Deep value in injection moulding sector: Hil, Lcth, Sanichi & Geshen

angiegoh

Publish date: Sat, 31 Oct 2015, 12:00 AM

Injection moulding sector

Injection moulding is a manufacturing process of injecting material into a mould to produce many things, i.e. packaging, bottles, automative parts, containers, mechanical parts, and most other plastic products.

The main raw material of injection moulding is polymers, sometimes known as resins - a derivative of crude oil.

Prices of polymer are positively related to crude oil prices. As a result, injection moulding companies now enjoy lower material (hence production) cost.

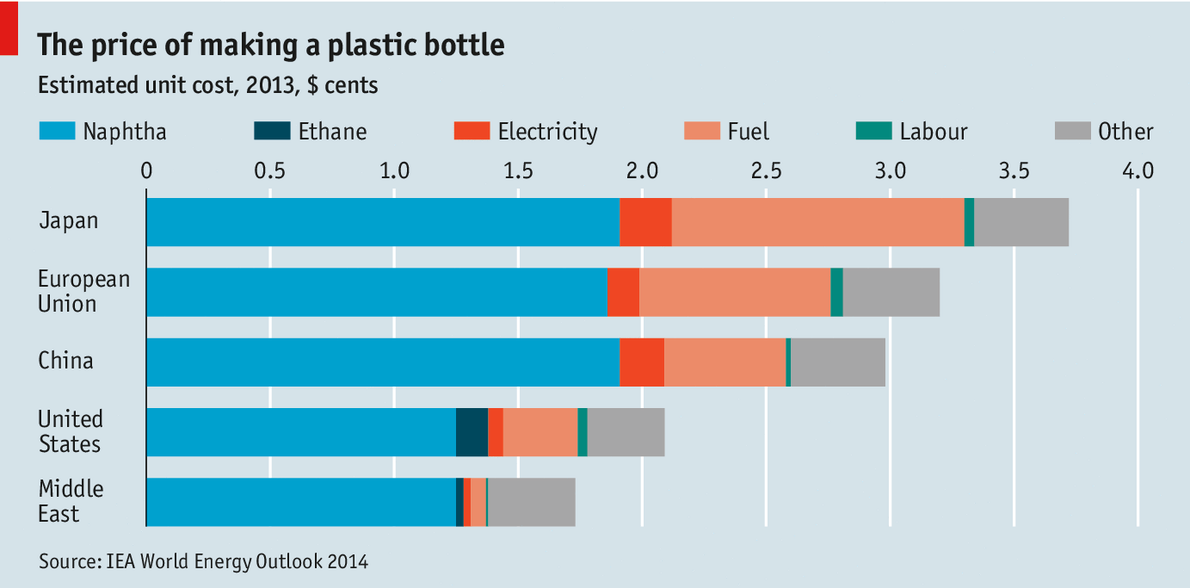

The chart below suggests that the raw material conservatively represents more than 50% of the total production cost of a plastic product.

As a result, injection moulding companies will enjoy better margin. The margin improvement will be more significant for export-orientated companies.

We, therefore, posit that certain injection moulding companies offer deep value investing opportunities.

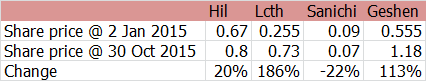

Stock performance of companies

Based on the stock performance, it seems like investors are informed of the growth factors that mentioned earlier.

Nevertheless, there are 2 potential laggards (Hil and Sanichi) which might offer deep value.

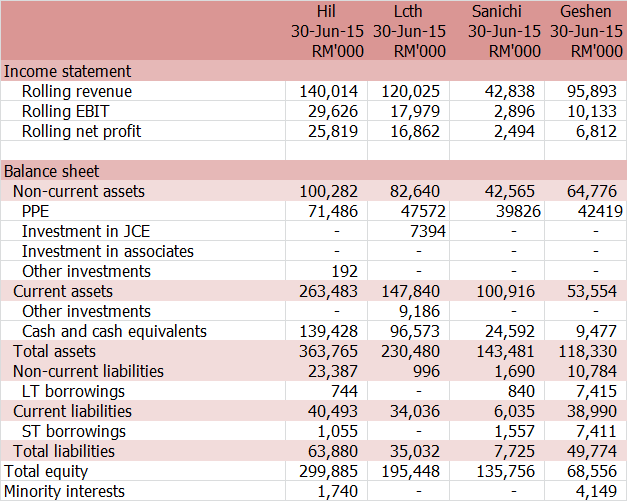

Financial statements

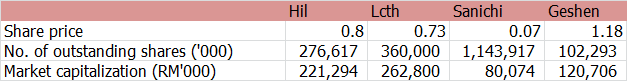

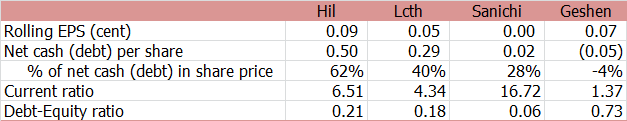

Net cash companies: Hil, Lcth, and Sanichi

Net debt company: Geshen

Among the net cash companie, Hil has the best record for both gross and net profit margins.

