Alpha Stock Hunt (21 - 25 Sep 2020)

ripmorepoints

Publish date: Mon, 21 Sep 2020, 06:06 PM

Hey, hope you all are having a great time trading/investing in the month of September. KLCI had been on a downtrend since the beginning of September but not all gloom in the bourse as we continue to search for the alpha stock for this week.

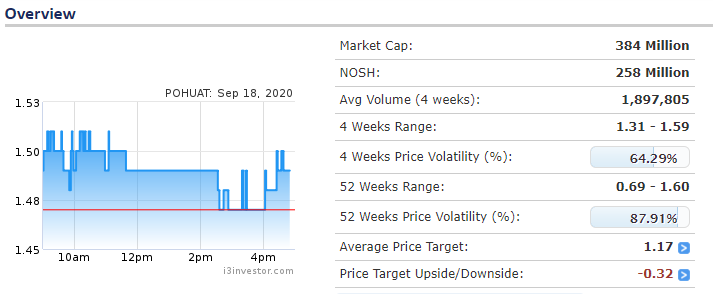

1. POHUAT (7088)

Catalysts

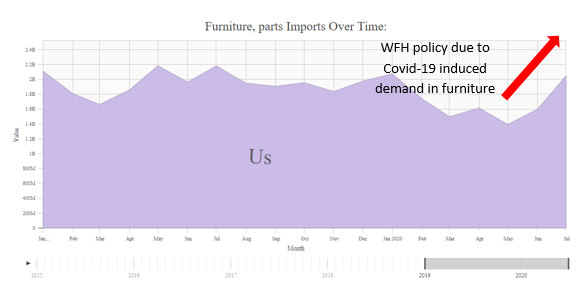

- Strong Demand of Furniture in US

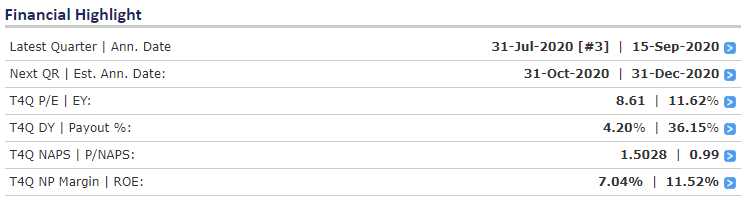

POHUAT recently released its Q3 results on 15 Sep 2020 with the “Prospect for the Current Financial Year” section stating the below.

Let’s cross-check with the import statistics of US:

(Source: https://www.ustradenumbers.com/import/furniture-parts/)

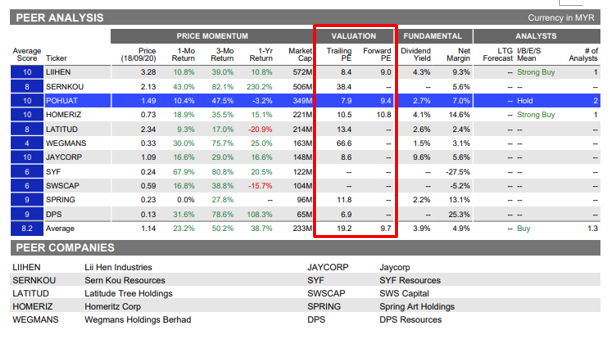

- Reversion to Sector Mean P/E

Based on peer analysis, the Trailing P/E of POHUAT at 7.9x is relatively low compared to its sector average P/E of 19.2x. Even at a conservative take profit P/E of 10-12x, there is at least 25% upside to POHUAT.

