Personal Wealth, The Edge Malaysia Weekly Cover Story: Lower for longer II

Yong Chu Eu Money & Life Master (杨子佑硕士-财福人生导师)

Publish date: Wed, 21 Sep 2016, 11:10 PM

This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on September 12 - 18, 2016.

Pension funds are beginning to see lower returns from their investments and have warned that this could continue for some time. Hence, contributors will be forced to rethink their retirement planning strategies.

A prolonged period of low growth and low returns from investments is beginning to affect pension funds around the world. Soon, their contributors will be faced with a stark new reality and will have to re-evaluate their retirement plans as they dig deeper into their savings to fund their golden years.

“Most won’t even scrape 5%. Our five-year return assumptions have steadily moved lower since the financial crisis, amid weak global growth prospects, easy monetary policy and rising valuations. We have lowered our assumed returns for most fixed-income assets, following a drop in yields (and rise in valuations) in the second quarter,” he added.

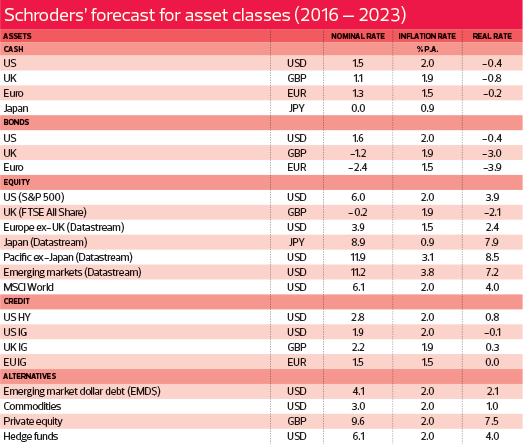

According to Schroders’ Seven-Year Asset Class Forecast Returns: 2016 Update, Asia-Pacific ex-Japan equities will generally be the best performer in the 2016 to 2023 period, with real returns forecast at 8.5%. This is followed closely by Japanese equities, with real returns of 7.9%. UK equities will be the worst performer, delivering real returns of -2.1%. Private equities will do well and is predicted to generate a 7.5% real return (see table).

The low-growth, low-return environment will make it much tougher for those heading for retirement. In McKinsey Global Institute’s Diminishing Returns: Why Investors May Need to Lower Their Expectations, released in May, it was found that lower rates of return could have a profound effect on both individual and institutional investors, and by extension, on governments as well. For example, a 2% difference in average annual returns over an extended period means that a 30-year-old today would have to work seven years longer or almost double her savings to live as well in retirement.

“As a result, pension funds could face a funding gap that is even larger than the one they are struggling with today. Among others likely to be affected are asset managers, whose fees will come under pressure in a lengthy period of lower returns, and insurers that rely on investment income for earnings … policymakers may need to prepare for a later generation of retirees with less income,” says the report.

As it is, one’s retirement savings are usually not enough. In May, EPF’s head of strategy management Balqais Yusoff pointed out more than two-thirds of its contributors (78%) did not have at least RM196,800 to sustain them in their retirement years.

As pensions are going to be affected, those who are preparing for retirement today have to make serious adjustments to their lifestyle or savings, says Wan Kamaruzaman. “We are trying to educate civil servants on the importance of financial planning when they enter the labour market. Financial planning starts the moment you start working.

“Previously, we focused more on people nearer the retirement age. But now, it is the other way around. We are trying to inculcate a saving culture to remind us that we need to save more to retire.”

He acknowledges that it is not going to be easy. “It is a Catch 22 situation — you tell people they have to save more, but the cost of living and discretionary spending mean they do not have enough to save. Companies are not performing that well, so obviously, the bonuses will not be as great. It is a vicious cycle.”

Datuk Javern Lim, group managing director of VKA Wealth Planners Sdn Bhd, advises people to focus on increasing their monthly income so as to be able to save more. “Focus on increasing your monthly income stream, which can lead you to save a bigger 10% portion for investment too. Consider some structured investment products that may require a longer lock-in period but are able to offer a higher return on investment.”

