APM - An UNDERVALUED GEM Revving Up For Growth (KingKKK) - Intrinsic Value: RM4.66 (60% upside)

KingKKK

Publish date: Sat, 03 Feb 2024, 04:10 PM

A. Why is APM worth RM4.66?

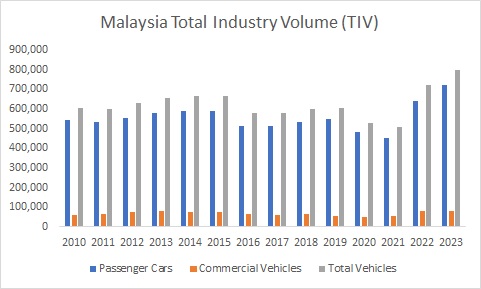

In the first 3 quarters of 2023, APM already made 19.63 sen of EPS. The Q3 itself is the strongest at 13.25 sen. As Malaysia auto industry is still growing with TIV hitting all time high of 799,731 units in 2023, I believe APM business will continue to grow. My forecast is 2023 EPS at 32.93 sen and 2024 EPS at 35.89 sen.

I am using 13x PE which is the average PE when the company is consistently profitable excluding the COVID years of 2020 and 2021.

So 13x PE times 35.89 sen I get my intrinsic value of RM4.66.

This intrinsic value is conservative because it is 31% below its book value of RM6.79. It is also below the peak of RM6.35 in May 2014. Remember that TIV is still growing with record high achieved in 2023 and is still growing. But APM price is still below its peak significantly.

Details of 3Q result is here:

APM Automotive Holdings Berhad (424836-D) Latest Quarterly Results

The slides are here:

PowerPoint Presentation (listedcompany.com)

B. Q3 earnings TRIPLED

| Q3-2023 | Q3-2022 | Change | |

| Revenue | 518.45 | 467.84 | 10.8% |

| Operating Profit | 39.67 | 11.86 | 234.6% |

| Operating Margin | 7.7% | 2.5% | NA |

| Profit Before Tax | 42.379 | 15.613 | 171.4% |

| Net Profit | 25.905 | 8.114 | 219.3% |

| EPS | 13.25 | 4.15 | 219.3% |

In Q3-2023, APM EPS grew 219% against Q3-2022 to 13.25 sen. This brings its 9M-2023 growth to 110%. The reason behind the strong earnings growth is due to increase in revenue by 11% in Q3-2023. The demand from APM's Original Equipment Manufacturer ("OEM") customers in Malaysia has been exceptional with a high level of backorder bookings and new model launches. Operating margin improved substantially to 7.7% in Q3 2023 from last year same period's 2.5% due to cost pass on to certain customers and the recovery of tooling cost.

C. Positive prospect ahead

APM Automotive Holdings earnings is poised to grow higher due to higher number of new cars registered every year, its strong balance sheet allowing it to expand and its solid expansion plan. APM Automotive Holdings Berhad's expansion plans focus on several key areas:

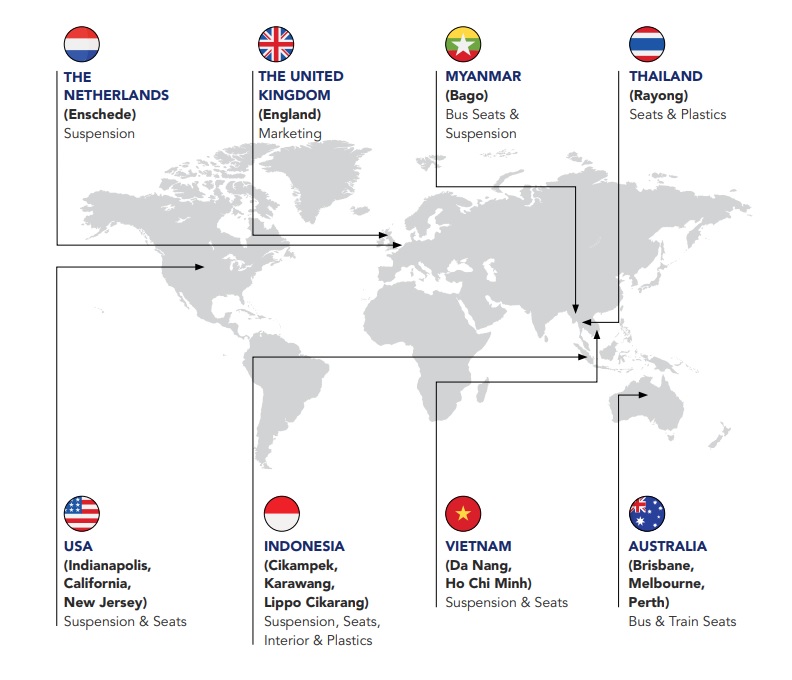

1. Strengthening Regional Footprint:

Indonesia: They aim to improve performance in Indonesia through increased localization, production efficiency, and strategic partnerships.

ASEAN: They plan to solidify their foothold in other ASEAN countries, particularly focusing on Vietnam.

Western Australia: Their recently established plant in Perth for train seats is expected to contribute positively.

2. Expanding Replacement Market Reach:

New Product Categories: Exploring the production of new automotive products beyond their current offerings.

Export Market Participation: Increasing presence in overseas markets for their existing products.

Strategic Ventures & Partnerships: Pursuing new OEM opportunities through collaborations with other companies.

Localization & Efficiency: Improving production efficiency and local sourcing to remain competitive.

3. Embracing Electrification:

EV-related Ventures: They are actively seeking ventures related to electric vehicles, demonstrating their commitment to the future of the industry.

