LAMBO - Multiple Proposal of Share Consolidation, Rights Issue With Free Warrants (COMPLETED on 13/9/21)

whistlebower99

Publish date: Thu, 22 Jul 2021, 11:14 PM

MULTIPLE PROPOSALS

As At 22/7/21

LAMBO GROUP BERHAD ("LAMBO" OR THE "COMPANY")

- PROPOSED SHARE CONSOLIDATION; AND

- PROPOSED RIGHTS ISSUE WITH WARRANTS (COLLECTIVELY REFERRED TO AS THE "PROPOSALS")

https://www.klsescreener.com/v2/stocks/view/0018/lambo-group-berhad

Total Issued shares = 4,987,880,099

Total Warrant B = 1,051,058,992

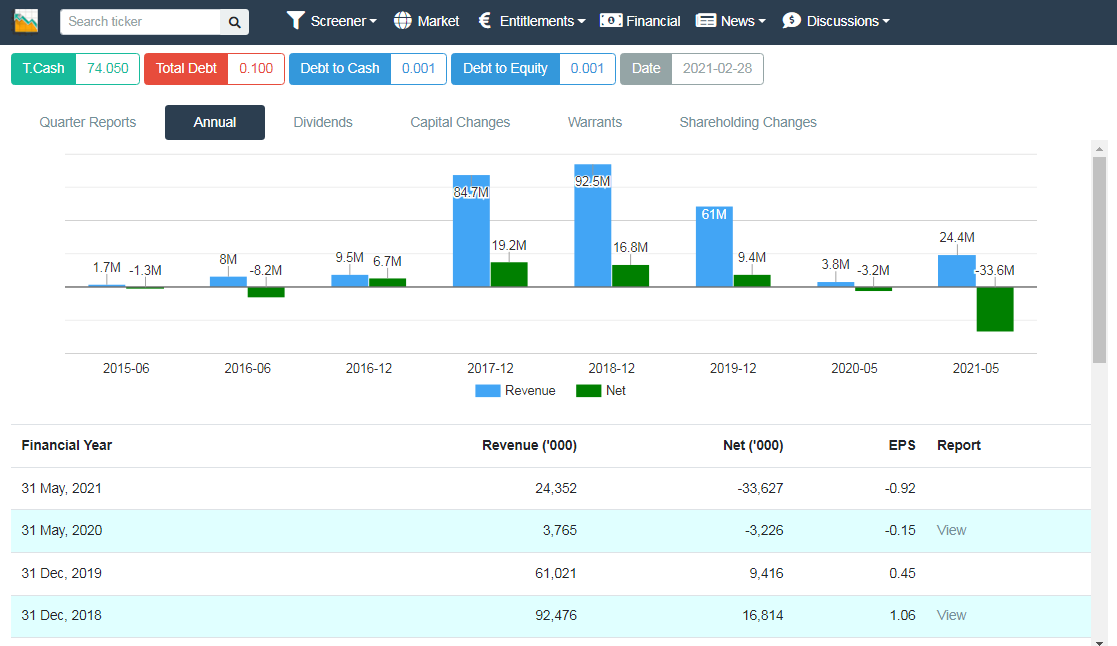

Incurred annual losses since 2005 except between 2016 to 2019.

As at last quarterly date (28/2/21),

Total Cash =RM74.050 million

Total Debt = RM0.10 million

Cash rich from share issuance and sale via ESOS and Private Placement. Yet the directors have decded to undertake Share Consolidation and Rights Issue exercise.

The current total issued shares of 4,987,880,099 is the result of

1. conversion of warrants mostly in 2019

2. frequent and massive share issuance to ESOS and Private Placement in 2020 until March 2021

Click link for Additional Listing Announcement / Subdivison of Shares due to ESOS, Private Placement and Warrant conversion,

For announcement of past and present Multiple Proposals, clink the below link.

