Valuation on poultry industry in Malaysia - currently seemed overpriced!

Asia Equity Research Licensed Investment Adviser

Publish date: Tue, 21 Nov 2017, 11:28 AM

The poultry industry is an important source to supply meat protein to Malaysian. The total value of sales value for chicken eggs and chicken meat ex-farm are believed to exceed RM 10 billion annually.

As an average, the consumption of chicken meat is averaged at 45 kg and chicken eggs 370 eggs per capita (person) annually . This translates to a daily demand of approximately 30 million eggs a day.

POULTRY ECOSYSTEM

Upstream

(i) Feedmill

In feed mill business producing animal feed to grow chicken. Main ingredient in chicken animal feed are corn and soybean meal which are imported.

(ii) Breeding

Breeder farm to breed fertilised eggs and then be incubated to be day-old chicks in hatchery. These day-old chicks will then be supplied to either boiler farm, layer farm, or back to breeder farm as parent chicken stocks.

(iii) Broiler farm

Growing day-old chicks to be reared into full-grown chicken for their meats (boiler).

(iv) Layer farm

Having day-old female chicks to be fed into hens to produce eggs. Largest producer currently is QL Resources Bhd with daily output of 3.6 million eggs a day.

Mid-Stream and Down-Stream

Chicken meat, chicken processed meat and manufacturing egg trays.

Each listed company are involved differently in the activities.

CORPORATE ACTIVITIES IN RECENT YEARS WITHIN THE POULTRY INDUSTRY HAS ATTRACTED INVESTOR’S ATTENTION TO THIS INDUSTRY

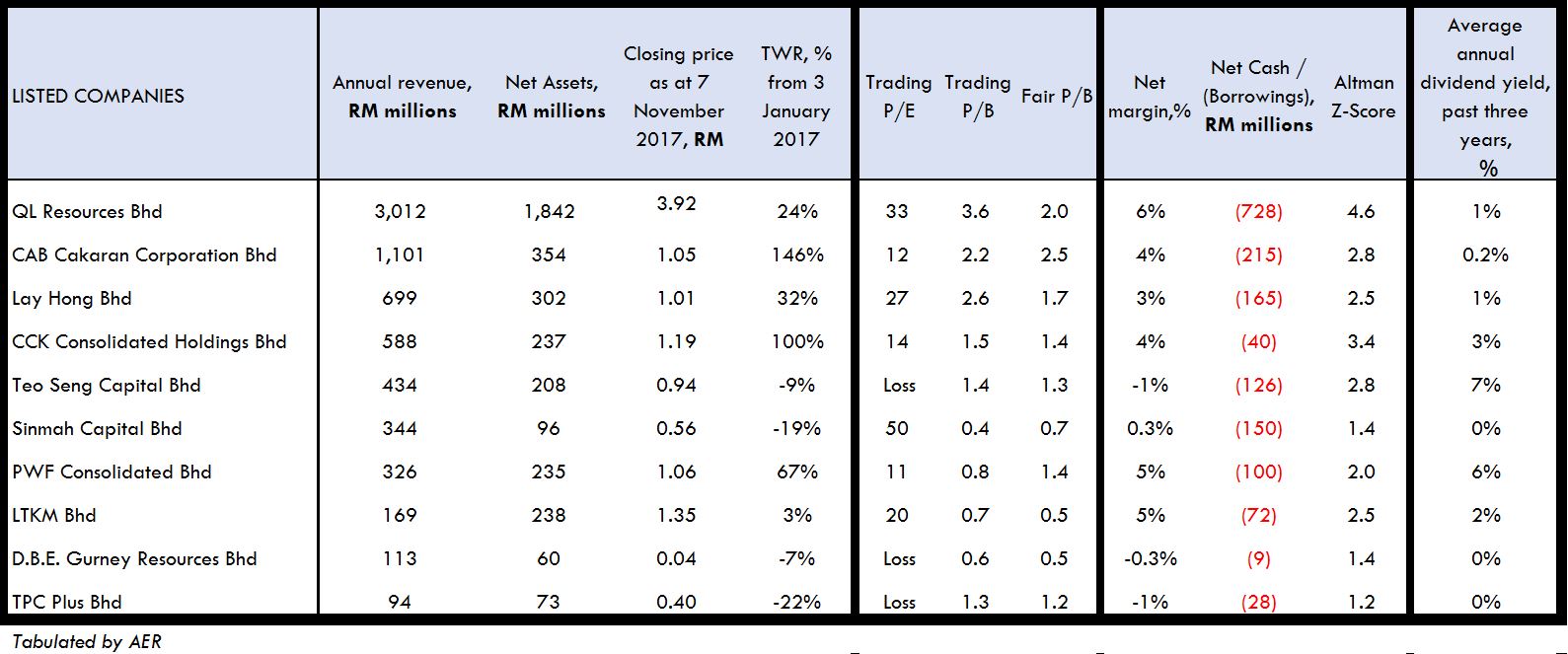

The poultry industry in Malaysia has gathered investors’ attention especially caused by corporate exercises within the poultry industry in recent years. The increased attention has cause investors to bid for the counters resulting that most counters are fairly / over-valued, for most companies within the poultry industry.

