Deep value in fastener sector: Chinwel & Tongher

angiegoh

Publish date: Sat, 24 Oct 2015, 12:00 AM

To me, personally, I acquire new knowledge through stock investment almost everyday.

It is fortunate to have helpful forum members like JTYeo, Noby and KcChong.

Now we are on the same page.

Fastener sector

Fasterners are a hardware device that mechanically joins objects together.

They are used in industry, commerce, and household. Therefore, there is sustainable demand for fasterners.

Raw materials for fasteners include stainless steel, aluminium, and copper. Prices of these raw materials have been declining, and touched a base of five-year low.

Most Malaysian made fasterners are exported to the West. Local fastener companies should benefit from RM depreciation.

There is a good chance that Chinwel and/or Tongher offer a deep value investing idea.

Stock performance of companies

It seems like investors have, so far, disagreed with the prospect of both fastener companies.

Financial statements and simple anlyses

It is noted that Tongher's net profit in the latest quarter was affected by the negative earnings of its associate.

Theoretically, companies should not consolidate the share of results (profit/loss) of associates (with only 30% shareholding) in their incme statement. However, many companies do so and 'wash' their net profit.

Consequently, the reported net profit does not reflect the operating profit of a particular company.

We, in deep value investing, focus on the cleanest operating profit (EBIT) that derived purely from the company's operating business.

Note: 6-month cash flow is used here.

Note: 6-month cash flow is used here.

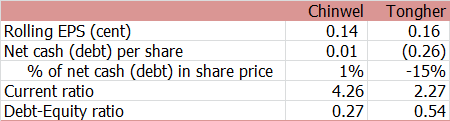

Investors are concerned about their USD denominated borrowings. Their ability to meet the obligation is, of course, backed up by their healthy financial position and on-going free cash flow.

For Chinwel, its USD currency loans were reduced from USD73.138 mil (as at 30 June 14) to USD53.011 mil (as at 30 June 2015).

For Tongher, its USD currency loans were parred down from USD48.30 mil (as at 30 June 14) to USD40.98 mil (as at 30 June 2015).

In addtion, these two companies have used forward exhange contracts to protect them from fluctuations in currency pries. As stipulated in the contracts, Chinwel and Tongher agree to buy or sell a certain amount of foreign currency on a specific future date.

Simple valuation

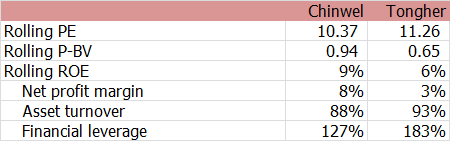

At first, based on PE ratios, Tongher seems to be more expensive in transacton for lower ROE.

Nevertheless, Price-Book Value ratios suggest otherwise.

The contradiction prompts us to compare the two companies on a standard basis without being affected by their capital structures.

Deep valuation

Now it is clearer.

Tongher's invested capital is smaller, and it is more efficient in employing its invested capital to generate ROIC 13%.

Most importantly, Tongher remains cheap. It is trading at Acquirer's Multiple 3.72 or Earnings Yield 27%.

Its 'cheapness' is reinforced by the inverse of free cash flow yield: Tongher is now selling, at a steep discount, of approximately 50% of Chinwel's valuation. The estimate (4.32) also suggests that Tongher can pay back our cost of acquisition or generate cash to reinvest in its business at a significant faster pace than Chinwel.

All these evidences perhaps explain why Tongher bought back 750,300 units of its stock in the open market from 1 Sept to 7 Oct 2015.

Kc Chong has also written about Tongher. Read here.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Deep value investing

Created by angiegoh | Oct 31, 2015

Discussions

@Icon8888, I read your article before, yes, mistake had been made. So do you will buy more leverage down or you will cut loss save capital or do nothing and see first?

@Angiegoh, I always love when some like you who believe in deep value write article like this. Btw, why your Aquire value = ev/ebit is different numbers then mine?

2015-10-24 02:49

Hi Angie, something you might be interested. Deep value case studies but based on UK companies. There's a link for Jeroen Bos and appendix.

http://csinvesting.org/2015/10/13/deep-value-investor-and-case-studies/

2015-10-24 04:41

However, many companies do so and 'wash' their net profit.

Is there any reason why they do so? are they hoping that the associate will recover so that the next quarter will pop out more profit?

2015-10-24 06:06

I think Chinwell far better than Tong Her in terms of profit and cost controlling.

2015-10-24 12:01

For Tongher it is more a commodity play. Last time when Nickel price shot up Tongher share price also jumped up (Guan Chong jumped also due to rising cocoa bean prices. Tongher had large stock of Nickel while GuanChong hoarded cocoa beans). For the last 5 years Nickel priced dropped by 50%. So Tongher also weakened in price.

As for fasteners Europe is now in recession. Euro zone also put dampener for M'sian exports.

A better Stock with VERY DEEP UNDERVALUATION IS MULTICO. It has Very Solid NTA. Last time pay generous dividends. Also its two divisions 1) Electrical & Electronic & 2) Automotive components will benefit Greatly from coming TPP.

Since today is Sunday time to visit www.chick.com

2015-10-25 10:32

Icon8888

For Tongher, associate company loss, if any, will continue to dampen sentiment

I know

Because I was its victim

2015-10-24 00:13