Should You Invest in Unitrade Industries Berhad New IPO? Here are my key takeaways…

Gem Man

Publish date: Fri, 27 May 2022, 02:36 AM

Founded in 1979 and being one of the largest homegrown building material wholesalers & distributors in Malaysia, Unitrade seems to be an interesting company that may benefit from the robust construction activities in 2022. Oh ya, at RM500 million market cap, it is also the largest listing in the history of ACE Market.

But as an investor, should we invest in Unitrade’s IPO?

Let’s see, let’s see…

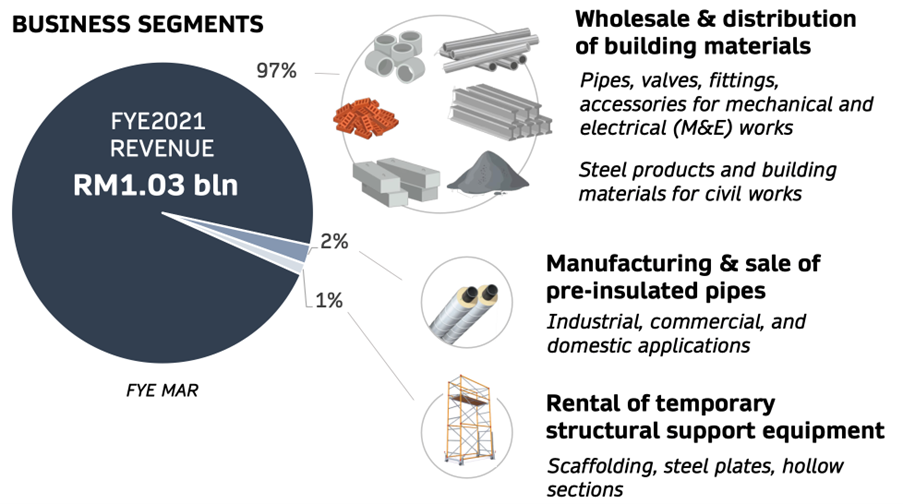

When it comes to business, Unitrade is principally involved in the wholesale & distribution of building materials such as pipes, valves, fittings, accessories for the M&E and civil work industry. The company is also involved in the manufacturing & sale of pre-insulated pipes and rental of temporary structural support equipment, the revenue contribution however, was minimal.

As far as I’m concerned, Unitrade had been supplying reinforcement steel, structural steel as well as other build materials for the construction sector for the longest time. In terms of steel related products, the company has their in-house brands of Alfran and S2S, where they outsource the manufacturing process to China, or OEM in short.

Like it or not, the construction material prices had – to an extent which I would use the term exacerbated, where steel prices, be it cold rolled or hot rolled steel, had gone past the peak level in 2021.

Yes, inflation is in place, and it is hurting us, especially if you are buying a house later or going for renovation works lately and it involves steel, I believe you would feel the pain.

As for Unitrade, they had proven themselves to benefit from the rise of construction material prices, in which they had their best year ever in financial year 2021.

I had also done some studies onto some peers in the building materials industry. Most of them had an amazing financial year in 2021, and some of them had an extraordinary 1Q results, too.

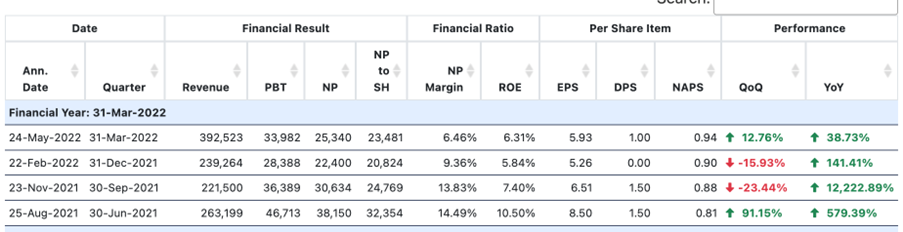

Results for AYS for the past 4Q.

