The Old School Yet Effective Ways To Come Up With Trading & Investing Ideas & What To Do About Them?

Ming Jong Tey

Publish date: Wed, 18 Jan 2017, 05:33 PM

Some of my friends are always interested to find out why and how I have many trading/investing ideas. Is there any perfect scanner that will spit out all these great ideas?

Trading Ideas

In general, I build up trading ideas the old school way, which is to create multiple watch lists for various kind of stocks. One good tool that I used for monitoring the watch lists is ChartNexus (free version will do).

Also, before that, find out your trading styles first. I am a swing/position traders so I look at weekly/daily chart. End of day data usually sufficient for me. My trading timeframe is on daily, so a trade on Bursa market might last for weeks to months until either the stop loss or targeted profit is hit.

If you are a day trader or contra players, some of them might not be applicable as the volume is your main concern.

1. From the newspaper. Nanyang, Sinchew, The Star, New Straits Times, The Edge Malaysia/Singapore Daily/Weekly, etc...Pay attention to the financial section of the papers, find out what's happening to various stocks. Corporate actions like the bonus, share split, dividend, etc...or expansion by building new plants, machine, etc...

Follow some of the stocks and check out their charts that you are interested or showing potential.

2. On your broker platform, check out the Most Active Counters in terms of volume and top gainers.

Again, go through some of the stocks and look at their chart. Watch out for stocks that you have seen on the papers and also show up in the most active counters or top gainers.

3. Forum/group. There are plenty of forums and FB groups around. In my own posting alone, there are more than 10 trading ideas still active and valid. Some of the posts talk about fundamental, some focus on technical, like mine. Just have a glance through and pick up a few stocks for you to put on your watchlist to monitor.

4. When you are in the market long enough, you will notice a lot of sector rotation play. Create your watchlist and monitor 5-10 stocks within that sector. For furniture/fibreboard, you might think about HEVEA, POHUAT, LIIHEN, LATITUD, FFHB, HOMERIZ, JAYCORP, SSH, etc...

There are a lot of sectors such as Steel, Aluminium, Construction, Property, Electrical/Electronic that you can do some research and create your own watchlist for each sector.

Watchlists Filter

After you have created the watchlist, open up the chart and scan them through with your eyes to look for up trending pattern. A simple way to look for up trending stocks is to look for higher high and higher low, like JHM as shown below:

Create another watchlist containing only the up trending stocks. Now what? You might be wondering.

What To Do About The Up Trending Stocks?

Now, you have a list of the up trending stocks. You will need to create your own trading plan to look for entry, stop loss and possible target price.

A trading plan consists of scenarios that could happen and your response accordingly. Take a look at the example below:

1. PESONA Rounding Bottom Hitting Neckline With Strong Resistance - 3 Possible Scenarios Inside

Once you have done your trading plan, just sit back, relax and be patience to act according to your plan, which is basically to review the daily chart every day. Should any opportunity arise, you are ready to act according to your trading plan.

Investing Ideas

Don't worry. I did not forget about the investing part, which is shown in the title of this post.

Traders believe everything has been factored in and reflected in the price.

If we take this to the next step and have a deeper thought, we might be able to find the next investing ideas. If the price runs ahead of the fundamental, can we study some of the up trending stocks in depth to find out the necessary metrics and news to support the investing viewpoint?

Let's take HEVEA as an example and explore further below:

