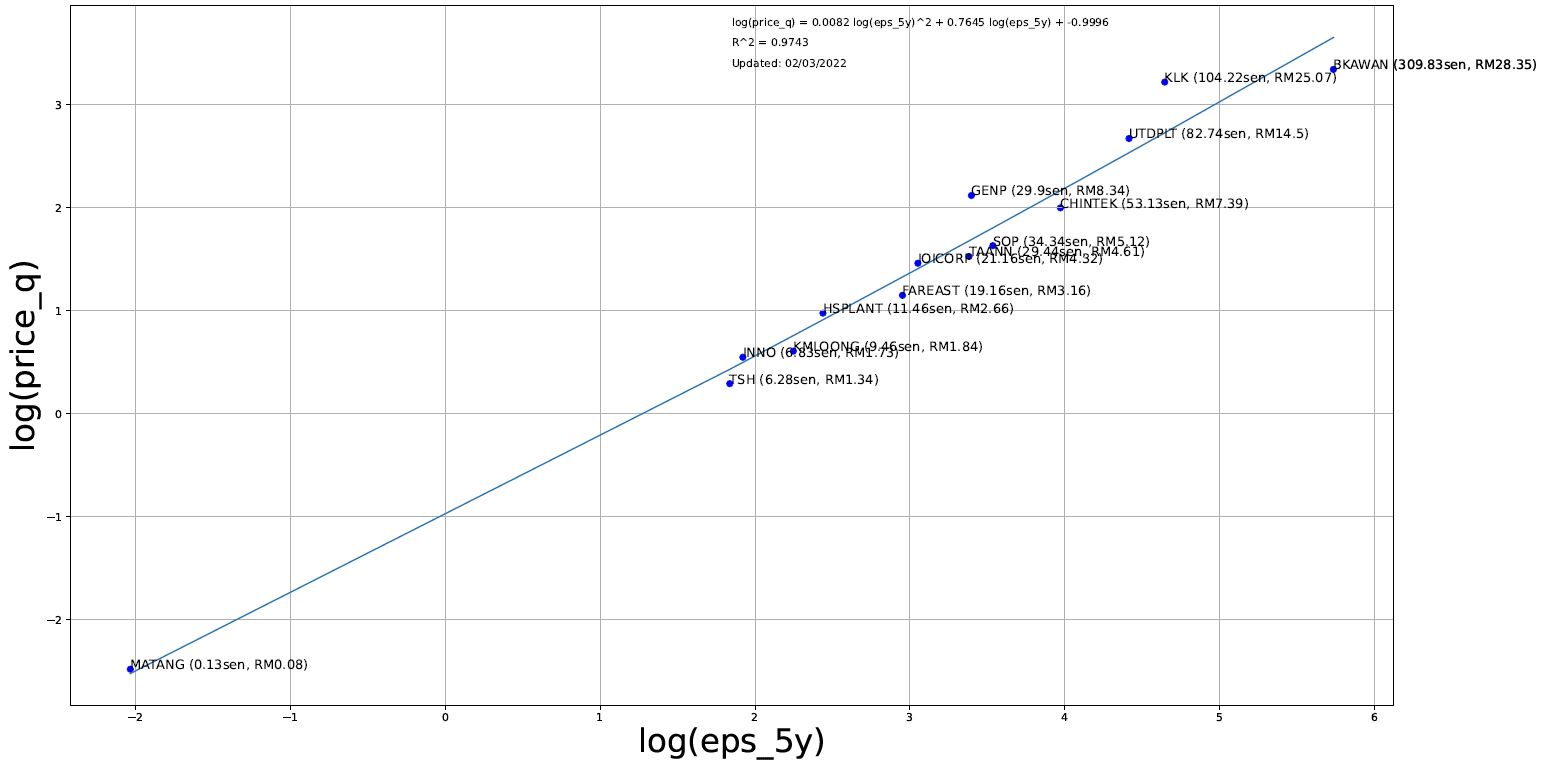

LVI: Plantation Sector Price to EPS Peer Comparison

Mark Goh

Publish date: Wed, 02 Mar 2022, 04:26 PM

Following my two posts (Energy and Semiconductor) Sector Price to EPS Peer Comparison) on sector Price to eps comparisons, 'plantation' stocks are lit right now too. So I took a stab -here it goes.

After using the same methodology, the plantation stocks that are left are:

INNO, KLK, TAANN, BKAWAN, SOP, UTDPLT, IOICORP, KMLOONG, FAREAST, HSPLANT, CHINTEK, TSH, GENP, MATANG

This time the plot looks extremely 'on the line' with an R squared of 0.97! There is no further proof needed that PE ratio works.

Caption: Right click and 'open in another tab' to see the full resolution graph.

If you want to know why some plantation stocks are more richly valued versus others? Answer: It is their earnings track record. The higher the eps_5y then the higher the price.

Hope my analysis helps you in hunting for value stocks. If you draw any conclusions on the plot above do write your comments below.

Thank you

More articles on Little Value Investor

Created by Mark Goh | Mar 11, 2022