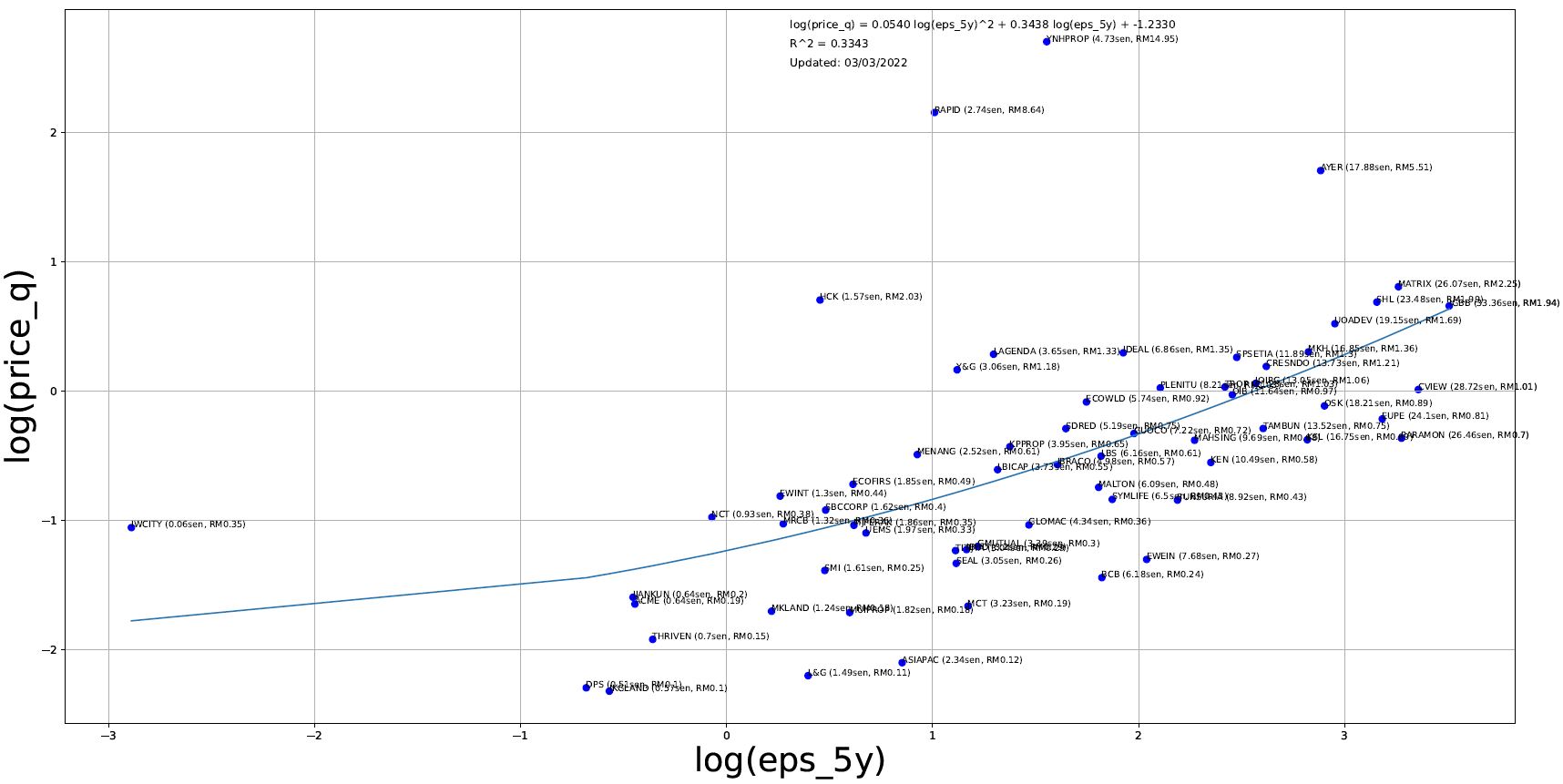

LVI: Property Sector Price to EPS Peer Comparison

Mark Goh

Publish date: Thu, 03 Mar 2022, 12:12 PM

In continuation of my series of sector analysis (previously Semiconductor, Energy, and Plantation) let's look at the property sector.

However upon closer inspection of a randomly selected stock PARAMON, I noticed that the plot showed that it is relatively undervalues versus its peers (being that it is located below the regression line) and I noted that PARAMON have a one off large net profit in the quarter 31 March 2020 of RM474.6mil this might skew the results of 'average 5y of eps' calculation. Reason? I am not interested at this point - I am going to still maintain my scope of analysis to be sector wide and not on individual companies.

Solution: I apply an outlier filter for each stock to filter out any extraordinary gains in a particular quarter.

This would give me an indication of the relative valuation of the stock versus its peers 'without' considering any extraordinary gains in the last 5 years.

The results, for the property sector we get an R2 of 0.20 which indicates that there are many counters in the property market that are richly priced and many are also poorly priced. This I cannot say for the plantation sector of R2 of above >0.90 where it looks like the market has efficiently priced the plantation sector.

Property stocks under the regression line would be considered undervalued versus its peers that are on the line or above it. Conclusively, there are higher chance of hunting for value stocks in the property sector right now.

Hope this helps with your selection of any property stocks you might have. Interested to read any other conclusion that you may draw from my analysis - please put them in the comment below.

Thank you Caption: To view full size image please right click and view the image in another tab.

Caption: To view full size image please right click and view the image in another tab.

More articles on Little Value Investor

Created by Mark Goh | Mar 11, 2022