Property Sector - Pre-CNY Rally Leaders and Laggards? Discussion about E&O, SIMEPROP, UEMS, SPSETIA, SUNWAY, IOIPG, MAHSING and ECOWLD - (KingKKK)

KingKKK

Publish date: Thu, 08 Feb 2024, 09:40 AM

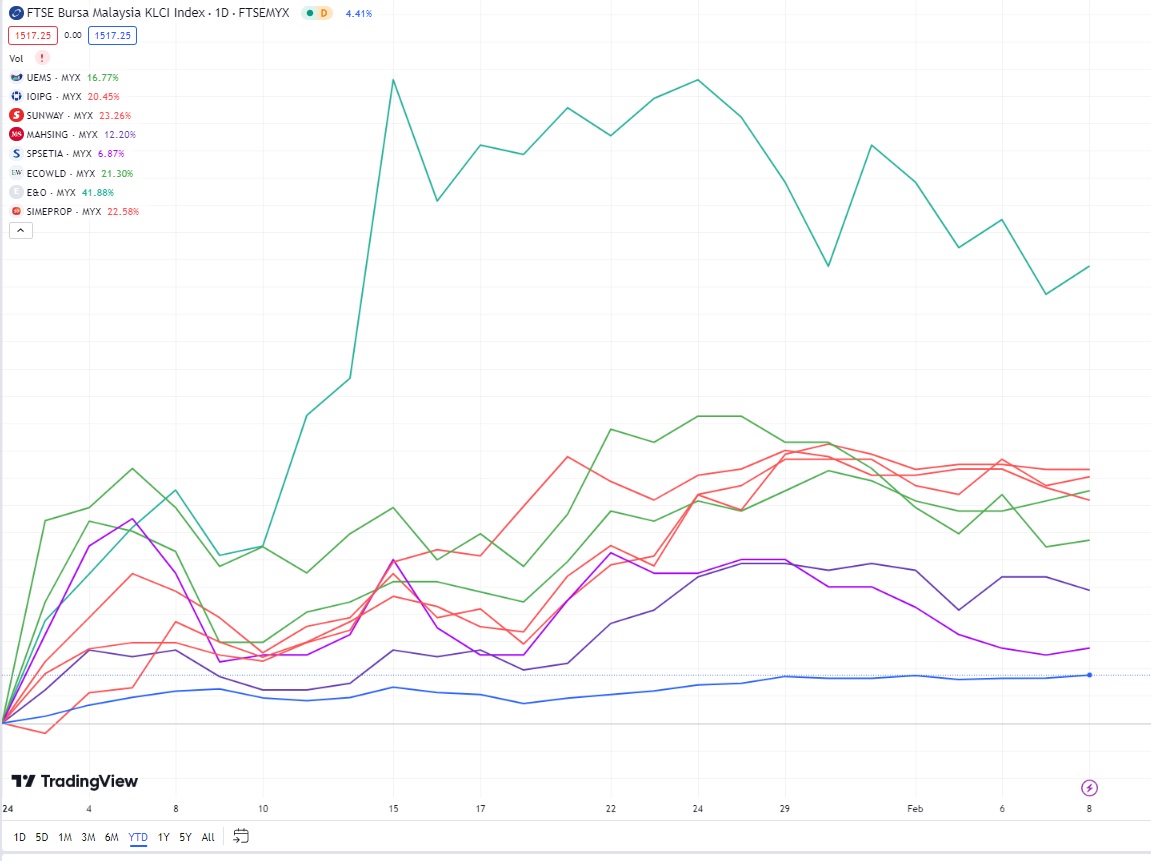

The chart above from TradingView shows the Year To Date (YTD) performance of FBMKLCI, UEMS, SPSETIA, SUNWAY, IOIPG, MAHSING, SIMEPROP, E&O and ECOWLD.

These are what I see:

1. All property companies outperformed FBMKLCI YTD. All mid and big cap developers share price performance are better than FBMKLCI. These property companies generated return YTD of 6.87%-23.26% against FBMKLCI +4.41%. Possible reasons are better newsflow from Iskandar Johor and stronger property sales.

2. E&O is the champion. E&O gained 41.88% YTD. It is a luxury developer which builds high-end residential & commercial properties in prime locations like Kuala Lumpur & Penang. They also manage the iconic Eastern & Oriental Hotel, known for its heritage and colonial charm.

3. SPSETIA and MAHSING are the laggards. SPSETIA (+6.87% YTD) and MAHSING (+12.20%) seems to have the lowest gain in price.

4. UEMS are the laggards among Johor theme play property companies. UEMS also lagged with price increase of 16.77% YTD against SUNWAY 23.26% and IOIPG 20.45%.

Ranking list:

1st: E&O +41.88%

2nd: SUNWAY +23.26%

3rd: SIMEPROP +22.58%

4th:IOIPG +20.45%

5th: ECOWLD +20.37%

6th: UEMS 16.77%

7th: MAHSING 12.20%

8th: SPSETIA +6.87%

More articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024