TEKSENG (7200) - 德成的公关灾难

Adam Khoo

Publish date: Wed, 05 Oct 2016, 01:46 PM

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on My View

Created by Adam Khoo | Jun 01, 2017

Created by Adam Khoo | Oct 21, 2016

Discussions

engchun, if you are from the management, then you surely don't know anything about Public relation disaster.

Please google yourself to see what is public relations disaster management!

2016-10-05 15:56

什么是傲慢?这个就是:

Also regarding shareholders' value, do keep in mind that the Company has always set out dividends almost every year. You're very much welcomed to email in and we will be pleased to reply you. Thanks

2016-10-05 15:58

什么是公关灾难,看看下面另一个例子:

遲報病情變公關災難 希拉莉拒認隱瞞

http://www1.hkej.com/dailynews/international/article/1390923/%E9%81%B2%E5%A0%B1%E7%97%85%E6%83%85%E8%AE%8A%E5%85%AC%E9%97%9C%E7%81%BD%E9%9B%A3+%E5%B8%8C%E6%8B%89%E8%8E%89%E6%8B%92%E8%AA%8D%E9%9A%B1%E7%9E%9E

2016-10-05 16:05

[Losing 24% of market value is really a big disaster]

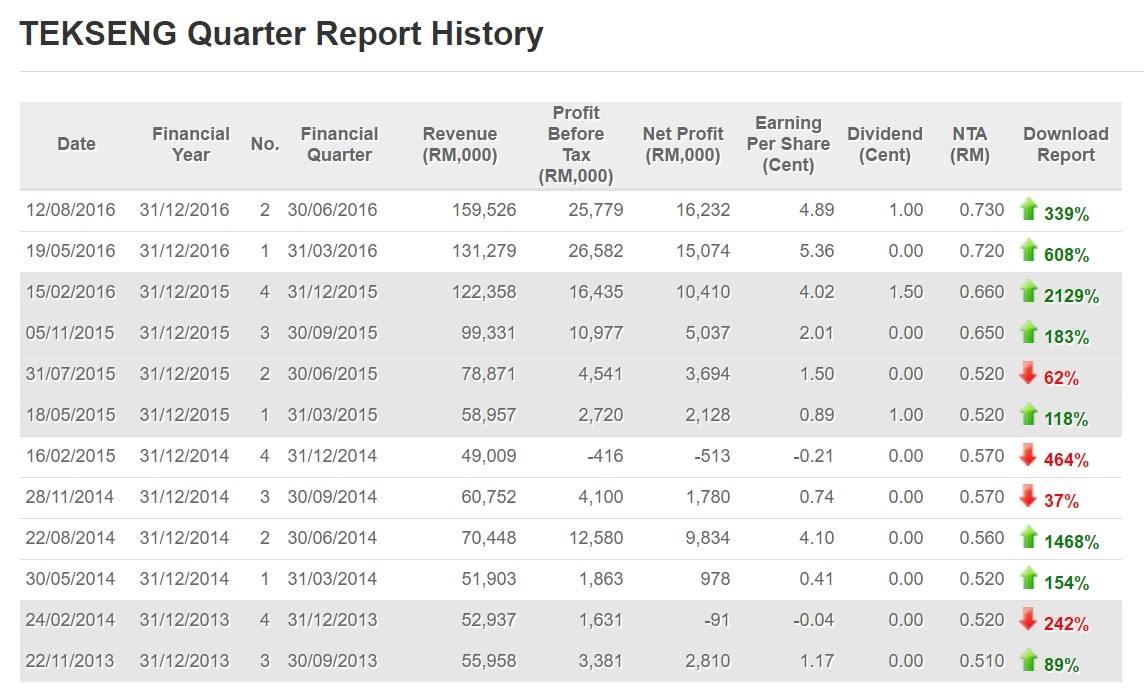

Mr engchun, I do understand from the publicly available information that this is a normal internal measure. But the leaking of the internal memo has been turned to a PR disaster & I think any company losing 24% of market value is really a big disaster. This clearly show Tek Seng is lacking of crisis management in PR. It is time Tek Seng CEO make a bold statement to address this confident crisis. It is not a very difficult steps to take, for e.g. doing an interview with The Star, providing the latest quarterly output figure should stop all the speculation that the company is running into trouble.

2016-10-05 16:23

@engchun

which one is the email contact for tekseng IR personnel.

tekseng@tekseng.com.my or wangsaga@wangsaga.com.my ??

2016-10-05 16:53

Nothing wrong with tekseng, management cant provide all info to you one ma, if you wanna know more just write in la, you want you sell la hahah, free money to brave hearts

2016-10-05 19:47

Tek Seng only issued a short memo to Bursa to clarify the matter after their memo leaked out. They clearly underestimated the magnitude of the crisis, it show they are slow & not decisive enough in crisis management.