In an investing climate like this, investors may be tempted to invest in higher risk assets to compensate for the lower returns from other assets. But Yong Chu Eu, licensed financial adviser at Fin Freedom Sdn Bhd, advises against it. He does not recommend taking higher risks in today’s climate as investors risk losing all of their money.

“High living costs are pushing more people to more complex, short-term, high-return investment schemes so that they can have their retirement on track or financial freedom soon, which I don’t think is appropriate. Because of this, many people end up losing money after falling into investment traps or scams, or taking on too high a risk,” he says.

Lim advises investors to stay away from investments that could see them lose all of their money. “When we invest in unit trusts, we invest in businesses. When we invest in properties, in the worst-case scenario, the properties are still there. The same goes for gold; the gold bars are still there. We are talking about accumulating a retirement fund for our old age. Our retirement fund is serious money. We cannot afford to lose it,” he says.

Picking an investment that offers tax benefits is all the more important in this climate. Lim says investors should consider instruments that could offer moderate returns and yet free you from tax implications. PRS is a case in point.

“[If you are in a high tax bracket,] you have already saved 25% in tax on that RM3,000 invested, that is, assuming the RM3,000 did not give you any returns. Moreover, the PRS funds are managed by the fund managers who also manage the existing funds [into which many of the PRS funds feed].

“Under the regulations, they can only charge up to 3%, so there is an immediate saving of 2%. Some even charge a 0% fee.”

De Alwis advises investors to reexamine their portfolio. “If everybody is chasing returns, now is the time to look again at your portfolio to ensure that you really have diversification across the different investment classes. Bear in mind, I don’t mean asset classes, but investment classes,” he says.

“When I say asset classes, many get confused because they begin thinking how much they should put into equity, fixed income and balanced funds. When I say investment classes, it is a good time for you to look again at things on a holistic level — how much exposure you have in unit trusts, the stock market, properties, bonds and so on.”

Today, it is even more important for investors to set a “true blue minimum target”, he says. “When I ask investors, they tend to say 8% or 10%. But your true blue minimum target should be your real inflation rate, which should be averaged at 3% to 4%.

“You can be more ambitious and give yourself 5%. But first things first. You have to build a portfolio to make sure you can achieve that minimum 5%. From there, you need to remember that you have certain things that give you higher returns over a certain period.

“You have to look at the annual returns of your portfolio. Start looking at those that give you higher returns over a rolling period [when returns and markets] are higher, and those during years that are lower.”

Investors must revisit their retirement portfolio and set realistic targets. De Alwis says with a floor target, their mindsets change and they find that they do not need to take on much risk to achieve their targets.

“If I were your financial adviser, I cannot build your portfolio around 8% [which is your ideal target]. I need to set a minimum floor of 5%. After that, we ask how do you achieve more than 5%?

“Let’s say you want 8%. If you use the rule of 72, you will need nine years [to double your initial investment]. But if you take 72 and divide by 5%, it will take about 12 years. Is that acceptable or do you need to put more money in? Do you need to save more? Then the reality sets in.

“So, I always ask people to take a few steps back. I am not saying you should put everything into less risky assets. But once you take a few steps back, you would have better peace of mind. I have already conservatively decided that I need 5% and I have 12 years to [double my investments], so that means I will be fine.

“It is a fact that the low-yield environment is here to stay. So, manage your expectations and revisit your portfolio; whatever extra is a bonus. Be more pragmatic about your financial planning — diversify properly across all investment classes.”

Investors must always have cash ready to deploy to take advantage of future opportunities and to average down. “These two strategies are different because averaging down means doing it when the market is down. You do not want to be forced to realise your loss. Opportunity means when you see a potentially good investment coming and you don’t want to sell down [your other investments], you have the cash. Now is a good time to revisit your portfolio because there are always opportunities when the market is down.