Simple financial statement analyses

Cash is king.

We, consequently, like the net cash companies, especially those offering a high percentage of cash in their share price.

Benjamin Graham would advice us to stay away from Geshen.

Simple valuation

The PE suggests that Hil is clearly a laggard although its ROE is comparable to its peers.

To us, that is just a suggestion to investigate Hil and its peers further on a standard basis without being affected by their varied capital structure.

Deep valuation

Ideally, we want to acquire quality companies at their undervaluation.

In term of quality, as suggested by the industry's average ROIC (10%), most of the injection moulding companies display above average performance.

When it comes to valuation, as indicated by acquirer's multiple, Hil is the cheapest among all. This finding reinforces what PE ratio suggested earlier.

At this current state, Hil is just selling for RM0.8 per share. The stock would need to be priced approximately RM1.65 to catc up with the industry's average acquirer's multiple 10.89.

In other words, Hil offers deep value and bold margin of safety.

Conclusions

With the ability to generate average returns on invested capital, however, Hil is adversely undervalued.

Support to this conclusion is rendered by its undemanding acquirer's multiple (2.82), which is far from its closest peer (Lcth, acquirer's multiple 8.32) and its industry's average (acquirer's multiple 10.89).

All in all, all these indicators suggest that Hil offers a deep margin of safety. The downside is limited

More articles on Deep value investing

Discussions

is HIL a beneficial of the weakening of ringgit? from the annual report i can see that foreign exchange translation results in lower profit vs 2014. Can u comment?

2015-10-31 08:05

But it has properties developments in it.. will it be a stable revenue for HIL? i read that it does trade with china only, will the devaluation of Yuan impact on its earnings/>

2015-10-31 09:06

Good Sat gentlemen.

The potential of better margin is hypothesized on the basis of cheaper raw material and RMB depreciation.

For Hil's core manufacturing business, they sell largely to China and are affected by RMB depreciation.

Although the contribution of manufacturing segment is lower, for now, the group's earnings are compensated by good sale of property in Shah Alam.

This demonstrates a good diversified business model.

Most importantly, Hil's free cash flow remains strong and deeply undervalued.

2015-10-31 09:55

Care to explain why is there a sharp increase in price and volume from Jan to March then went down all the way to 52sen in August before rebounding now? Despite it reporting a very good profit + positive cash flows, why it isnt be accounted for? Also, will HIL benefit from the depreciation of MYR vs USD? The properties segment, will the current effort of govt to limit purchasing power will benefitr HIL in long term ? pls explain.

2015-10-31 10:04

Good morning to Angie,

Welcome to i3 Investor's Forum.

Very nice reading your posts. With analytical mind and good English you will be an asset to i3 people. So keep up your good work.

As for Hil Mr. Bonescythe has already recommended it before. Hil should be Ok. Only thing is it is selling less than 30% discount to NTA.

Ben Graham advocates the 30% discount to NTA as a Margin of Safety.

Have a nice day

2015-10-31 10:09

HIL is not pure injection molding company, half of the profit is from property, not a good comparison vs other injection mold companies, in term of niche product in plastic injection, hil does not have. For plastic injection niche companies, consider skp & lcth

2015-10-31 10:20

SKPRES in Batu Pahat? LCTH in Johore?

Iskandar & Johore will boom for years to come!

2015-10-31 10:55

Based on HIL latest quarter, injection moulding contributed 73% of its revenue.

Property is a supplement and helps sustain HIL's financial wellbeing.

One can relate the same kind of business diversification strategy to Scientex, and it is proven effective even in tough economy.

2015-10-31 16:03

forgive me if i'm wrong, but sanichi is supposed to be a mould manufacturer. It manufactures the plastic injection mould instead of the plastic part.

2015-11-01 13:55

"Prices of polymer are positively related to crude oil prices" - correct, besides, it also related to exchange rate in USD, as well as buying volume of the company. In other words, the contract price of resin from any compounder is very much depends on the buying volume in metric tonnage.

2015-11-01 17:45

LCTH looks like better value. And it is actually focusing on its core business of injection moulding.

2015-11-02 09:16

Angiegoh, 1.65 for HIL is based on what method of calculation? I'm not so understand.

2015-11-02 14:51

AyamTua

www.shareinvestor.com/fundamental/factsheet.html?counter=5220.MY

2015-10-31 00:07