售手中庞大的股票数量,压低了不少的价钱。

中钢大马要在中短期平稳地上升至市场给予的目标价,也不是不可能的事,前提是钢铁价必须维持在目前的价位,及美佳钢铁仍处于暂停营运当中。

聚美钢铁厂,Choo Bee

股数仅109,900,000股,表现最为亮眼的中型钢铁股,最近一季的业绩,每股盈利高达9.14仙。现金流方面,零负债,是家净现金公司。前年派息12仙(2次),去年6仙(1次),今年累计4仙,股息会否陆续有来??

在今年6月的访谈中,执行主席MARK TAN提到自2009年开始,聚美钢铁厂就没有把hollow和gas pipes产品出口至美国、澳洲和中东国家,原因在于高成本的原材料导致无法给海外客户较低的竞争价格。

美佳钢铁厂的停止营运会否意味着聚美钢铁厂在未来可以再把该产品恢复出口至海外市场,以增加营业额??

笔者在1.70价位买了一些,然后在本周最后一个交易日又在2.10价位买了另一批,目前平均价位于1.90。笔者深信聚美钢铁厂潜能无限,论每股盈利、或每股资产,聚美钢铁厂的股价中短期都有可能站上3令吉或更高,接下来的业绩,确实值得期待。

(纯属分享,买卖自负)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 優秀的基本面分析者,應該學會孤獨。

Discussions

Agree. Charbee hoon is cheap and delicious meal but not ChooBee.

Posted by IBanker > Sep 16, 2016 07:01 PM | Report Abuse

Coz if BeeHun i have more confidence. Cheap and delicious. I will buy.

2016-09-25 05:20

probability

to help me read only..

Steel horse, CSCSTEL

China's largest manufacturer of cold-rolled steel coil, current PE ratios remain below 10, zero debt and holds 320 million cash. And most of the big debt compared to their counterparts, the lack of a dividend, class, thanks to good management, is the type of value investors like.

Steel horses annual production of 624,000 tonnes of cold-rolled steel sheet in coil, as we all know, cold rolled steel coil material is hot-rolled steel coils, mega steel ceased to promote the former from parent company buys raw materials at cheaper prices, reaping higher profit earning site.

Last month, CSCSTEL the lowest price was 1.41, the highest price of 1.89, up 48 cents, or 34%, is more stable. Now there is still a lot of space, because before there was a large shareholder in the market sell a huge number of shares, lowering prices.

Steel smooth rose to Malaysia in the short term target price from the market, is not out of the question, provided that the price must be maintained at the current price of steel, and the mega steel operation still in suspension.

Poly-us steel mills, CHOOBEE

Shares 109,900,000 shares only, most bright medium steel stocks, the latest quarter's performance, up to 9.14 cents in earnings per share. Cash flow, debt free, is net cash company. Dividend of 12 cents the year before last (2 times), 6 cents of last year (1), 4 cents this year, dividends will be??

In June this year in an interview with Executive Chairman MARK TAN referred to since the beginning of 2009, poly-us steel is not hollow and gas pipes products exported to the United States, Australia and the Middle East, because of the high cost of raw materials cannot be to overseas customers low, competitive prices.

Mega steel plant to stop operations will mean that poly-us steel mill in the future can then send the product to restore exports to overseas markets, to increase sales??

I 1.70 at bought some, and then on the last trading day of this week and bought another batch of 2.10 at, the current average price at 1.90. The author is convinced that poly-us steel mills of limitlessness, on the earnings per share, or share assets, poly-us steel's share price in the short-term may 3 million or higher, the next performance, really worth looking forward to.

(A share, sale of ego)

2016-09-16 17:58