Hibiscus buy Hibiscus IV - Oil price

zhangzuode

Publish date: Sun, 24 Oct 2021, 01:21 PM

Hibiscus buy Hibiscus IV – oil price, UP / DOWN

SEEK TRUTH FROM FACTS

General

Since my article in June 2022, oil price has gone up by 15%. As profitability of Hibiscus depends on the price of oil, it is imperative to know what is the trend of oil price going forward.

There are two factors why Hibiscus is so attractive: -

- Oil price remains on the upward trend

- Production of Hibiscus should (not could) increase by 3 times once Repsol assets are incorporated upon completion of the deal expected at the end of this year

Based on 1) above, IF, a big IF, the Repsol deal did not go through, then, just on the strength of increasing oil price alone, Hibiscus FY22 EPS is estimated to be 12.1 sen. This is better than FY19’s 11.4 sen.

But of course, once Repsol assets are included (possibly in Q3 & Q4 FY22), EPS double to 24.1 sen.

So, from an investment viewpoint, there is a high margin of safety.

The above assume average oil price for FY22 to be 75.62 ONLY. Do not forget that Q1 FY22 is over and average oil price for the quarter, US$ 73.47 is baked in already. And so far, October average oil price is US$ 82. Yes, there are reports of oil price going to 100 or even 200, but, as an investor, it is always prudent to err on the conservative.

Supply / Demand

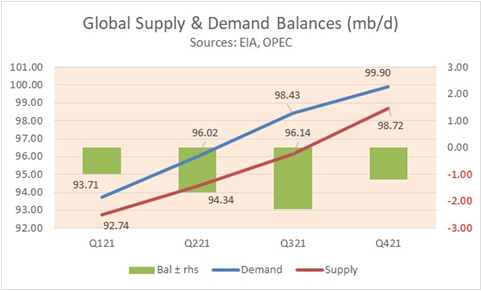

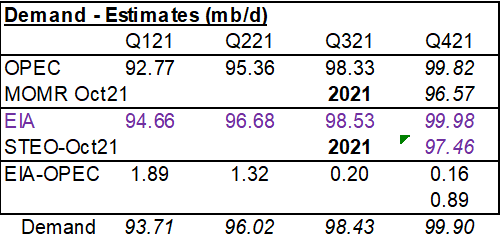

Below is the Global supply and demand balances for 2021.

The value is an average of the estimates provided by OPEC Monthly Report Oct 21 and EIA STEO Oct 21.

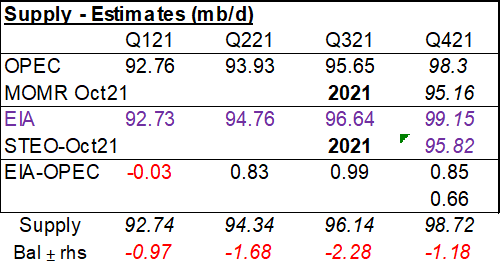

As a result, the shortfall in 2021 supply & balance pushes the stock levels down as shown below:

OPEC October 2021 monthly report: Preliminary August data sees total OECD commercial oil stocks down by 19.5 mb m-o-m. At 2,855 mb, they were 363 mb lower than the same time one year ago and 183 mb lower than the latest five-year average.

The OPEC report on OECD stock level lagged by two months. From the Supply Demand balance tabulation, the closing stock level at end 2021 is estimated to be 2,680 mb.

