KESM fundamental and technical analysis

Brian Loke

Publish date: Wed, 10 Aug 2016, 11:31 AM

Fundamental Analysis:

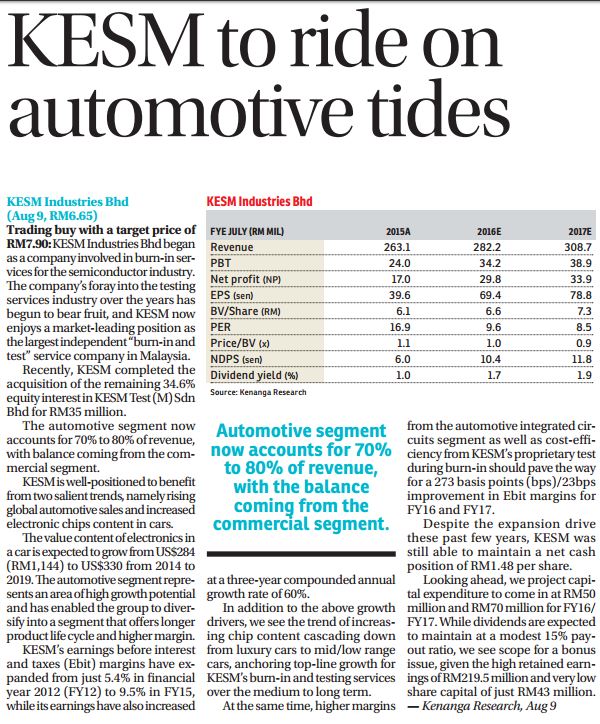

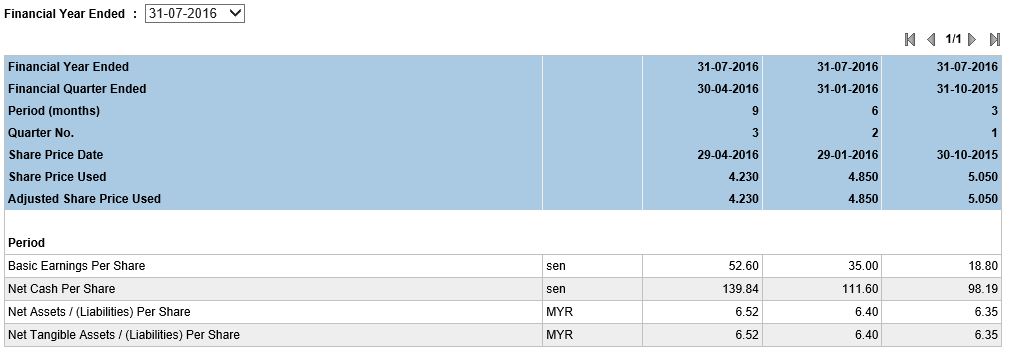

KESM revenue and profit continue to grow higher with its latest outstanding 3rd Quarter earning which is doubled last year Q3

I am expecting higher dividend payout at 4th quarter with the continue strong USD.

It also has strong balance sheet, net cash 139 cents per share and also higher NTA.

Technical analysis:

KESM stock price at strong uptrend with moving average above 20 days and 50 days and just broke historical high.

Elliotte wave shows increasing momentum with 3rd wave is stronger than 1st wave.

Its stock price just completed Fibonacci retracement at 61.8% (rm6.4) which formed its support.

GMMA with green arrow shows it is starting to have trend breaking out from compressing phase.

Target price at around rm7.90.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on fundamental and technical analysis

Discussions

when u compare their charts, KESM is at much stronger and just broke historical high

2016-08-10 15:31

UY

noted, thanks

2016-08-10 11:43