In 2012, Leong Hup Holdings Bhd was privatized. The poultry stocks have not been on investor’s radar until the privatization of Leong Hup Holdings Bhd took place in 2012, followed by two other companies.

Prior to the privatization, most of the companies within the poultry sector had been traded at low price to earnings and low price to book. At the point of privatization offer by Leong Hup Holdings Bhd, with an offer privatization price of RM 1.80 per share, it translated to a P/E of 4.3 times and P/B of 0.8 times.

Read more on...

https://m.facebook.com/story.php?story_fbid=1992748687631752&id=1654674194772538

Disclaimer:

The author wishes to declare that the author and Asia Equity Research do not have any share ownership in any of the companies discussed prior to this and until current date. The author can be contacted at general@aer.global for any further enquiries on the contents of this article.

You are required to obtain written consent from Asia Equity Research Sdn Bhd (AER), if you wish to redistribute or reproduce in its original form the information from this article or quoting in other materials. AER reserves the right to take legal action against any party / parties that violates any property rights with respect to this article without obtaining such written consent.

More articles on AER's Articles

Created by Asia Equity Research Licensed Investment Adviser | May 26, 2018

Created by Asia Equity Research Licensed Investment Adviser | Jan 30, 2018

Created by Asia Equity Research Licensed Investment Adviser | Jan 17, 2018

Created by Asia Equity Research Licensed Investment Adviser | Jan 02, 2018

Created by Asia Equity Research Licensed Investment Adviser | Dec 20, 2017

Created by Asia Equity Research Licensed Investment Adviser | Dec 05, 2017

Fear Trend

PWF

Stock term - mid term (6 months to 1 year)

*Pwf summary business*

Pwf is an integrated poultry business which include boiler breeding farming, layer farming and feed manufacturing

*Fundamental and business wise*

1) current pe is trading at 9 compare to their peers cab and ql trading at 10/37 respectively

2) nta of 1.49, which is trading at 47.5% discount from it's current share price

3) profit margin of 6/7%. By number itself, it may be low. But compare to their peers dbe, ql, cab, they are also trading around that number except dbe is at lower edge.

4) current ratio of less than 1. Not too favourable I would say. But they are still generating huge operating cash flow (in fact more than their earnings 29 million cash from operation compare to 16 million of profit. Mainly is good inventory and debtors management)

4. Comment on debt. Debts of 153 million is high but the mounting debt is due to the expansion plan of rm 100 million to convert the open house system into in-house system. Personally, ql have been so successful is due to converting their open house to in house. Open house system is vulnerable to weather and virus. In house system advantage is to mitigate any potential virus like Newcastle, etc and to avoid any weather to interrupt their business. With in house system, they are able to control the ventilation system (as for birth growth they will need minimum wind within it). This productivity will eventually reduce their feed conversion ratio. Recently they have added new boiler farms in perak as well.

5. Profit - if we were to look at their profit since 2013, there is a tremendous growth of cagr around 21.2% for past 4 years. If include the 5th years it will be cagr of 124.34%

6. Revenue - latest quarter of 93 million which is highest revenue throughout their history..:see_no_evil:

7. Dividend yield of 3%. Average. Dividend payout ratio of around 70 to 80% last three years. Based on their payout and 2016 given special dividend, if their profit were to increase this year, we may see more payout to shareholders.

Reason that it may be good for the 1st half of 2018.

1) ringgit has been appreciating compare to USD. Their raw materials are all imported cost which will be beneficial to them.

2) price of eggs are increasing for all grades. Check out jabatan perkhidmatan veterinar for the latest price.

3) commodity price especially for soy bean, feed and corn. Which all three has been going down as well. Can Google for the chart and price.

Technical chart wise

- support of rm1/0.98. if break this week may see it going lower. They have a strong resistance at 1.09. if break it we may see it hitting the next resistance of 1.15. good thing is there is no inverse hammer candlestick within the chart which we can roughly say not many contra players in it to buy low and sell high on the same day itself.

- short term ma 14 had already cross 25 but still struggling to cross ma 50.

Risk

1. Monitor the myr and usd. As long as USD and myr is trading at 3.8 to 4.10, my opinion is it wont be significant impact.

2. Significant impact will be rise of their commodity prices as well as the drop in the eggs price. Monitor it if there is any significant drop.

Opinion

- please do own research before buying. If you are buying, hold it for mid term and let it bear fruit if the assumptions are correct. This is not a speculative counter.

2018-01-22 01:31