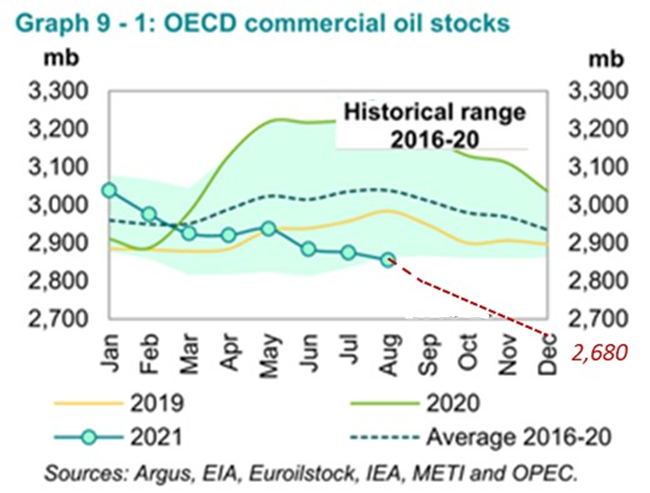

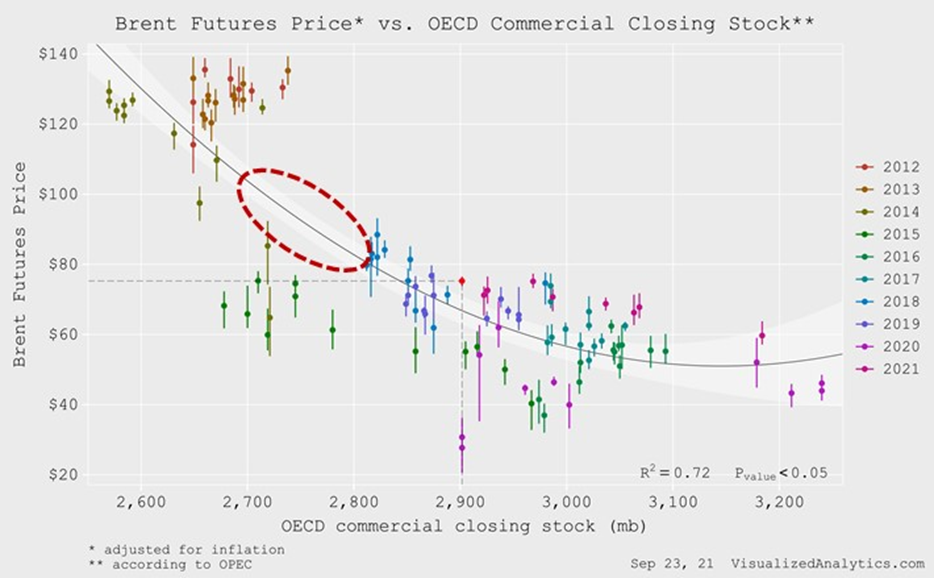

The price of oil correlate to OECD stock level as shown below. The stock level is projected to end the year at around 2,700 mb. Therefore, between now and end of the year, oil price may vary between 80 and 100, as per the red oval.

This price (range) projected are all theoretical and should be taken with great precaution.

Update on Repsol deal

Last week, Hibiscus made several announcements and posted details of Repsol assets audited accounts (Report) for financial year ending 31 December 2020. Here is a brief update:

- Hibiscus (financial health) is rated STABLE-(P)B1 by Moody, and STABLE-B+ by Standard & Poor.

- Merrill Lynch, JP Morgan and Seaport Global are Joint Global Coordinators and Joint Bookrunners to arrange a series of fixed income investor calls for potential US$ denominated 5-year senior fixed rate notes (BOND – layman take).

- Quantum of the Bond maybe US$ 300m or US$ 110m (RM 450.3m) and the fixed rate might be 7.18%. These values are derived from pages F-3, F-5 & F-12 of the Report. Of course, these are indicative and depends on cash-flow (internal generated fund). The final quantum could be less or more depending on market appetite and rate (less than 5%).

-

Status of Approval required – pages 67-68 of Report.

- PETRONAS & PetroVietnam approval is expected by November 2021

- Fulfil all conditions precedent to the S&P Agreement – December 2021 and hence by extension completion of the Acquisition as well.

- A negative goodwill (NG) of at least RM 36m (Page 17, F-8 & F-13 of Report) to be accounted for. NG might be higher.

Summary

Supply and Demand balances point to OECD stock level might end 2021 at 2,700 mb.

Thus, oil price is expected to hover between US$ 80 to 100 towards end of 2021.

Hibiscus financial health has been rated as STABLE by both Moody and Standard & Poor.

A 5-year fixed rate US$ 110m to potentially 300m Bond are now being “run” by Merrill Lynch, JP Morgan and Seaport Global from Singapore. Fund from the Bond will primarily be used to settle the Repsol Assets acquisition together with internally generated fund. This confirmed management call that there will be no more CRPS.

Approval from PETRONAS and PetroVietnam is expected in November 2021 while completion of the deal is still earmarked for December 2021.

On completion of the Repsol acquisition, a negative goodwill of at least RM 36m will be “booked”.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

More articles on Zhang Zuode

Discussions

Quantum of the Bond maybe US$ 300m or US$ 110m (RM 450.3m) and the fixed rate might be 7.18% - May I know where you get this rate of 7.18%. Bank loan interest is definitely at least 1% -2% lower. Shouldn't it be wiser to get a bank loan instead of issue bond?

2021-10-25 14:12

It is stated in the Report (Investor material Oct 21) posted on Hibiscus site - page F-12.

Yes, a bank loan might have lower interest, however, the terms might be too onerous. I think that the 7.18% indicated might be the top, maybe 5% would be fair since it is a US$ bond. Thus should interest be that low or lower, Hibiscus might then issue more to capture the low interest.

Also, a circular for the Bond was issued as per page F-3.

Thank you for reading.

2021-10-25 17:19

twynstar

Nice article !! Very detailed analysis !!

2021-10-24 22:00