On behalf of the Board of Directors of Lambo, Mercury Securities Sdn Bhd wishes to announce that the Company proposes to undertake the following:-

(i) proposed consolidation of every 25 existing ordinary shares in Lambo (“Lambo Shares” or “Shares”) into 1 Lambo Share (“Consolidated Share”) (“Proposed Share Consolidation”); and

(ii) proposed renounceable rights issue of up to 1,207,787,815 new Shares (“Rights Shares”) together with up to 603,893,907 free detachable warrants in Lambo (“Warrants C”) on the basis of 10 Rights Shares together with 5 free Warrants C for every 2 Consolidated Shares held by the entitled shareholders on an entitlement date to be determined (“Proposed Rights Issue with Warrants”),

(collectively referred to as the “Proposals”).

The details of the Proposals are set out in the attachment.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=114754&name=EA_GA_ATTACHMENTS

This announcement is dated 12 May 2021.

CIRCULAR TO SHAREHOLDERS IN RELATION TO THE:-

- PROPOSED CONSOLIDATION OF EVERY 25 EXISTING ORDINARY SHARES IN LAMBO GROUP BERHAD (LAMBO SHARES OR SHARES) INTO 1 LAMBO SHARE (CONSOLIDATED SHARE) (PROPOSED SHARE CONSOLIDATION); AND

- PROPOSED RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,207,787,815 NEW SHARES (RIGHTS SHARES) TOGETHER WITH UP TO 483,115,126 FREE DETACHABLE WARRANTS IN LAMBO (WARRANTS C) ON THE BASIS OF 5 RIGHTS SHARES TOGETHER WITH 2 FREE WARRANTS C FOR EVERY 1 CONSOLIDATED SHARE HELD BY THE ENTITLED SHAREHOLDERS ON AN ENTITLEMENT DATE TO BE DETERMINED (PROPOSED RIGHTS ISSUE WITH WARRANTS) (COLLECTIVELY REFERRED TO AS THE PROPOSALS)

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=209476&name=EA_DS_ATTACHMENTS

Date Announced: 24 June 2021

Salient Points:

- Existing Warrant B. As at 13 April 2021, being the latest practicable date prior to the date of this announcement (“LPD”), the Company has 4,987,880,099 Lambo Shares in issue and 1,051,058,992 outstanding warrants 2019/2024 issued by the Company, which have an exercise price of RM0.16 each and are expiring on 29 April 2024 (“Warrants B”).

- New Warrant C.

Issue size : Up to 483,115,126 Warrants C.

Tenure of the Warrants C : 3 years commencing on and including the date of issuance of the Warrants C.

CONSOLIDATION OF EVERY 25 EXISTING ORDINARY SHARES IN LAMBO GROUP BERHAD ("LAMBO" OR THE "COMPANY") ("LAMBO SHARES" OR "SHARES") HELD AT 5.00 P.M. ON 26 JULY 2021 INTO 1 LAMBO SHARE ("CONSOLIDATED SHARE") ("SHARE CONSOLIDATION")

Ex-Date : 23 Jul 2021

Entitlement Date : 26 Jul 2021

Date Announced: 9 Jul 2021

At end day of 26 Jul 2021, the total issued shares of 4,987,880,099 will be consolidated into 199,515,203 shares and 1,051,058,992 warrant B will be consolidated into 42,042,359 warrants. The consolidate shares and considated warrant B will be listed on 27 Jul 2021.

Assuming that the rights shares are fully subscribed, upon completion of the rights issue,

Total issued shares = 1,197,091,218

The total number of warrant B will be adjusted accordingly.

Total number of New warrant C = 399,030,406

1. Share Consolidation will result in 25 shares being consolidated into 1 share at end of day of 26 Jul 2021 (Etitlement date) and listed o 27 Jul 2021. Warrant B will also be consolidated from 25 warrants into 1 warrant.

2. Shareholders will see their shareholding reduced by 25 times.

3. If closing price is 1sen on 22 Jul 2021, then the reference price of consolidated share will be 25sen on 23 Jul 2021 (Ex-date)

4. As an illustration, a shareholder originally holding 50,000 shares will end up with 2000 shares on 23 Jul 2021

5. Likewise, holder of warrant B will see their holdings reduced by 25 times

6. The reference price of the consolidated warrant will be 12.5sen on 23 Jul 2021

7. The consolidated shares and warrants will be traded for a few market days pending the announcement of the dates related to the rights issue with free warrants exercise

8. Refer to stocks like SANICHI and PASUKGB (recently undergone similar Mutiple Proposals) to have an idea of the price movement of the consolidated shares, before/after ex-date for the rights issue and after the listing of the rights shares.

