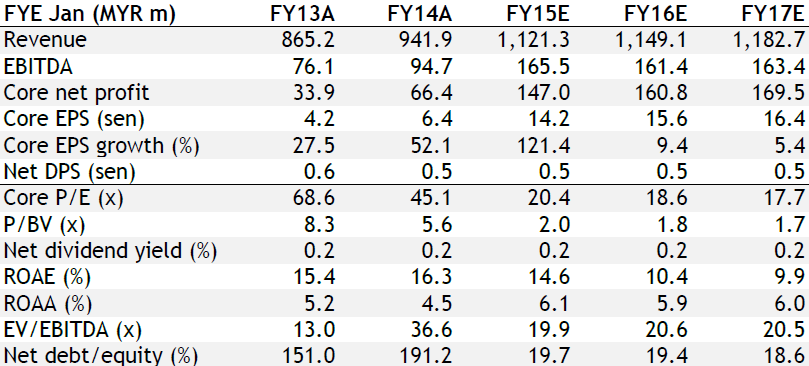

Secures Ghana FPSO job

A 15+5 year charter worth USD3.3b (ex-cost escalation).

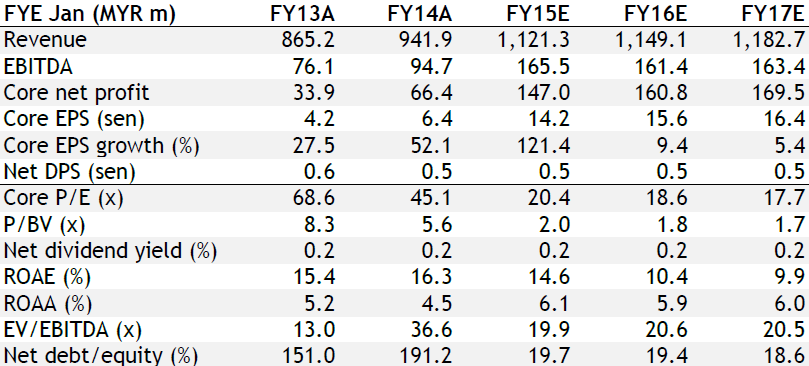

To contribute MYR110m-MYR170m p.a. profit from 2017

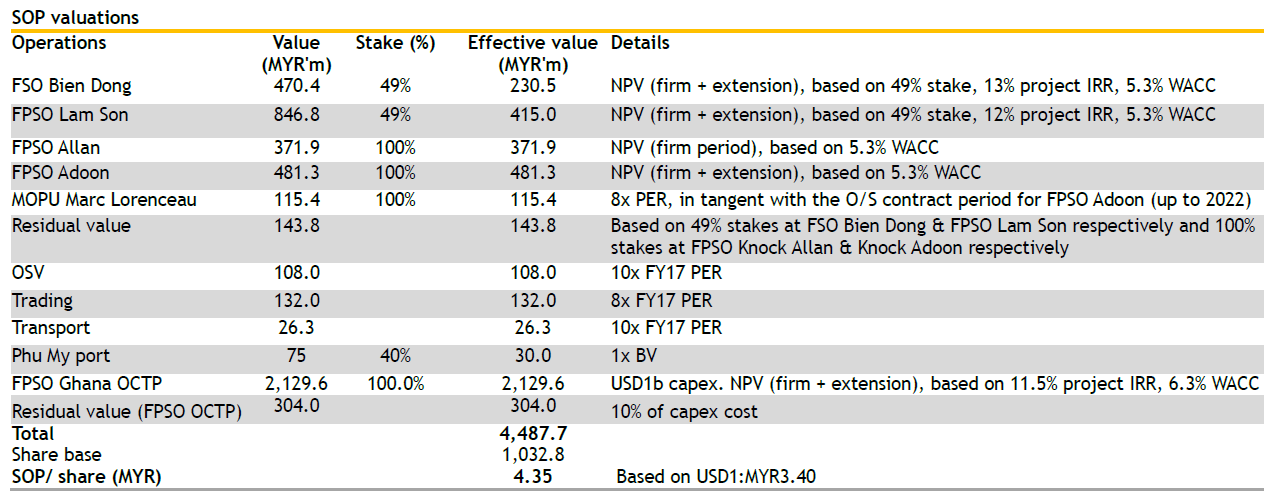

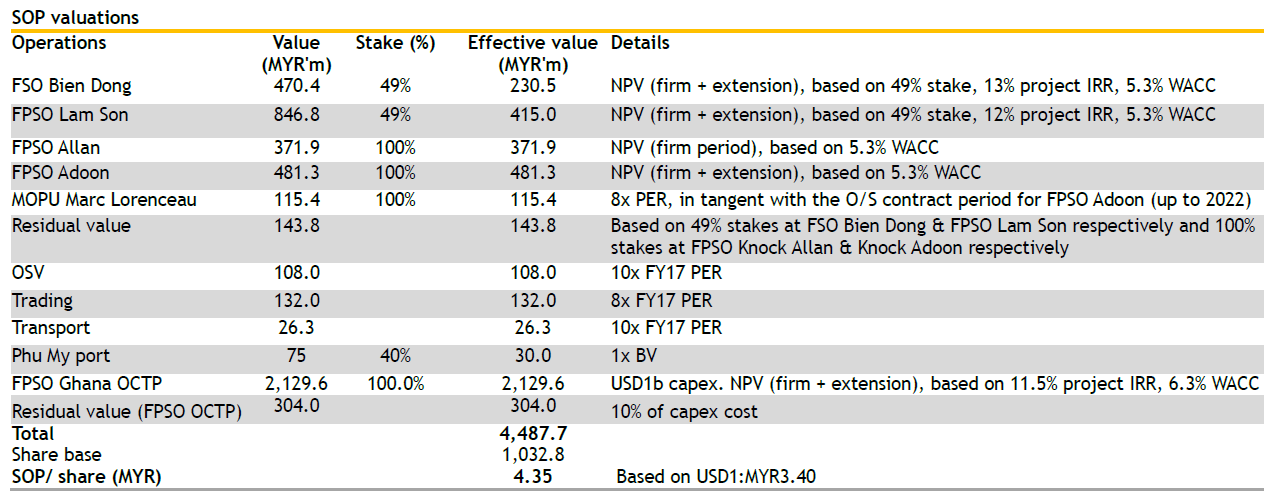

TP raised by 44% to MYR4.35 (SOP-based), offers 50% upside.

What’s New

Eni Ghana has awarded Yinson a chartering, operation & maintenance (O&M) contract of a FPSO facility at the Offshore Cape Three Points Block (OCTP) located in the Tano basin, 60km offshore Ghana. OCTP is operated by Eni Ghana (47.2%) with Vitol Upstream Ghana Limited (37.8%) and Ghanaian state-owned Ghana National Petroleum Company (15%) as its partners. The contract is for a 15-year firm charter, valued at USD2,539m with 5 yearly extension options worth USD717m, exercisable by the client. The FPSO is scheduled for commercial operations by 2017.

What’s Our View

This is a major positive, from both an operating and financial perspective. Foremost, this is a bankable contract with good counter-party risk. The OCTP field is commercially viable with reserves recoverable beyond 15 years. This is Yinson’s maiden FSO/ FPSO contract (i) secured outside Vietnam (its main domain) and (ii) post the purchase of Fred Olsen Production (FOP) in 2013, validating the USD170m M&A deal. This job win is also Yinson’s first FPSO contract valued at the USD1b capex level, enabling it to further consolidate its position in the Top-10 global league table. We gather that the revenue has 2 major elements: (i) bareboat (BB) charter, (ii) O&M rates. Based on an USD1b conversion capex, the daily BB rates should range around USD354k (firm charter) and USD315k (extension) respectively. The O&M rate is projected to be at USD85k per day. Yinson will convert its already purchased Samsung-built tanker Ulriken (bought for USD26m) for this job. We estimate this Ghana FPSO contract to contribute MYR110m- 170m p.a. net profit from FY1/18 to FY1/22. Valuations wise, this job adds MYR2.45b to NPV (MYR2.36/shr), based on a 12% project IRR.