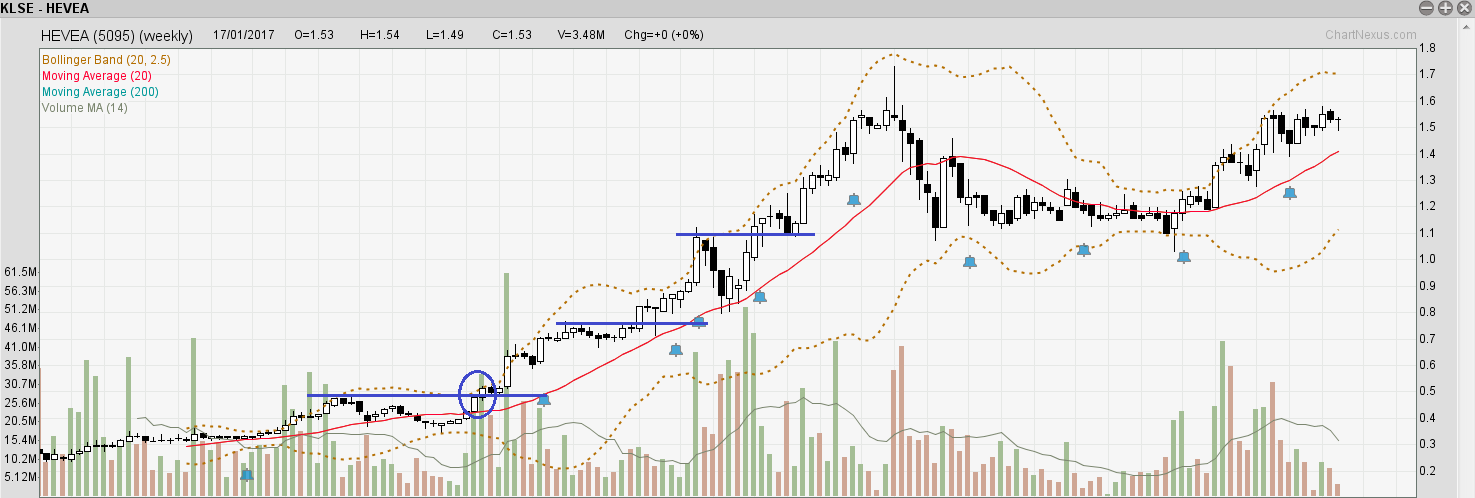

HEVEA broke out of the base on 23 Jan 2015 and peak at 08 Jan 2016. During this 1-year period, the price shot up from 0.5 to 1.7, an impressive multi-bagger.

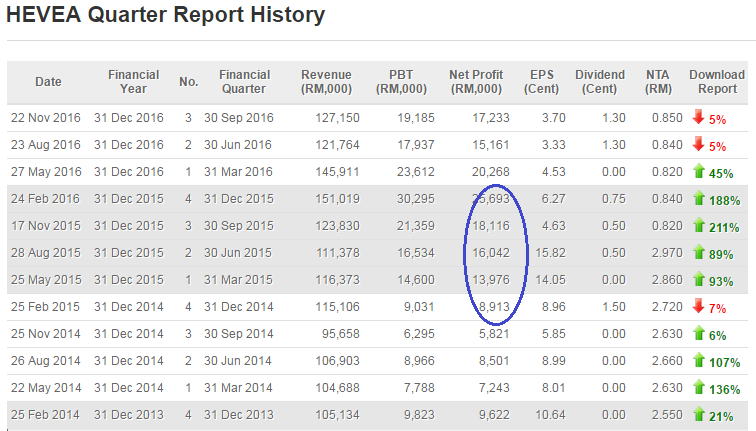

HEVEA's quarterly earning results are shown below:

From the quarterly earning report history, we notice that HEVEA might be an undervalued stock since the company has been generating solid profit.

The share price runs ahead of the earning announcement on 25 Feb 2015 from 0.5 to 0.63 after broken up from the base with great volume.

The subsequent quarters showed significant earning growth and the price keep shooting higher.

That's how we can turn a trading idea into an investing idea by doing further research on the specific stock.

Whether you check on the qualitative stuff like news, earning potential, future prospects, etc...or quantitative stuff like the Profit & loss statement, balance sheet and cash flow statement, that will depend on your own investing criteria.

Of course, not every trading ideas will turn up like HEVEA.

Trading and investing both takes a lot of effort. But that's the reality if you want to beat the market and have an edge ahead of others.

What about screeners? Yes, there are some screeners around which will save you some work, like scanning the stocks breaking 52-weeks high, etc...Still, you will need to put them in your watchlist and create your trading plan, monitor daily and act according to your trading plan.

Having a good entry is only partial of the work, the key still lies on trade management, which I will talk more about it in my future post.

Further Reading

How to determine the "bullishness" of the patterns- https://www.facebook.com/BursaSGXcandlestick/videos/378260995905662/

The Trade Management Technique You Need To Know - http://klse.i3investor.com/blogs/candlestick/114496.jsp

Best Way To Learn To Trade Without A Mentor - http://klse.i3investor.com/blogs/candlestick/113821.jsp

Entry Illustration - http://klse.i3investor.com/blogs/candlestick/113605.jsp

Stop Loss & Safe Trading - http://klse.i3investor.com/blogs/candlestick/113510.jsp

Position Sizing - http://klse.i3investor.com/blogs/candlestick/113061.jsp

Cheers,

Ming Jong

Get Update From ==> http://www.vipplatform.com/lp/ideas/

& FB page ==> https://www.facebook.com/BursaSGXcandlestick/

Telegram Channel ==> https://t.me/BursaSGXCandlestick

Contact Via Email ==> ![]()

More articles on Candlestick & Breakout Patterns

Created by Ming Jong Tey | Jun 29, 2017

Created by Ming Jong Tey | May 25, 2017

Created by Ming Jong Tey | May 21, 2017