9. Most likely the price of warrant B (12.5sen on 23 Jul 2021) might drop further as the exercise price would have been adjusted upward as a result of the consolidation. Thie trend can be seen in the case of SANICHI-WE.

9. For the rights issue, the entitlement is 5 RIGHTS SHARES TOGETHER WITH 2 FREE WARRANTS C FOR EVERY 1 CONSOLIDATED SHARE

PRICE CHART OF SANICHI AND PASUKGB THAT HAD SHARES CONSOLIDATION AND RIGHT ISSUE

For both SANICHI and PASUKGB rights issue, the total valid acceptances were under-subscribed, This means that many shareholders are not willing to take out more money to pay for the rights shares plus free warrants, after incurring huge losses due to consolidation exercise or losing confidence in the stock.

However, there were high percentage of Total valid excess applications as shown in the tables. These excess applications were likely from major shareholders, company directors, operator, or friendly parties in view of the under-subscription, and showing support for the exercise.

SANICHI - Details of such valid acceptances and excess applications received are as follows:

| No. of Rights Shares | % of total issue | |

| Total valid acceptances | 586,105,752 | 48.73 |

| Total valid excess applications | 616,517,751 | 51.25 |

| Total valid acceptances and excess applications | 1,202,623,503 | 99.98 |

| Total Rights Shares available for subscription | 1,202,831,466 | 100.00 |

| Not subscribed for | 207,963 | 0.02 |

PASUKGB - Details of such valid acceptances and excess applications received are as follows:-

| No. of Rights Shares | % of total issue | |

| Total valid acceptances | 186,547,381 | 18.80 |

| Total valid excess applications | 805,442,371 | 81.16 |

| Total valid acceptances and excess applications | 991,989,752 | 99.96 |

| Total Rights Shares available for subscription | 992,394,432 | 100.00 |

| Not subscribed for | 404,680 | 0.04 |

23/7/21

Today 23/7/21 is the 1st day trading of the consolidated shares. The reference price is 25sen for share and 12.5sen for warrant B.

Take the price movement of SANICHI as a guide. The price of LAMBO might follow the same trend.

Take note of the following dates where the price could be volatile at certain stages :

1. Share consolidation = 23/7/21

2. Rights Ex-date = 11/8/21

3. Trading of Rights (OR) = 13/8/21 - 19/8/21

4. Rights Application Closing Date = 27/8/21

5. Listing of Rights Shares And New Warrant C = 13/9/21

[All dates have been confirmed by announcements released on 28/7/21 (see below)]

|

Announcement on 23/7/21

On behalf of the Board, Mercury Securities wishes to announce that the Board has resolved to fix the issue price of the Rights Shares at RM0.10 per Rights Share (“Issue Price”) and the exercise price of the Warrants C at RM0.10 per Warrant C (“Exercise Price”).

|

( 5 RIGHTS SHARES TOGETHER WITH 2 FREE WARRANTS C FOR EVERY 1 CONSOLIDATED SHARE )

If a person had bought 50,000 shares @ 0.05 some time ago, and goes through the exercise.

1. Cost of 50,000 shares = RM2,500

2. 50,000 shares will be consolidated to 2000 shares

3. Based on reference price on consolidation date, value of 2,000 consolidated shares @ 0.25 = RM500

4. Based on the entitlement ratio, 2,000 consolidated shares will be entitled for 10,000 rights share with 4,000 free warrant C

6. Cost of subsribing for 10,000 rights shares @0.10 = RM1,000

7. The person will end up with 12,000 shares and 4,000 warrant C

8. Average cost per share (excluding free warrants) = (2500 + 1000) / 12000 = RM0.29

Based on the buy price of the original share (pre-consolidation), work out your average cost and act accordingly

Note :The person apply for rights share can also apply for excess rights share by paying 10sen per excess rights share, The excess rghts application is subject to approval by the company.