De Alwis elaborates further on portfolio allocation. “In your portfolio, 20% should be as liquid as possible because the first rule of thumb of liquidity when you invest is you need to know how much your reserve can last you.

“Before you invest in anything, make sure you have a cash reserve of three to six months. That is the basic principle. Once you have the reserve, you can invest the additional portion. Of that portion, I recommend putting 20% in liquid assets.

“You never know when an investment opportunity is coming and you want to catch the trend without have to sell any of your current holdings as it is just a short opportunity that you can liquiditate later. Do not have an investment portfolio that gives you no choice but to realise your losses unnecessarily.”

Options for EPF contributors

Contributors to the Employees Provident Fund (EPF) have a few options if the dividend is low. Yong Chu Eu, a licensed financial adviser at Fin Freedom Sdn Bhd, says they can use their EPF savings to pare down debts such as their mortgages or withdraw more to put into unit trusts.

“They can use their EPF savings to offset debts, especially housing loans. If interest rates fall to a similar rate as the housing loan, the free cash can be used to invest.

“Let’s say your current effective interest rate for the housing loan is about 4.5%. If EPF dividends fall below 5%, then it is wise to withdraw your EPF money to pay monthly loan instalments for a year, which will give you free cash to invest. This way, you are managing your ‘good debt’ to grow your wealth.

“They can also withdraw some of the EPF money [quarterly] to invest in approved unit trusts to get more returns. The EPF investment strategy is very conservative. If you look at its previous annual reports, most of its money are invested in bonds and the guaranteed annual return is 2.5% (the average return over the past 64 years has been about 5.9%).

“That might not match the risk appetite of someone who is hungry for higher returns or looking for more risk (more equity/foreign exposure) ... If we refer to Fundsupermart’s fund ranking (last updated Aug 20), Kenanga Growth Fund is the top performer with an average 17.2% return yearly for the past 10 years (about around 17% annualised return for the past 15 years). This fund’s returns are far more superior than those of EPF and unit trusts.”

Those who have cash to spare can place their savings in private mandates under the EPF-approved investment scheme. A quick check found that PhillipCapital is a provider of the private mandate option.

“Investors can withdraw their money from Account 1 and pass it to the EPF-approved fund managers who will select stocks for them. The minimum investment is RM30,000, so this option is only for investors who are willing to take higher risks in exchange for possibly higher returns,” says Datuk Javern Lim, group managing director of VKA Wealth Planners Sdn Bhd.

More articles on 杨子佑硕士 财福人生导师 Yong Chu Eu Money & Life Master

Created by Yong Chu Eu Money & Life Master (杨子佑硕士-财福人生导师) | Feb 26, 2020

Created by Yong Chu Eu Money & Life Master (杨子佑硕士-财福人生导师) | Apr 29, 2019

Discussions

"Contributors to the Employees Provident Fund (EPF) have a few options if the dividend is low. Yong Chu Eu, a licensed financial adviser at Fin Freedom Sdn Bhd, says they can use their EPF savings to pare down debts such as their mortgages or withdraw more to put into unit trusts."

This is the worst 'financial advise' I ever come across my entire life!!!!!!!

What is the objective to contribute to EPF?

Take out EPF and settle housing loan? You think you are discipline enough not to spend the 'extra money' in your bank? You need to strive harder to make thing easier if you you are still struggle with your daily expenses.

Take out EPF money to buy Unit Trust? You don't know Unit Trust like Public Mutual (supposely the best Unit Trust Operator in town) sucks?

Do you know welfare starts from home?

Do you really think Public Mutual is so noble?

Do you know how much commission earned by the agents?

Do you know how much management fees charged by Public Mutual?

Do you know how much bonuses made by Public Mutual Fund Managers?

If you think Unit Trusts suck, wait till you see the Insurance companies' life policies.