As such, we raised our TP to MYR4.35, changing our valuation methodology to SOP-based (previously on 18x FY15 PER).

Salient details of the OCTP FPSO contract

Ahead of competing bidders

We understand that Yinson secured this job ahead of its two competitors,

namely Bumi Armada and Modec, from a pricing perspective. In essence,

Yinson achieves many ‘firsts’ in this contract. This is Yinson’s:

(i) first FPSO contract in Ghana,

(ii) first FPSO job won outside Vietnam,

(iii) first FPSO contract post the acquisition of FOP and

(iv) first big-sized FPSO with capex of USD1b.

Yinson will convert its already purchased Samsung-built tanker Ulriken

(bought for USD26.3m). Total conversion cost is expected to be USD1b.

This job win could lift its FPSO/FSO fleet size to five and further

consolidate its Top-10 position on the FPSO global league table.

Energy security interest

The OCTP project is a government-back project with much domestic

interest aligned to it. The Ghana government has approved Eni’s USD6b

Sankofa Gye Nyame oil & gas project to develop the deepwater Offshore

Cape Three Points (OCTP) block. First oil production is estimated to be in

mid-2017, first gas in 2018 and the peak production will be 80k bpd in

2019. This deepwater will require a FPSO and a gas pipeline ashore a year

later. The OCTP field will continuously supply Ghana’s thermal power

system from 2018 to 2036 (18 years).

Project is commercially viable

The OCTP field is commercially viable. This leads to the FPSO contract

having good counter-party risk. NOC-backed Ghana National Petroleum

Corp (GNPC) has a 15% working interest in this OCTP project, with the

option to raise it to a higher 20%.

Recoverable oil reserves (ex-gas) of 131m barrels alone ensure the

commercial viability of this job (USD46/bbl production cost). Its 1.15tcf of

gas reserves will also be monetised. The project can deliver up to 170

million cubic feet of gas a day (mmscfd) for the next 20 years. The gas will

be sold for domestic market use, at an agreed price of USD7-8/mmBtu.

Contract has cost escalation clauses, incentives

While the base contract is worth USD3.3b (USD2,539m on a 15-year firm

charter plus USD717m for 5 yearly extensions), we gather that there is an

escalation clause in this contract, which offers further upside. We reckon

the add-ons are to largely cover increase in opex (i.e. inflation, labour

expenses).

Local content requirement

The O&M portion of the FPSO under Yinson Production West Africa Limited (YPWAL) would be taken on by a 49:51 JV between Yinson and Oil and Marine Agencies Ghana Ltd (OMA). OMA is an indigenous Ghanaian company, principally involved in among others, the provision of offshore support services, logistics & freight forwarding, vessel husbandry and liner agency.

Assessing the FPSO contract

Accounting-wise, this job will be classified as an operating lease in Yinson’s books, consistent with all of Yinson’s floating solutions operations. The FPSO is expected to contribute earnestly from 2017.

Based on the firm/extension charter periods, we estimate the daily BB and O&M rates to be at USD354k/USD315k and USD85k/USD85k respectively.

We estimate the project IRRs for the OCTP FPSO job to range between 10% (firm charter) and 12% (firm plus extension), based on a 98% uptime.

Likely to depreciate the asset over a 20 year period, taking into account the tenure (firm + extension) and the recoverable reserves.

Earnings/ NPV impact

All in, we estimate this Ghana FPSO contract to contribute MYR110m-170m p.a. net profit from FY1/18 to FY1/22 (assuming 80:20 debt-equity financing; 4.5% interest costs). As such, our FY15-17 earnings forecasts are unchanged.

Valuations wise, this contract adds MYR2.45b to NPV (MYR2.36/shr), based on our estimates. Our assessment takes into account a 6.3% WACC estimate and excludes any upside from cost escalation.