Announcement on 28/7/21

https://www.klsescreener.com/v2/announcements/view/3400247

Announcement 1 : Rights Issue

| Entitlement description |

RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,207,787,815 NEW ORDINARY SHARES IN LAMBO GROUP BERHAD ("LAMBO" OR THE "COMPANY") ("LAMBO SHARES" OR "SHARES") ("RIGHTS SHARES") AT AN ISSUE PRICE OF RM0.10 PER RIGHTS SHARE TOGETHER WITH UP TO 483,115,126 FREE DETACHABLE WARRANTS IN LAMBO ("WARRANTS C") ON THE BASIS OF 5 RIGHTS SHARES TOGETHER WITH 2 FREE WARRANTS C FOR EVERY 1 EXISTING SHARE HELD BY THE ENTITLED SHAREHOLDERS OF THE COMPANY AT 5.00 P.M. ON 12 AUGUST 2021 ("RIGHTS ISSUE WITH WARRANTS")

|

| Ex-Date | 11 Aug 2021 |

| Entitlement date | 12 Aug 2021 |

| Entitlement time | 5:00 PM |

| Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.1000 |

| Ratio (New:Existing) | 5.0000 : 1.0000 |

| Rights Crediting Date | 12 Aug 2021 |

https://www.klsescreener.com/v2/announcements/view/3400245

Announcement 2 : Important Relevant Date for Renounceable Rights

| Date for commencement of trading of rights | 13 Aug 2021 |

| Date for cessation of trading of rights | 20 Aug 2021 |

| Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 06 Sep 2021 |

| Last date and time for : | |

| Sale of provisional allotment of rights | 19 Aug 2021 05:00 PM |

| Transfer of provisional allotment of rights | 23 Aug 2021 04:30 PM |

| Acceptance and Payment | 27 Aug 2021 05:00 PM |

| Excess share application and payment | 27 Aug 2021 05:00 PM |

| Available/Listing Date | 13 Sep 2021 |

| Rights Securities will be listed and quoted as the existing securities of the same class | Yes |

| Other important dates as the listed issuer may deem appropriate | |

| Entitlement Details | |

| Company Name |

LAMBO GROUP BERHAD

|

| Entitlement | Ordinary Shares |

| Ratio (New : Existing) | 5.0000 : 1.0000 |

| Rights Issue / Offer Price | Malaysian Ringgit (MYR) 0.1000 |

The quarterly report was also announced on 28/7/21. As expected, it is another losses for the quarter, mainly due to the item "Fair value loss on other investment" of (60,811,969).

Quarterly rpt on consolidated results for the financial period ended 31/5/2021

https://www.klsescreener.com/v2/announcements/view/3400215

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 May 2021

|

31 May 2020

|

31 May 2021

|

31 May 2020

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

491

|

0

|

24,844

|

0

|

| 2 | Profit/(loss) before tax |

-65,197

|

0

|

-98,672

|

0

|

| 3 | Profit/(loss) for the period |

-65,198

|

0

|

-98,841

|

0

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-65,193

|

0

|

-98,821

|

0

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-1.71

|

0.00

|

-2.59

|

0.00

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.0252

|

0.0612

|

||

SUMMARY

1. Share consolidation = 23/7/21

- Ex-consolidation price = 0.25

2. Rights Ex-date = 11/8/21

3. Trading of Rights (OR) = 13/8/21 - 19/8/21

- OR traded at 0.005 seller quote during the entire trading period

4. Rights Application Closing Date = 27/8/21

Details of such valid acceptances and excess applications received are as follows:-

| No. of Rights Shares | % of total issue | |

| Total valid acceptances | 222,147,853 | 22.27 |

| Total valid excess applications | 775,304,998 | 77.72 |

| Total valid acceptances and excess applications | 997,452,851 | 99.99 |

| Total Rights Shares available for subscription | 997,575,975 | 100.00 |

| Not subscribed for | 123,124 | 0.01 |

Successful applicants of the Rights Shares will be given Warrants C on the basis of 2 Warrants C for every 5 Rights Shares successfully subscribed for.