D. Auto Industry is Growing

Malaysia’s total industry volume (TIV) hit an all-time high of 799,731 units in 2023. This is 11% above 721,177 units sold in 2022. The source is from the Malaysia Automotive Association (MAA). News article as below. This year in 2024, I think TIV will grow 3%-5% to around 825,000 units. More importantly, a lot of existing cars on the road will need to replace their spare parts as it gets old, so whether TIV continues to grow is just a bonus not a super important factor to begin with.

Malaysia’s TIV Hits All-Time High Of 799,731 Units In 2023: MAA | BusinessToday

E. Strong revenue growth

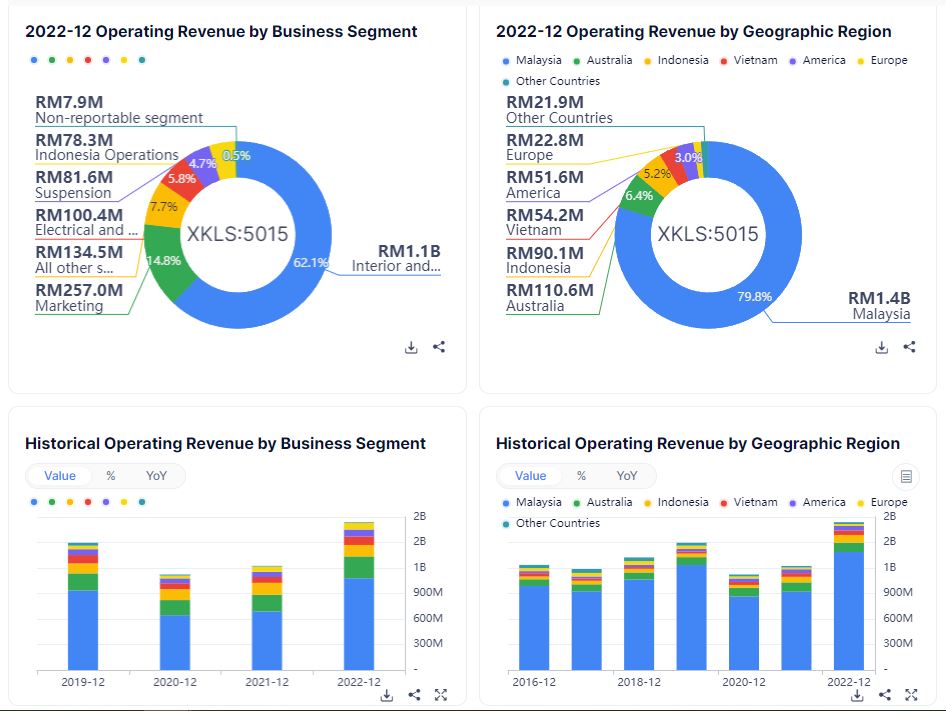

In the past 10 years, APM revenue has been on uptrend. This is excluding 2021 and 2020 in which their factories were forced to run at below optimal level due to Covid-19. In 2022, revenue has grown 42% against 2021 to RM1.74b. Net profit turned around to RM26.4m against 2021 loss of RM11.3m. Earnings per share turned positive to 13.50 sen from 5.75 sen loss in 2021. APM announced 14 sen of dividend in 2022 which is a 6-year high. Chart below from gurufocus.

F. Strong balance sheet with net cash

In the past 10 years, APM has been in net cash position. This means that it has super strong balance sheet. Net cash position has increased to RM210m in 2022 from RM208m in 2021. This figure jumped more to RM285 million as of end-3rd quarter in 2023. More charts from gurufocus as below.

G. Background (Top clients include Ford, Honda, Toyota and Volkswagen)

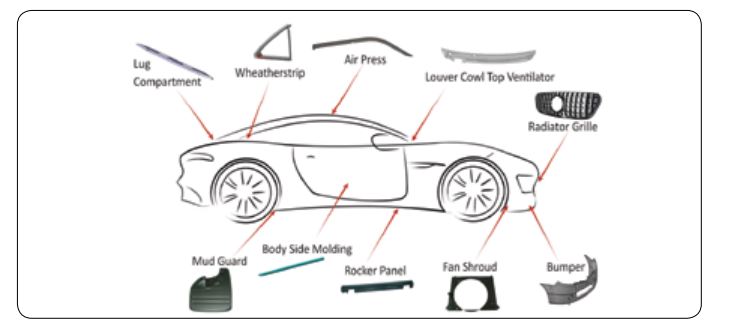

APM Automotive Holdings Berhad, founded in 1971, is a leading Malaysian manufacturer of automotive components. The company account is audited by KPMG which is one of the Big 4 accounting firm. The company has four key segment which contributed more than 90% of its total revenue. These include:

1. Suspension Division:

APM Springs: Renowned for leaf springs, coil springs, shock absorbers, and more.

2. Interior & Plastics Division:

Auto Parts Manufacturers Co. (Seats): Expertise in bus, van, and specialty vehicle seats.

APM Seatings: Produces high-quality seats for diverse applications.

APM Plastics: Manufactures plastic components for various automotive functions.

APM Automotive Modules: Integrates modules for enhanced functionality and comfort.

APM Auto Safety Systems: Focuses on seatbelts and other safety-critical components.

These pictures are from Annual Report 2022.

3. Electrical & Heat Exchange Division:

APM Climate Control: Designs and manufactures air conditioning systems and components.

4. Marketing Division:

Auto Parts Marketing: Ensures effective reach and distribution of APM products.

H. History

APM was incorporated on 26 March 1997. Led by Dato' Tan Heng Chew, they became a regional and now global supplier. Pioneering "firsts" in their field, they lead in leaf springs, van & bus seat design, and more. Their journey started with the Tan Chong Motor Holdings Berhad group, establishing an Autoparts Division in the 70s-80s. Incorporated in 1997, they grew rapidly, focusing on customer satisfaction and quality.

H. Video to understand APM operation

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024