No more guaranteed cash value (or surrender value), but the value of the units you have at the prevailing price.

Insurance companies will not take care of your interest, but their own backside.

This is the same as Public Mutual.

Better just buy all the Reits with your money, and that definitely give you better return than any Public Mutual Funds on long run...........

http://klse.i3investor.com/servlets/forum/600104256.jsp

IF YOU ARE NO GOOD, PLEASE DON'T MISLEAD OTHERS FOR YOU WILL MAKE THEM SUFFER FOR THE REST OF THEIR LIFE

2016-09-22 09:56

ks55, thanks for your comment, but bear in mind that my suggestion is based on the situation when the EPF's Dividend Rate is almost near housing loan interest rate-below 5%, then you can consider to withdraw to invest unit trust or pay off debt. This is the best advise that i ever made.

Maybe you have bad experience with Unit trust, and i have mine too but i also have experience of getting 100% within 3-4year with unit trust fund.

I totally agree that REITs is one of the good options available but not limited to this

2016-09-22 15:38

Best advice ever have to ask people take out money from EPF?

What is the purpose of contributing to EPF?

That is the minimum safety net for the old and incapables.

When the contributors are still young, inability to make ends meet already show they cannot plan properly by themselves even when they still earn.

The reason is simple, expenditures more than income.

Fail to make proper planning.

Need to use EPF money to help pay mortgages?

Biggest joke I am coming across in my entire life.

If they cannot afford bungalow, can they settle with 2-storey terrace?

If they cannot afford terrace, can they settle with medium cost apartment?

Find something that suit their budget.

About withdrawing EPF and put into unit trust or PRS.

Tell me which unit trust give you return 100% within 3-4 years span?

Be sincere and honest, don't bluff.

How many lose most of their saving by putting into 'wrong unit trust'?

Unit Trusts Suck.

Please refer:-

http://klse.i3investor.com/servlets/forum/600104256.jsp

2016-09-22 17:46

ks55, what i want to say:

a) I am not pro any unit trust/insurance/public mutual as i believe every investment tool play it role, investor should do more homework before invest, bad apply always exist in any investment tool

b) EPF is for retirement, this is for sure, the reason of withdraw is to increase more return for retirement when high return EPF cannot offer, this is pro-active way. If you cannot accept it doesn't mean it is bad, respect other for any different idea or approach, don't put emotion or negative word when commenting as it hurt you first even before it come out from your mouth or heart, you can see how i respect your different, be professional, considerate and moderate

c) I think unit trust fund from Eastpring and Kenanga, both offering a good return where one of them offered me 100% return (100% return is for sure but i did not exactly count the total period of holding because i invested several time EPF, mean several batch of investment, i roughly count is around 3-4 year++), i am pulling in second time from EPF again hoping another 100%. I want to compound my EPF money faster on top of EPF return. i am not here to show off the beauty of unit trust or 100% return but just want to say each investment play it role

d) I know what i am doing or advising, i am sure it is at the best interest of public and of course, everyone is different, i can accept people disagree with it, i respect people for different and the right of comment but don't miss-used it just for the sake of commenting

2016-09-22 22:31

19 Unit Trust Funds were removed from PRS.

Out of which 13 was from Public Mutual.

Bearing in mind Public Mutual claimed to be the best managed funds in Malaysia.

One or two funds make fantastic return are coincidence. Probably due to timing of their fund launching. Something like 1999? 2009?

Generally return from Unit Trusts do not beat EPF.

Too many examples, just to quote a few, certain Unit Trusts operated by Ban Hin Lee Bank, Southern Bank lost 90% of their capital.

To get a few good ones may be exceptional lucky.

To underperform is the norm.

Comment from kcchongnz:-

"by winston1 > Sep 14, 2016 01:56 PM | Report Abuse

I have invested some RM130k in Public Mutual using EPF over the past 10 years with current value at RM205k. Returns 75% for the period. It all depends on what funds you have invested.