(Probably under-subscribed by retailers. Most excess rights probably taken up by operator, substantial shareholders, directors, etc; Need to confirm with coming announcement on changes in shareholdings )

5. Listing of Rights Shares And New Warrant C on 13/9/21

Total shares = 1196968046; WB = 94595020; WC = 398981138

RI price = 0.10, Closing price = 0.07

WC closing price = 0.02

STATUS : SHARES CONSOLIDATION AND RIGHTS ISSUE COMPLETED ON 13/9/21

INVESTMENT IN QUOTED SECURITIES

A. Investment in SINARAN (formerly known as KSTAR) (stock code 5172)

- The Board of Directors of LAMBO wishes to announce that its wholly-owned subsidiary, Oriented Media Holdings Limited in Hong Kong, had on 15 September 2020 acquired 90,000,000 ordinary shares of K-Star Sports Limited (“KSTAR”), representing 19.78% of the issued and paid up capital of KSTAR, at RM0.135 per share (“KSTAR Shares”) for a total cash consideration of RM12,150,000 (“Consideration”) (“Investment”) from open market.

This announcement is dated 15 September 2020.

-

The Board of Director of LAMBO wishes to announce the following additional information:-

- Net loss as per the latest audited report as at 31 December 2019 of KSTAR was RMB 10,919,000

- Net asset as per the latest audited report as at 31 December 2019 of KSTAR was RMB 41,147,000

This announcement is dated 22 September 2020.

- Refer to earlier announcement dated 15 September 2020, the Board of Directors of LAMBO wishes to announce that its wholly-owned subsidiary, Oriented Media Holdings Limited in Hong Kong (“OML”), had acquired additional 34,600,000 ordinary shares of K-Star Sports Limited (“KSTAR”), representing 5.43% of the issued and paid up capital of KSTAR (“KSTAR Shares”) for a total cash consideration of RM7,958,000 (“Consideration”) (“Investment”) from open market.

This announcement is dated 26 March 2021.

|

Date |

Shares Purchased |

Amount (RM) |

Average Price |

|

15/9/20 |

90,000,000 |

12,150,000 |

0.135 |

|

26/3/21 |

34,600,000 |

7,958,000 |

0.230 |

|

TOTAL |

124,600,000 |

20,108,000 |

0.162 |

As at 23/7/21, closing price of SINARAN = 0.08

Unrealized loss = 20,108,000 X (0.162 – 0.08) = RM1,648,856

Follow the link to check on NON RELATED PARTY TRANSACTIONS :

B. Investment in FOCUS DYNAMICS GROUP BERHAD (sock code 0116)

The Board of Directors of LAMBO wishes to announce that its wholly-owned subsidiary, Oriented Media Holdings Limited in Hong Kong, had from 6 July 2020 till 10 July 2020 acquired 22,796,600 ordinary shares of Focus Dynamics Group Berhad (“FOCUS”) at averace price of RM1.1253 each (“FOCUS Shares”) for a total cash consideration of RM25,653,013.98 (“Consideration”) (“Investment”) from open market.

This announcement is dated 13 July 2020.

As at 23/7/21, closing price of

FOCUS = 0.045

FOCUS-PA = 0.01

Based on the purchase price, closing prices and the price movement of FOCUS in 2021, it is likely that the company will end up with massive losses in this investment.

At the moment, it is not easy to compute the actual unrealized losses as the shareholdings has changed due to FOCUS undertaking a Multiple Proposals that was completed in December 2020.

|

FOCUS – Multiple Proposals:

