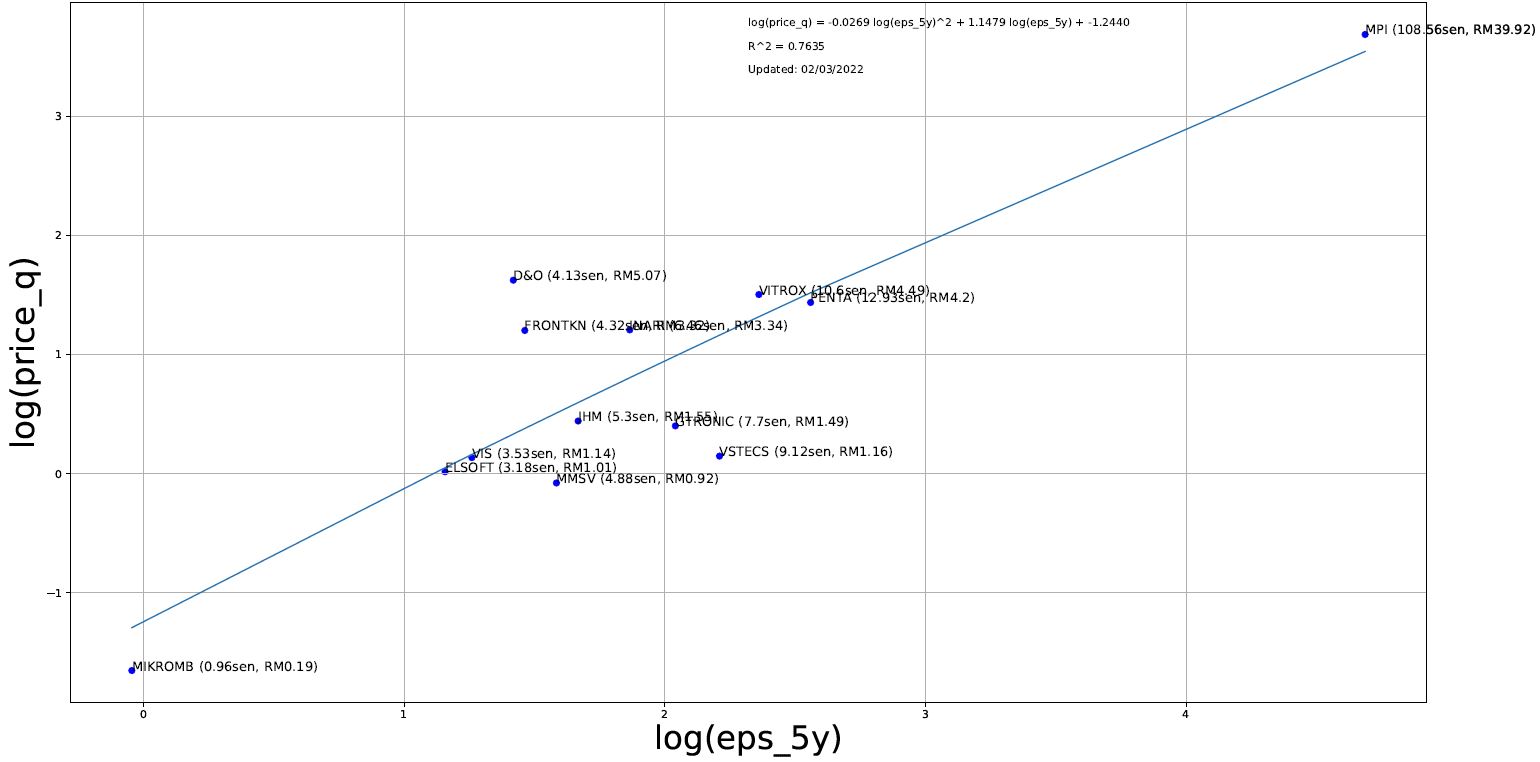

LVI: Semiconductor Sector Price to EPS Peer Comparison

Mark Goh

Publish date: Wed, 02 Mar 2022, 12:53 PM

I was curious to understand how the semiconductor peers are are priced relative to each other. This is what triggered my research.

Using some python programming support here is the methodoloogy I adopt:

I filtered all stocks that are under 'semiconductor' and 'technology equipment' subsectors in the entire Bursa. The result is it include all the following component stocks:

GREATEC, UWC, FRONTKN, GTRONIC, VIS, MPI, INARI, VSTECS, D&O, JHM, JFTECH, PENTA, ICTZONE, MMSV, VITROX, ELSOFT, UNISEM, UCREST, AIMFLEX, MI, AEMULUS, KESM, MIKROMB, CABNET, EDARAN, GENETEC, TURIYA, FSBM, JCY, MQTECH, K1, NOTION, VC, MLAB, SMTRACK, KEYASIC, ITRONIC, KGROUP, TRIVE

After researching all stocks on Bursa, over the last few years - I can confidently deduce that the equity market is mostly driven by the relationship between price and eps. I found proof in this - probably a post for another time. So I decided to adopt the PE method of analysis. Formula I would be using is as follows:

vwamc, Volume weighted average market capitalization

price = vwamc / no of shares

eps_5y, Average 20 net profit of trailing twelve months

As a conservative approach, I am dropping all the stocks that net profit ttm that are negative. With this the following counters are left:

FRONTKN, GTRONIC, VIS, MPI, INARI, VSTECS, D&O, JHM, PENTA, MMSV, VITROX, ELSOFT, MIKROMB

And plot price and eps on a log scale.

Here is what I received:

Caption: Please right click and view the image in another tab.[it looks distorted in this post]

The linear regression line an R squared of 0.76 which is pretty good. (Correction: Polynomial regression line is used)

From here, all stocks that are below the line are trading at relatively undervalue and above the sector are stocks that are overvalue. I need to stress the word relatively because there are some companies that deserve a lower valuation and some deserve a higher valuation.

However, my analysis allowed me to narrow my search of a value semiconductor stock. Lately, I have been looking at Gtronic, MMSV and Vstec.

More articles on Little Value Investor

Created by Mark Goh | Mar 11, 2022