PESONA Rounding Bottom Hitting Neckline With Strong Resistance - 3 Possible Scenarios Inside

Ming Jong Tey

Publish date: Mon, 26 Dec 2016, 05:06 PM

PESONA (8311): Bullish

Pattern: Rounding Bottom Pending Breaks Up

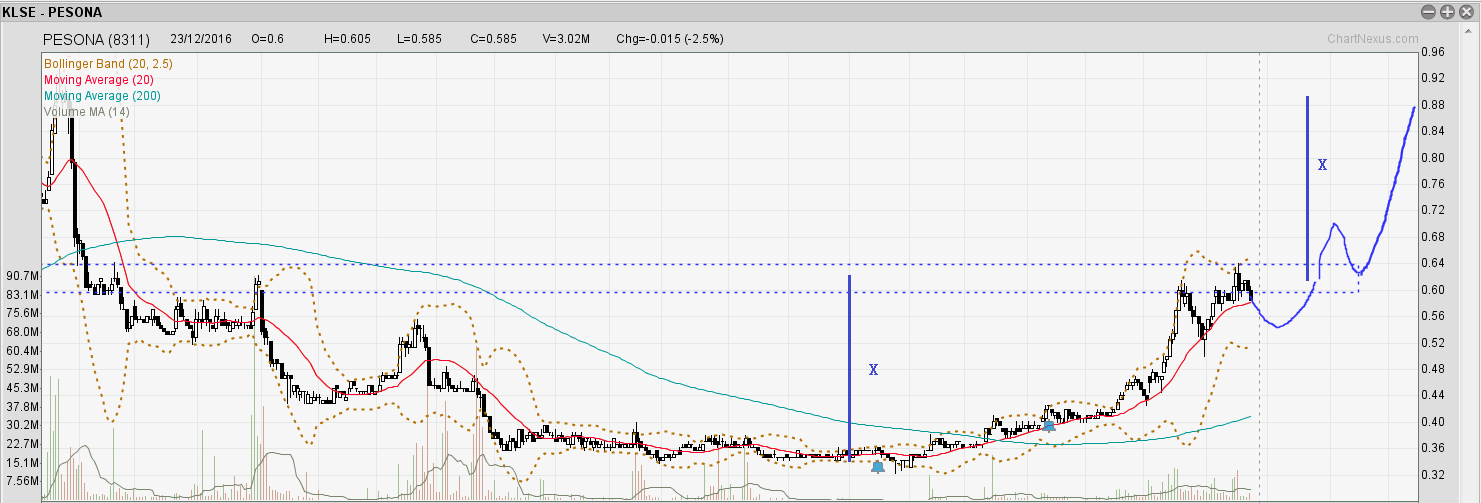

As shown in the weekly chart below, Pesona has formed a beautiful rounding bottom pattern, which takes about 1.5 years.

It hits the neckline, which corresponds to a strong resistance area as highlighted in the red rectangle. Last week bearish engulfing price action suggests losing bullish momentum.

Based on the projection (X) of the rounding bottom structure, the target price is around 0.88.

On the daily chart below, the price attempted twice to penetrate the resistance area (0.6-0.64) but did not succeed.

I assume 3 scenarios going on from now:

- Price makes a pullback before attempting to break the resistance area, as shown in the daily chart above.

- Price hovers around 0.58-0.64 region to resume bullish momentum to hit the first target price of 0.88.

- Price breaks up without consolidating and heads toward the target price.

My preferred scenarios are in the order of 1, 2, 3.

Should scenario 1 happen, it will provide a great opportunity to long on pull back at a better price (maybe around 0.54-0.56) after a reversal candlestick pattern shows up.

For scenario 2, aggressive traders can jump in first during the consolidating period. Else, you can wait for the confirmation of a successful break up.

For scenario 3, breakout traders can jump in after the price breaks and close above 0.64.

Else, we can wait for a break and retest pattern (also shown in the daily chart) to long at around 0.64. The downside of this is that the retest of the neckline might not happen.

I am bullish as long as it stays above 0.5.

Will the affordable housing theme play out for PESONA? Feel free to comment below in terms of fundamental, news, discounted cash flow or any other forms of analysis :)

Topics That You Do Not Want To Miss

How to determine the "bullishness" of the patterns- https://www.facebook.com/BursaSGXcandlestick/videos/378260995905662/

The Trade Management Technique You Need To Know - http://klse.i3investor.com/blogs/candlestick/114496.jsp

Best Way To Learn To Trade Without A Mentor - http://klse.i3investor.com/blogs/candlestick/113821.jsp

Entry Illustration - http://klse.i3investor.com/blogs/candlestick/113605.jsp

Stop Loss & Safe Trading - http://klse.i3investor.com/blogs/candlestick/113510.jsp

Position Sizing - http://klse.i3investor.com/blogs/candlestick/113061.jsp

Come Up With Trading Ideas & Turn Them Into Investing Ideas - http://klse.i3investor.com/blogs/candlestick/114110.jsp

Cheers,

Ming Jong

Get Update From ==> http://www.vipplatform.com/lp/ideas/

& FB page ==> https://www.facebook.com/BursaSGXcandlestick/

Telegram Channel ==> https://t.me/BursaSGXCandlestick

Contact Via Email ==> ![]()

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Candlestick & Breakout Patterns

Created by Ming Jong Tey | Jun 29, 2017

Created by Ming Jong Tey | May 25, 2017

Created by Ming Jong Tey | May 21, 2017

VenFx

Good observation .

2016-12-26 17:37