Risks

- Increase in the cost of raw materials

- Increase in labour costs

- Unfavourable exchange rates

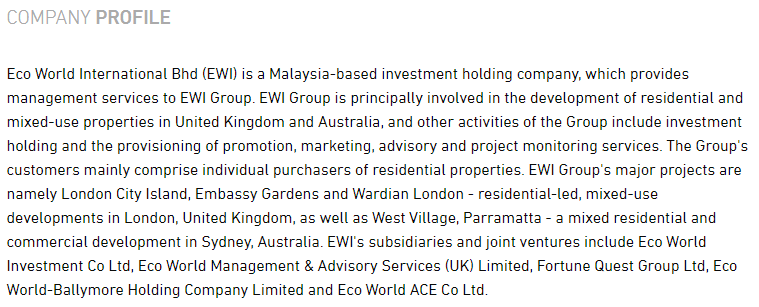

2. EWINT (5283)

Catalysts

- Recovery in UK Properties Sector

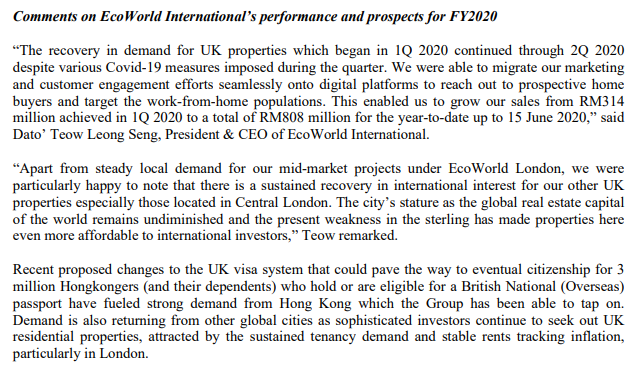

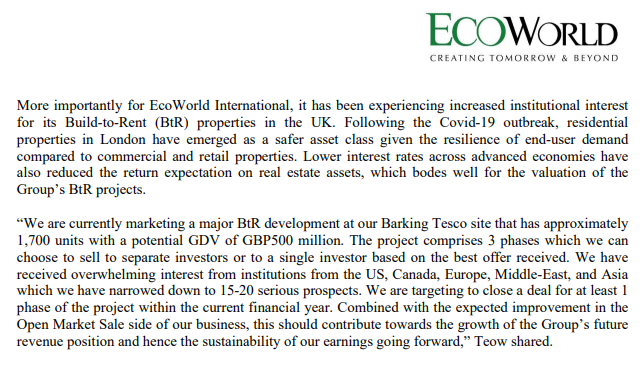

In EWINT latest Q2 result, the management had highlighted upbeat performance in their YTD sales performance mainly due to the recovery in demand for UK properties.

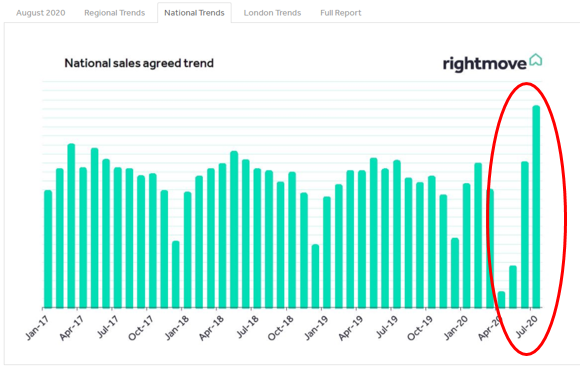

Now, let’s confirm their statement with the performance of UK Housing Sector:

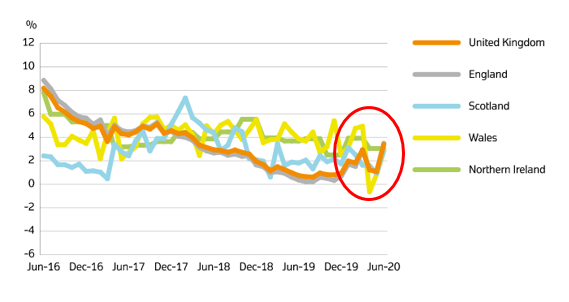

Rightmove House Price Index - this is the UK's earliest report on housing inflation

(Source: https://www.rightmove.co.uk/news/house-price-index/)

UK House Price Index - Change in the selling price of homes

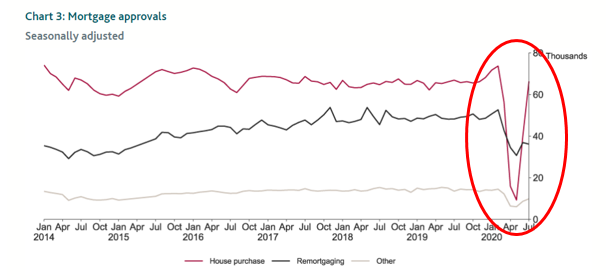

Bank of England Mortgage Approvals - number of new mortgages approved for home purchases

(Source: https://www.bankofengland.co.uk/statistics/money-and-credit/2020/july-2020)

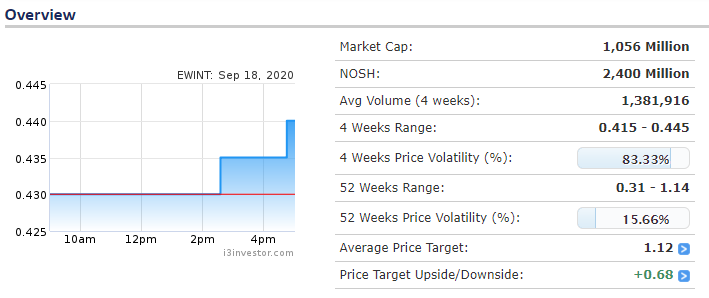

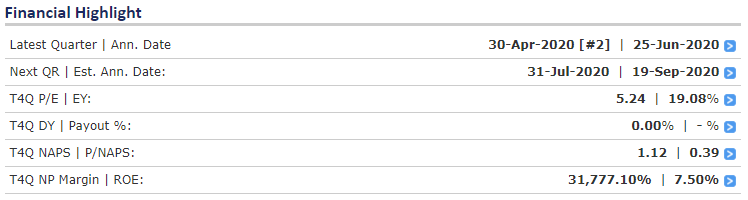

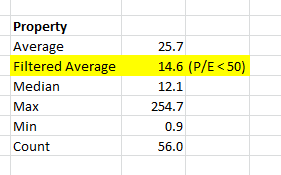

- Reversion to Sector Mean P/E

(Source: https://www.malaysiastock.biz/Listed-Companies.aspx?type=S&s1=13)

Based on peer analysis, the Trailing P/E of EWINT of 5.2x is relatively low compared to its sector average P/E of 14.6x. Even at a conservative take profit P/E of 10, there is at least 50% upside to EWINT.

Risks

- Unfavourable exchange rate

- Negative effect from Brexit

- Slower progress in development project

DISCLAIMER: The information above is provided for education purpose only and does not constitute a buy or sell recommendation. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of you acting based on this information.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

WannaBeTechAnalyst

Good write up for POHHUAT

2020-10-12 00:13