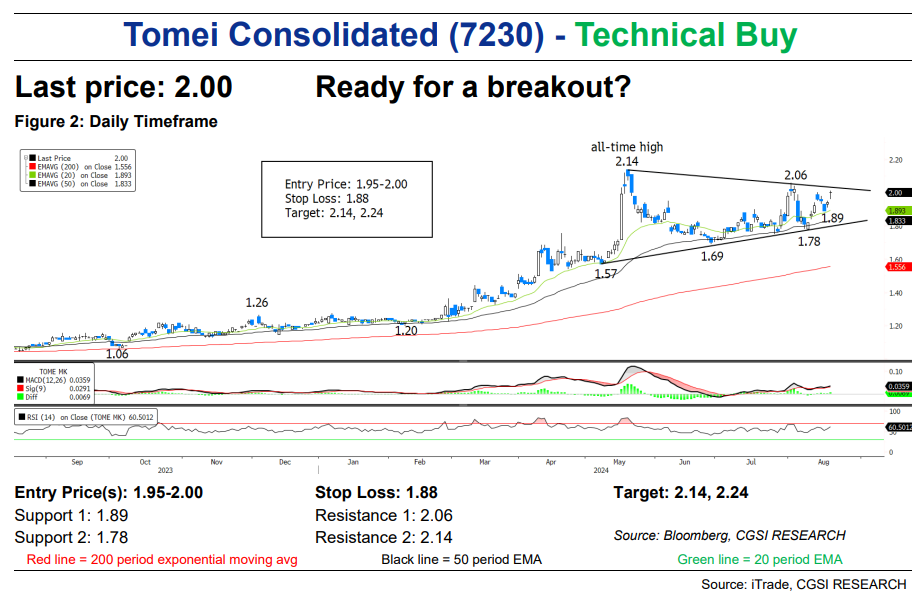

Tomei Consolidated - Ready for a Breakout?

sectoranalyst

Publish date: Tue, 20 Aug 2024, 01:36 PM

The stock has hit our first target following our Technical Buy call (see here for our previous call) but could not quite reach the second target. The stock remains in a triangle consolidation which we believe has ended when prices tested the 20-day EMA but failed to close below it. Yesterday’s gap up likely suggests that the stock is ready to breakout of this 3-month consolidation. The rising EMAs support our near term bullish view.

Both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) have hooked up again, indicating that the upward momentum is picking up.

We think that aggressive traders may want to go long here or on weakness with a stop-loss set at RM1.88 (a tick below the 20-day EMA). On the upside, prices may push on to test the all-time high at RM2.14 next. If momentum stays strong, prices may even climb higher to test the next Fibonacci target at RM2.24 (1.618x).

Source: CGS-CIMB Research - 20 Aug 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CGS-CIMB Research

Created by sectoranalyst | Dec 11, 2024

Created by sectoranalyst | Sep 27, 2024