APOLLO: The Consumer Sector's RISING STAR? (KingKKK) - (New Intrinsic Value is RM11.30; 60% upside)

KingKKK

Publish date: Thu, 04 Apr 2024, 01:36 PM

APOLLO announced its 3rd quarter FY 2024 earnings on 18-March. Share price has increased since then. Is it still undervalued now? Let's find out.

Source: Google

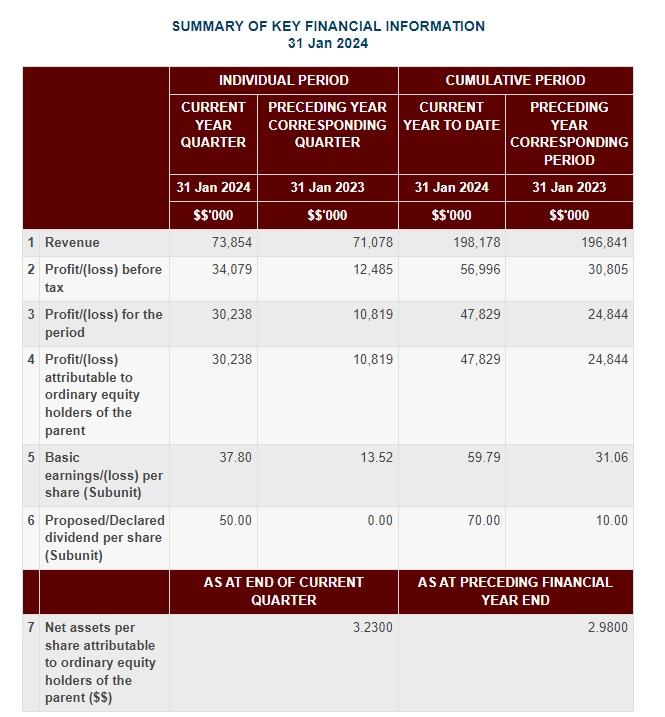

1. Top line +4% YoY and 12% QoQ to RM73.8 million. The company's 3QFY24 revenue increased due to better domestic sales. I believe sales volume is better due to new management effort to promote its product.

2. Profit before tax (PBT) surged 173% YoY and 164% QoQ. There is a one off disposal gain of investment properties of RM18.6 million. However, excluding this PBT still grow at respectable 24% YoY and 20% QoQ. The company stated that gross profit margin has improved.

3.Net profit jumped 179% YoY and 204% QoQ. Excluding the impact of investment properties gain, net profit is RM15.2 million (+41% YoY or +53% QoQ).

4. Cash increased year-on-year (yoy) and qoq:

Q3 FY24: RM142.5m, Q2 FY24: RM133.5m, end-FY23 = RM104.9m.

5. Free cash flow in 9 months already exceed FY 23 level:

9M FY24 = RM31.9m, FY 2023 = RM20.8m.

6. 50 sen dividend announced. 9M dividend of 70 sen is 7 times higher than last year's 10 sen.

Source: Bursa Malaysia

What I think?

1. The result is way better than I thought. Last time, I think Apollo can make 11.8 sen per quarter or 47.3 sen a year. But now after the strong earnings it looks like Apollo can achieve RM15 million net profit or EPS of 18.8 sen per quarter.

2. Strong earnings has just started. New management takeover effective December-2023 and earnings already shown good progress. Next quarter Q4 FY 24 (February to April 2024) will be the full quarter under new management so I think there is high chance of better earnings ahead.

3. Prospect looks great. The company strong balance sheet means that it can expand via merger and acquisition if it is willing to leverage. Internally, the company mentioned that it is exploring expansion by developing new markets and new customer segments to maximise potential, deepen our market penetration and increase sales.

4. The new intrinsic value is RM11.30. I am using PE ratio of 15x to calculate the intrinsic value of Apollo. This is the average PE for 5 years and 33% discount to consumer sector PE of 20x.

Given the estimated FY 2025 EPS of 75.2 sen, this calculation results in a value of RM11.30.

About KingKKK

My portfolio performance in Q1 is +19.60%, I am ranked #8 in i3 Stock Pick Year 2024 competition.

Stock Pick Year 2024 - 29 Mar Result | I3investor

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024