You are one of the lucky ones investing in unit trust. However, your return in CAGR is only 4.7%, way below EPF.

So if you withdraw EPF and invest in it, then you become the unlucky one as the performance is substantially below EPF return."

"Posted by batman11 > Sep 13, 2016 06:10 PM | Report Abuse

To prevent getting "slaughtered" by the fund house or the market, you can consider to invest in 0% front loading KLCI tracker fund. We have RHB KLCI Tracker Fund to meet your need. Buy handsomely when KLCI index moves above its SMA 200 line and sell when long term up-trend becoming reversed.

The long-term return of tracker fund will mimic the return of the broad market, less the annual management expense ratio. You can actually mimic the broad market return by buying the component stocks of KLSE, without having to pay the management fees.

Then you are talking about market timing here which is not for unit trust, which should be long-term investment to get any decent return."

"Insurance life policy, those participate in the profit ones, has two components; one is life coverage and the other investment. The investment return will probably mimic that of unit trusts or managed fund. The killer is the marketing cost. Insurance agents are rewarded with a few hundred percent of the annual premium paid. With this taken straightaway from your policy, how can one get good return from the investment portion of the life policy?

It is just common sense. However, few policy holders understand it. Even licensed financial advisors, not to mention insurance agents, either they don't understand it which i am not surprised, or they deliberately don't want to know.

Sorry, I am just being very direct. Of course there are also some good and knowledgeable licensed professional financial advisors around, but they are far and few."

2016-09-22 23:04

ok, understand what you mean, it is good to be direct, i did lost money also in few funds which is country/sector/new themes specific, so i encourage people to go for more generic fund like Asia or Asia Pac fund, if you see from fundsupermark's top fund, Kenanga Growth and Easpring Small Cap, both are performing very well, around 16-17++ annually (10yrs++), Kenanga Growth even have 17%++ annual since (if not mistake is since 2001) the fund being launched. Norway's Sovereign Fund even allocate some money to Kenanga to invest for them for Malaysia Region. Chen Fan Fai used to be Fund Manager of Kenanga but now jump to Easpring, he is one of the best fund manager in Malaysia. I totally agree, more job need to be done by unit trust industry, not many good fund in malaysia, i also agree passive fund like KLCI tracker sometime can beat those active managed fund.

2016-09-23 07:28

Giving wrong advise to ignorant and ill-informed laymen definitely lead them to grave problem when they are old.

For those with 'extra knowledge', if sincerely want to give 'professional advise' must do it in good faith.

You know the meaning of good faith? Nothing is said to be done in good faith if it is not done with due care and attention.

The EPF ensures that your savings are secure and receive reasonable dividends. It guarantees a minimum of 2.5% Dividend annually.

Unit Trusts never guarantee any return. Read carefully the small prints in the prospectus. Unit Trusts sales personnel and agents won't tell those things. They just produce fantastic return from selected few funds in particular period of time.

If any layman having good knowledge, skill and experience, definitely they won't go for Unit Trusts. What is that to remind them they should have done their homework before they invest in Unit Trusts?

So, what do you have to say about:-

1. Withdraw EPF money to help pay your mortgage?

2. Withdraw EPF money and invest in Unit Trusts?

I rest my case...........

2016-09-23 10:35

calvintaneng

Good warning given,

High living costs are pushing more people to more complex, short-term, high-return investment schemes so that they can have their retirement on track or financial freedom soon, which I don’t think is appropriate. Because of this, many people end up losing money after falling into investment traps or scams, or taking on too high a risk,” he says.

Notice these words which aptly apply to many foolish i3 forum members,

"MANY PEOPLE END UP LOSING MONEY AFTER FALLING INTO INVESTMENT TRAPS OR SCAMS, OR TAKING ON TOO HIGH A RISK"

2016-09-21 23:25