Profitability and Efficiency of Liihen, Pohuat and Homeriz

UncleShares

Publish date: Sat, 04 Feb 2017, 12:36 AM

Purpose: This analysis is not a buy-call. This is purely an analysis from my knowledge and my point of view.

Ps: If there is any mistake, kindly comment the article and I will correct it next time and I'll truely appreciate that.

I took two companies in same level (Liihen and Pohuat) and one company with lower level (Homeriz) as my objective. The analysis will include Profitability and Efficiency. Furthermore, I took five years as my analysis period and all of the data are come from the companies' annual reports respectively.

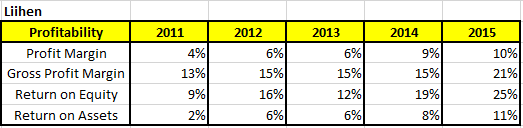

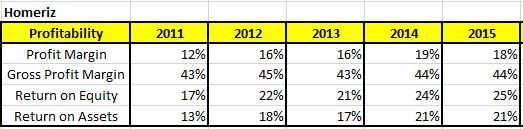

Profitability

From the above table showing, Homeriz actually has the better profit margin. While Pohuat and Liihen are almost similar with each other. The higher profit margin may be because of better cost control or higher selling price.

In addition, Homeriz has higher ROA than others but the figure won't tell the true. In this 5 years, fixed assets of Homeriz is decreasing because it didn't acquire any assets. Pohuat and Liihen did add in new assets in this five years and therefore the rate of increase in their ROA is less than Homeriz.

For the ROE, a long term investor will pay more attention in ROE. It indicates how well the company to use shareholders' money to generate profit. It also show how well is the management team. Pohuat and Liihen are increasing its ROE sharply while Homeriz's is increasing but with lower rate.

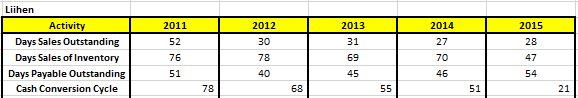

Efficiency

Days Sales Outstanding (DSO) - Measure the number of days that a company takes to collect the revenue after a sale has been made.

Days Sales of Inventory (DSI) - Measure how long a company takes to turn its inventory into sales.

Days Payable Outstandings (DPO) - Measure how long a company takes to pay its invioce from trade creditors.

Cash Conversion Cycle (CCC) - Measure how long a company takes to convert cash on hand into inventory and account payable, through sales and account receivable, and then back into cash (DSO + DSI - DPO).

So far, you can see that Liihen and Pohuat have a very short cash conversion cycle which are 21days and 27days. While Homeriz's is 103 days. The difference is quite big. This may be related to their profit margin. Since there is no appreciation in the value of inventory and no interest income from debtor, so they lower their selling price and cause the collection of cash faster. As a result, Liihen and Pohuat have lower profit margin and lower cash conversion cycle.

***If you imagine that you are a supermarket owner and you will know how important it is. Let say you order 100 boxes of mineral water and the credit term is 30 days and you need 60 days to sell out all of the mineral water and get back the cash. That means you have to pay your creditor before you sell out all of the mineral water. So, you have to use the money make from other products. What if the same problem occur in other product? Your cash will stuck at there and you have to pump in additional cash.

If you only use 20 days to sell out all, then you have 10 days extra to order more mineral water and make more money. Of course, the lower the better.

Put in other view, this is an altertive way to finance your company. You sell out all the mineral water in 20 days but the amout due on 30days. That means you hold the money 10 days with no interest expense.

In conclusion, analyzing the figure in financial statement in not the end of selecting good stock. But it is a basic guideline in long-term investment.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on UncleShares Analysis

Discussions

thx for sharing on how to select good stocks. This article is not asking anyone to buy Liihen, Pohuat or Homeritz, just guiding newbies on how important of cash flow and returns from money invested into assets etc..

2017-02-04 14:07

Thanks for sharing. It is important to take note the Cash Flow of the company.

2017-03-10 09:09

Thank you for sharing, agreed to gohkimhock, it is important for newbies learn the basic of investing skills & never expect unrealistic return targets.

Unrealistic targets will most likely ended up guaranteed loss in investing.

2017-09-23 18:44

prices od the stocks will gap up Mon!! due to the hurrican effects in US!

2017-09-23 18:47

newbie92

Why Latitude not in list?

2017-02-04 00:44