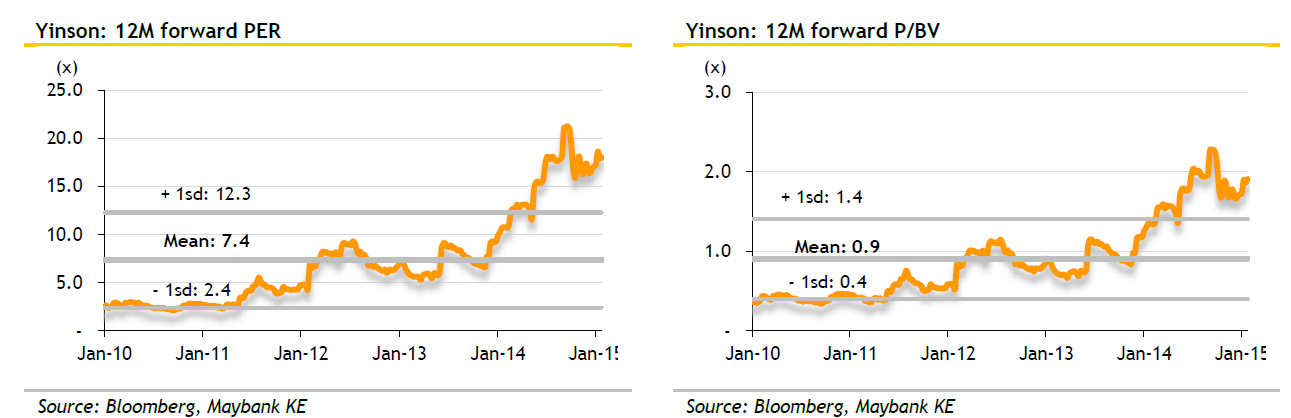

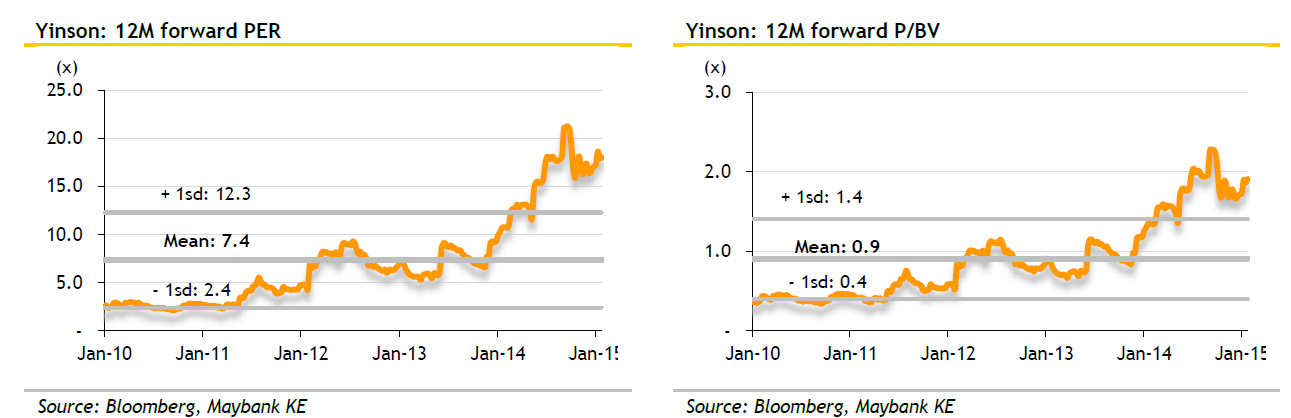

Raise TP to MYR4.35; Reiterate BUY

Our new TP offers a 50% upside from Yinson’s last trade price. We have

changed our valuation methodology to a more refined SOP-based method

from 18x FY16 PER-based in the past. We do not rule out the potential

divestment of its non O&G operations and new share placement exercise in

the future to part fund its capex-heavy O&G venture.

Source: Maybank Research

matrix6050

Thanks Ctea for sharing

2015-01-29 10:13