Economics - BNM holds key rate at 3.25%

kltrader

Publish date: Wed, 06 Mar 2019, 06:50 PM

- BNM left OPR at 3.25%

- BNM kept its neutral statement

- Overall tone is cautious

- BNM expects inflation to stay broadly stable in 2019

- OPR to stay at 3.25%

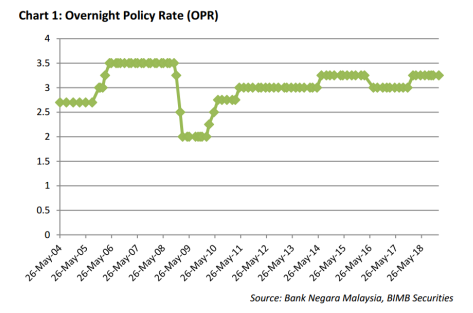

Bank Negara Malaysia (BNM) left the Overnight Policy Rate (OPR) unchanged at 3.25% as expected. The decision is widely expected and timely as global and domestic macroeconomic indicators are reflecting moderating signs especially from the global economy. Nevertheless, we expect Malaysia’s GDP growth to remain stable this year and we are maintaining our 2019 growth forecast of 4.8% on the back of supportive private consumption and investment activity.

In its monetary policy statement (MPS), BNM highlights a cautious outlook on growth, citing the global growth is moderating amid slower growth in most major advanced and emerging economies. Unresolved trade tensions remains a key source of risk that would affect global trade and investment activities. Tighter global financial conditions and elevate political and policy uncertainty could lead to financial market adjustments, which further weigh on the overall outlook. The central bank still believed “on the balance” that the Malaysian economy will “remain on a steady growth path”. They also highlighted downside risks from “unresolved trade tensions, heightened uncertainties in the global and domestic environment, and prolonged weakness in the commodity-related sectors”.

On inflation, the deflation reading of -0.7% yoy in January was mainly due negative transport inflation arising from lower oil prices. Meanwhile, core inflation remains stable and reflective of steady consumption. BNM expects average headline inflation to stay broadly stable in 2019, on the back of stable global oil prices

OPR to stay at 3.25%

With inflation staying subdued and growth moderating, BNM kept policy rates unchanged and it appears prudent on BNM’s part to keep the benchmark rate on hold. Against the backdrop of regional central banks tilting dovish (e.g. Reserve Bank of India and Reserve Bank of Australia), expectations are rising somewhat for BNM to follow suit. However, we expect BNM to wait to get more certainty on how the economic situation eventually pans out before making any decision on the OPR. The central bank is also appearing more vigilant this time around as they said, “recognizing that there are downside risks in the economic and financial environment, the MPC will continue to monitor and assess the balance of risks surrounding the outlook for domestic growth and inflation”. There still remains a lot of ambiguity regarding the global environment especially in relation to a resolution for the US – China trade talks. As Malaysia is a small open economy, the outcome of the talks would obviously have a substantial impact on the country’s economy. Despite a more cautious stance on growth, we do not expect BNM to tweak their monetary policy stance for now. We maintain our view for the OPR to remain unchanged at 3.25% for the year.

Source: BIMB Securities Research - 6 Mar 2019

More articles on Bimb Research Highlights

Created by kltrader | Nov 12, 2024

Created by kltrader | Nov 11, 2024

Created by kltrader | Nov 11, 2024

Created by kltrader | Nov 11, 2024