On behalf of the Board of Directors of the Company (“Board”), Mercury Securities Sdn Bhd (“Mercury Securities” or the “Principal Adviser”) wishes to announce that the Company proposes to undertake the following:- (i) proposed share split involving the subdivision of every 1 existing ordinary share in Focus (“Focus Share” or “Share”) into 3 Shares (“Split Shares”) (“Proposed Share Split”); (ii) proposed renounceable rights issue of up to 2,044,266,157 new irredeemable convertible preference shares in the Company (“ICPS”) together with up to 3,066,399,235 free detachable warrants in the Company (“Warrants D”) on the basis of 2 ICPS together with 3 free Warrants D for every 6 Split Shares held by the entitled shareholders of the Company (“Shareholders”) (“Entitled Shareholders”) on an entitlement date to be determined (“Entitlement Date”) (“Proposed Rights Issue of ICPS with Warrants”); and (iii) proposed amendments to the constitution of the Company (“Constitution”) to facilitate the issuance of the ICPS pursuant to the Proposed Rights Issue of ICPS with Warrants (“Constitution”) (“Proposed Amendments”). The Proposed Share Split, Proposed Rights Issue of ICPS with Warrants and Proposed Amendments shall collectively be referred to as the “Proposals”. Please refer to the attachment for further details on the Proposals. This announcement is dated 18 August 2020. On behalf of the Board, Mercury Securities wishes to announce that the Corporate Exercises have been completed following the listing and quotation of:- (i) 6,132,798,471 Split Shares on the ACE Market of Bursa Securities on 27 October 2020; and (ii) 2,044,266,042 ICPS and 3,066,399,051 Warrants D on the ACE Market of Bursa Securities on 3 December 2020. This announcement is dated 3 December 2020. |

Figure out why the "smart" directors are willing to invest in other penny stocks at high prices. The sellers must be laughing their ways to the bank at the expense of LAMBO's shareholders.

Think harder and you will likely able to get a clearer picture of one of the ways how 'smart' directors of loss making penny stocks utilsed and depleted company fund (rightfully belonging to shareholders).

COME BACK FOR MORE UPDATES

More articles on For Newbies To Know And Learn About Penny Stocks

Created by whistlebower99 | Sep 06, 2021

Created by whistlebower99 | Jul 21, 2021

Created by whistlebower99 | Jul 20, 2021

Discussions

Issuing shares is easy way for directors to increase company fund instead of bringing in money from business profits.

In many cases, the company funds will be depleted by continuous quarterly losses, asset acquisition at high price, settlement of debts, or even losses in investment in other penny stocks, etc.

In investment losses, it is not surprising to see them buying penny stocks at near peak prices. And look suspicious!!! Try figure it out...

2021-07-24 13:14

Why you dont include Airasia, and AAX in your so-called list of lousy stocks?? also facing same scenario.

2021-07-24 13:20

whistleblower- selective prosecution??? avoid big fish Tony the magnificent? wakaka

2021-07-24 13:27

Learn how loss making companies survive for 10 years. Stop feeding them.

2021-07-24 13:36

yeah, Rights are for sardines to pay for directors salary and luxury living expenses every month and continue losses of company, later another consolidation and rights over again.

Posted by whistlebower99 > Jul 24, 2021 1:14 PM | Report Abuse

Issuing shares is easy way for directors to increase company fund instead of bringing in money from business profits.

In many cases, the company funds will be depleted by continuous quarterly losses, asset acquisition at high price, settlement of debts, or even losses in investment in other penny stocks, etc.

In investment losses, it is not surprising to see them buying penny stocks at near peak prices. And look suspicious!!! Try figure it out...

2021-07-24 13:42

Why the ikan bilis with majority public shareholdings more than conman directors not voting kick them out??? These conman normally have very less controlling shareholding right? Except avoid buying but never take action against all these conman?

2021-07-24 13:53

I am an advocate of preference shares; especially on Irredeemable Convertible Preference Shares (ICPS). I have repetitively stirs ICPS away from the rest of the funds raising instrument as highlighted the advantagious in some of my published articles. The writer can caution to newbies on "pump and dump" stocks which I supported; please do NOT lump stocks with ICPS issuance as bad (case by case basis)...

My articles link for easy reference:

https://klse.i3investor.com/blogs/BLee_AGES/2021-07-16-story-h1568014371-ICPS_My_investment_stretagy.jsp

https://klse.i3investor.com/blogs/BLee_AGES/2021-07-03-story-h1567802175-Focus_PA_Where_is_the_money.jsp

https://klse.i3investor.com/blogs/BLee_AGES/2021-07-22-story-h1568729473-AGES_PA_Where_is_the_money.jsp

Happy trading

2021-07-24 14:55

@BLee

ICPS with high issue price and high conversion ratio comes with higher risk of losses when the underlying share price dropped below the conversion price.