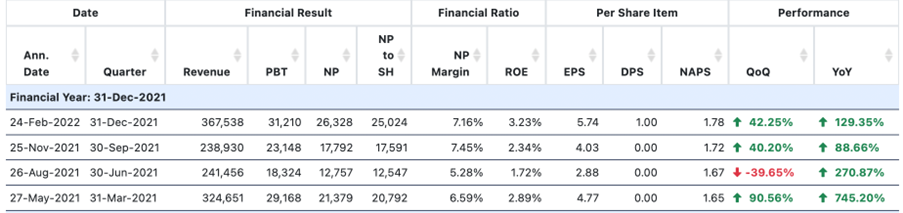

Results for Engtex for the past 4Q.

So… yeah, the building material is doing fairly well recently.

Revenue-wise, I noticed only a handful of building materials companies record revenue exceeding RM1bln (eg. CMSB, Chin Hin, Malayan Cement, Hiap Teck, Engtex). Unitrade is also one of them – hence the term one of the largest in the country. The bigger boys naturally enjoy greater economies of scale in operations and stronger bargaining power with suppliers when it comes to sourcing.

Another factor that investors need to take into consideration is the 2022 construction GDP growth forecasted by the MoF, which is around 11.5%. Several mega projects like the RTS, LRT 3, MRT 3, and Pan Borneo Highway will be consuming lots of construction materials.

As for the residential and non-residential sectors, several initiatives by the government such as Rumah Mesra Rakyat, People’s Housing programmes, Tun Razak Exchange and KLIA Aeropolis will boost the demand for construction materials, too.

Most importantly, General Election is said to be around the corner, as some speculate it to be in August or September, but… who knows? What we as investors know is as GE comes in, it will be better for property, construction and of course, the construction materials industry, too.

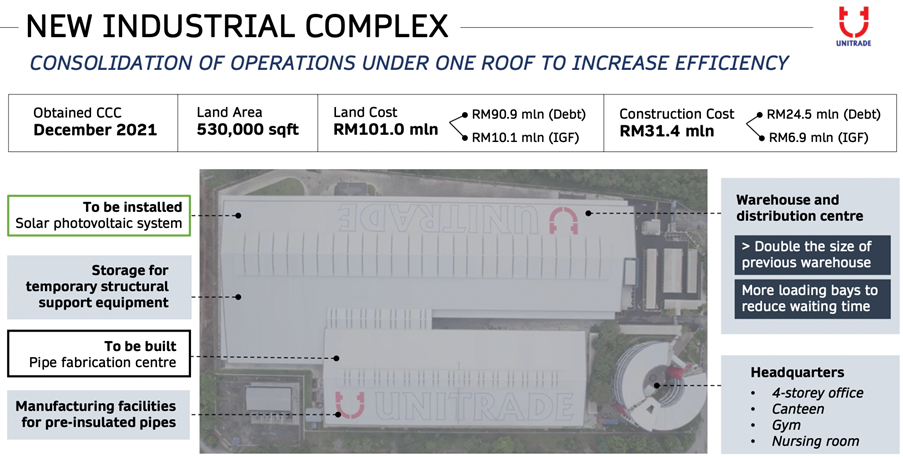

In fact, the new warehouse for Unitrade is massive, where they can have more stock keeping units and purchasing volume. When you have both SKUs and volume, it will be easier for them to control their margins due to, again, economies of scale.

To conclude, I think the timing of Unitrade’s listing is quite fitting based on the reasons above.. and deserve some attention. Anyhow, I cannot predict how the share price would move when the listing takes place, but at least for the earnings for Unitrade, things seem bright in 2022.

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

keinming28

i notis share application close this monday 30/6. they are raising RM100million! that's a lot of money.. well, i guess if the shares are fully subscribe, it shld mean market confidence towards them is good. we shall see.. who knows it may be another Chin Hin... :P

2022-05-27 11:54