Transparency, on time & disassemble of appropriate information is paramount to a Public Listed Company (PLC). Asking investor to write in is a joke, how could they answer thousand of mail from each investors? Again as a public listed company, they are responsible to thousand of investors, not one or two unhappy customer. The company should instead hold a proper press conference to clarify the matter.

Now the company not only losing substantial market value, the crisis also affecting the confidence of the whole investment community which include not only the individual investor, but also the fund manager, lender, investment bank, and even their business partner, supplier and customer.

2016-10-06 09:03

Definitely Tekseng didn't handle well in this crisis. It really impact the confidence level of the investors.

2016-10-06 10:56

As a listed company, retrenchment consider corporate exercise? I do not know, just asking

2016-10-06 11:48

Instead of wasting time arguing whether it is bad PR just do some research and it will tell you there is a global supply glut and panel prices have been falling. Mere bad PR will not cause a company to lose millions in market value, don't be so naïve (or lazy).

http://reneweconomy.com.au/2016/new-solar-glut-could-push-solar-module-prices-as-low-as-30cwatt-54970

http://www.bloomberg.com/news/articles/2016-08-23/solar-industry-braces-as-looming-glut-threatens-to-erode-prices

http://fortune.com/2016/09/14/china-solar-panel-production/

2016-10-06 17:27

China Solar cell demand & pricing start to rise in Oct, below latest news from Taiwan.

2016.10.04 / 工商時報 / 記者王中一

昇陽科10月稼動率,將拉高到7成

太陽能產品報價在一口氣跌了半年、屢屢創下歷史新低後,終於看到止跌回升!太陽能業界表示,報價在9月中旬跌落谷底之後,近期伴隨大陸「十一長假」前的小幅拉貨,價格在半個月內回升約5~10%,至於訂單量也有增溫,在寒流當中已見到春燕蹤跡。

對於市況回溫,太陽能電池廠昇陽科 (3561) 予以證實,認為這一波的最低點已經過去。該公司強調,隨訂單的價量見到回溫,預期10月的生產線稼動率將拉高到7成,比現在的5成水準足足高出2成水位。

不過,太陽能矽晶圓和電池的報價是在9月中旬創新低,因此,對於國內相關的業者來說,9月份營收仍是持續下探,再創近年單月新低。以昇陽科來說,9月份營收4.49億元、月減22.8%,連續第3個月出現衰退,甚至還低於2月份春節長假水準;至於太陽能矽晶圓廠達能 (3686) 的9月營收更降至4,100萬元,比起前月的8,650萬元腰斬。

所幸,這波太陽能產業景氣下探期間已有半年,市場對於矽晶圓廠和電池廠9月份營收續創新低並不意外,甚至頗有「利空鈍化」意味,反映在股價上也有提前落底跡象。以昨(3)日太陽能族群股價表現來看,包括綠能 (3519) 、昱晶 (3514) 、茂迪 (6244) 和昇陽科等都有1%以上之漲幅。

昇陽科坦言,9月中旬的報價再創新低,「已經跌到大家都不太想賣」,而整個業界歷年來經歷多次景氣反轉後也學乖了,不再會超低價搶單,整個市場處於庫存超低的局面。昇陽科強調,9月份的產能利用率僅有5成,但目前來看,10月份可望拉高到7成水準。

但昇陽科強調,對於大陸十一長假結束之後的市況,仍得謹慎觀察,若有進一步變化,仍會機動調整。至於該公司的高效多晶PERC電池,則因大陸的領跑者計畫需要高效產品,需求面確實有拉升。

而電池廠業績回溫,對於矽晶圓廠業績也是水漲船高。據了解,矽晶圓廠有意在大陸十一長假後調漲價格,綠能、國碩將是最大受惠者。

2016-10-07 01:42

In Q3 2016 , Global solar module average selling price been drop from usd 0.45 to below usd 0.40 per watt . If you refer to Nasdaq listed solar company, majority share price been drop around 30% to 40% in last few month . The main reason of price war is supply is more than demand after China Mfg is over expand their capacity . Y2017 will be very tough business situation for solar industry .

2016-10-07 22:17

engchun

Hi Adam Khoo, regarding your article, I would like to highlight a few points. The news was purely just a business decision and had no harm as announced. There is an email for the IR dept. in the website which you can send in inquiries. The Company has then announced it's merely a business decision. Also regarding shareholders' value, do keep in mind that the Company has always set out dividends almost every year. You're very much welcomed to email in and we will be pleased to reply you. Thanks

2016-10-05 15:48