FOCUS-PA

Issue price = 0.055 (very high, could have manipulated up the share price prior to price fixing)

Conversion Price = 0.55

Conversion Ratio = 10:1

Total Issued Shares = 6,372,205,736

Total ICPS (PA) = 903,363,292

Total WB = 3,066,399,051

You need lots of luck if you are holding FOCUS-PA at high price, even though the maturity date is in 2030. Very likely potential candidate for share consolidation and rights issue with free warrant if current cash position is depleted over time without profit improvement.

AGES-PA

Issue Price = 0.01

Conversion Price = 0.13

Conversion Ratio = 13:1 (consider high)

Total issued shares = 1,262,036,173

Total ICPS = 3,850,826,509

Lots of money collected from ICPS issuance and conversion (around RM129,000,000) and not much cash left (how the money was utilised)

If ICPS is fully converted, total issued shares will exceed 5 BILLION

ICPS conversion ratio of 13:1 is on the high side.

Just hope annual profit can be maintained or improved as EPS will be affected by conversion of ICPS.

Good luck.

2021-07-24 16:47

Posted by whistlebower99 > Jul 24, 2021 4:47 PM | Report Abuse

@BLee

ICPS with high issue price and high conversion ratio comes with higher risk of losses when the underlying share price dropped below the conversion price.

FOCUS-PA

Issue price = 0.055 (very high, could have manipulated up the share price prior to price fixing)

Conversion Price = 0.55

Conversion Ratio = 10:1

BLee: I have answered this question before. Let me answer again. Due to 2 methods of conversion, present trading price of around 1 sen, could cost around 10 sen to convert and NOT 55 sen.

Why buy at 1 sen and not around 5 sen for mother shares?

- opportunity of x5 leverage.

- lower downside risk as almost at bottom of 'pump and dump'.

- decrease in market availability upon more conversion, mother shares will increase.

- anti-dilution. Example given earlier in one of my articles.

@whistleblower99: You need lots of luck if you are holding FOCUS-PA at high price, even though the maturity date is in 2030. Very likely potential candidate for share consolidation and rights issue with free warrant if current cash position is depleted over time without profit improvement.

BLee: I wished it will happen on share consolidation and RI (not on without profit); explained in one of my articles on conversion price/ratio adjustment upon any new RI.

@whistleblower99:

AGES-PA

Issue Price = 0.01

Conversion Price = 0.13

Conversion Ratio = 13:1 (consider high)

Total issued shares = 1,262,036,173

Total ICPS = 3,850,826,509

Lots of money collected from ICPS issuance and conversion (around RM129,000,000) and not much cash left (how the money was utilised)

BLee: Answered in my article, Ages-PA: Where is the money???

@whistleblower99: If ICPS is fully converted, total issued shares will exceed 5 BILLION

ICPS conversion ratio of 13:1 is on the high side.

Just hope annual profit can be maintained or improved as EPS will be affected by conversion of ICPS.

BLee: I hope the conversion will happen. As shown in one of my articles, collection of 60 million and 29.6 million shares in the 2 trades seem extraordinary...guessing game.

Please also see my answer on:

Stock: [FOCUS]: FOCUS DYNAMICS GROUP BHD

Jul 13, 2021 8:04 AM | Report Abuse

A very good morning to Focus D investors and whistleblower99. I have no intention to pick a 'fight' with anybody; just sharing opinion on share market investing. Nothing personal..

and

Stock: [FOCUS]: FOCUS DYNAMICS GROUP BHD

Jul 12, 2021 9:48 AM | Report Abuse

@whistlebower99 - Especially for newbies trading in loss making penny stocks

BLee: Yes, newbies should take notes that Focus NOT loss making for the last 5 quarters with good cash position.

Good luck. (BLee: Thanks, and Happy Trading)

2021-07-24 20:48

.png)

bpsiah

Why issue huge amount of shares and later do such consolidation? Why have private placements and rights issue that will dilute the price of the shares? These may be the rights of the company but they should not take it as a privilege. Respective authorities must play a more stringent role in curbing such unscrupulous practice and prevent companies from taking advantage of the whole situation to the detriment of investors, especially the retails.

2021-07-23 23:03