4898 TA Analysis

Cheekiong

Publish date: Tue, 02 May 2017, 10:59 AM

文章摘自:Investalks- 都督专区

从季报和年报得到的资料显示,TA拥有 :

1)本身的broking,share investment 和 lending 业务

2)拥有60%的TAGB,而TAGB拥有investment,Finance service,Prop invest,Prop Dev,Hotel

所以今年TA的盈利,大有可能像双引擎般启动。

下个季度,有可能的利多是 :

第一个引擎

1a)Brokering收入会增加,因为1~3月市场热,成交量增。

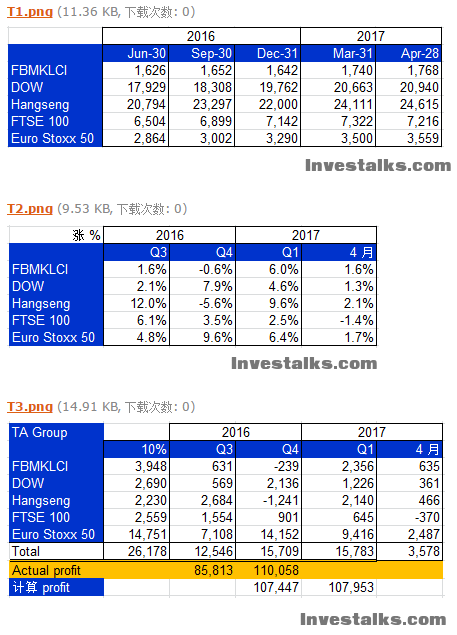

1b)Share investment 这块会爆赚,因为大马和世界股市上涨5~10%,有望取得5~9千万的gross profit

1c)Lending和股市涨跌息息相关,股市热,收入也是会增加。

第二个引擎

2a)TAGB 的 investment 和 Finance service,和世界股市的冷热息息相关,1~3月行情不错,收入将增加

2b)Property investment 这板块,收入应该稳定中和

2c)Property Dev 这块比较难预测,听说澳洲和加拿大两三年前卖出的产业,有望在今年有上亿的入账

2d)Hotel 这个今年肯定会比较好,因为去年好几间完成了装修工作,花费减少,再加上新的Trump Hotel 开始营业。

老板 Datuk Tiah 连续不断买入 TAGB,相信property Dev 这块应该不是空穴来风。

------------------------------------------------------------------------------------------------------------------------------------------------------

买入Ta,最恼人的不过是

1)老板以前炒股被捉,所以算是蛇了

2)Investment Securities 这板块盈利难料

老板目前为人如何,没办法评估。只好看看这个investment securities如何了。

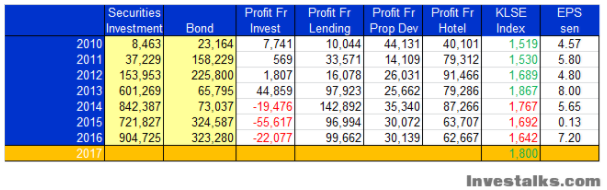

a) 可以看到2014~2016年,investment Securities这板块都是在亏损,而KLSE指数也是连续3年下跌。完全一致。

b) 2010~2012年, 虽然KLSE指数上涨,但盈利很少。因为投资额不多。

c) 2013年,盈利大增,主要是投资额大,KLSE指数高涨180点或12%。

但是投资6亿,回酬0.44亿, 才7%,跟指数12%的涨幅不一致。 再深入探讨原因如下 :

原来在2013年内,当指数升高,TA作了傻事,高价位加码,每个季度平均加码一亿。。。

这种高价逐步加码法,虽然投资额高了,但也造成平均投资价位高,2013年

a) 虽然投资6亿,但回酬不会高过指数涨的12% (基金式的投资)

b) 一旦指数从1867高点下跌,Ta接下来都要面临亏损。 所以一直到2016年尾指数1642低点,Ta都在亏。

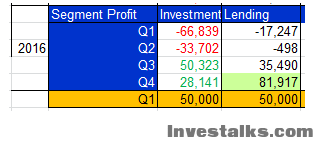

如果我们在仔细探讨2015年~2016年的情况,可以看到如下 :

2015年Q2,Investment开始亏损,从Q2~Q4,Ta都在卖出/作fair value adjustment/impairment。2016年Q1更是大刀刮斧,清理了2.7亿投资垃圾。剩下4亿多的股(相信是以低价位的fair value计算)然后在Q2~Q4开始低价买入股票,3个季度买入了近5亿的投资。当时的指数才1650点。目前总投资9亿。 可以预见的是这批9亿的投资是以低价位买入 + 以低价位估算fair value的(对比2013年当时的买入情况是不一样的)。 目前2017年1月~3月,全世界指数大涨, 3月尾的KLSE指数也已经涨了近100点。

也就是说从1642点涨至1740点,那么这笔9亿投资的盈利要怎么算?

--------------------------------------------------------------------------------------------------------------------------------------------------------

今天看了Ta 和 Tagb 的最新2016年报,对 Ta 这公司有了多一点的了解。

其中吸引我的,就是这个investment Holdings。

如果把 tagb 产业板块排除,这个investment holding,就是Ta最大盈利贡献来源。

原来 Investment Securities 的盈利贡献给 Investment Holding 和 Credit & Lending 板块。

之前就一直觉得Lending这板块盈利那么高,是不是跟 Investment Securities 有关,现在谜底打开了。

也就是说2014~2016年股市下跌,investment holding面对亏损,但是Credit & Lending还是大赚,因为部份进行了股票买卖交易赚钱和Bond的利息收入。 所以总体来说还是赚。 如果2017年股市大涨,这两个板块不知会是什么情形??

INVESTMENT HOLDINGS - OPERATIONS REVIEW

The Group’s cash and bank balances have increased by 98.9% to RM1.1 billion in FY 2016 compared to RM554 million in FY 2015. The cash is actively managed by Group Treasury to meet financial needs of operations and the available funds will be invested in securities to maximize return to shareholders while better investment opportunities arise from within the Group’s core business. To achieve this, we search for potentially good investments across key global markets as disparity in valuations in these markets create bargains and opportunities.

These investments are conducted by the subsidiaries of TA Enterprise Berhad and TA Global Berhad. Thus, this net segment results are parked under investment holding, and credit and lending. The Group has investment securities under current and non-current assets amounting to RM1.27 billion or 16.83% of the Group’s total assets.

Our investment portfolio comprises of short term and medium term investment with diversified maturity period in order to meet the Group’s operating cash flow requirements. There are investment securities under “available-for-sale” for recurring interest income and equity-linked structured investments under “held-for-trading” for yield enhancement purposes besides potential capital appreciation. The portfolio is well diversified into sectors, country and type of industries amongst listed and unlisted instruments.

INVESTMENT HOLDINGS - OUTLOOK AND PROSPECTS

On the back of improving global economy and recovery in commodity prices, we believe prospects for our investments remain good. Nonetheless, these investments have exposure to credit risks, market risks and liquidity risks as established in note 29 of Annual Report. To manage these risks, we have established an effective control framework that includes regular monitoring by our Treasury team and investment committee, and periodic reporting to the Management and Board of Directors as mentioned in the Statement on Risks Management and Internal Control. With good investment strategies and efficient “check and balance” in place, we believe contribution from the investment activities will complement the Group’s bottom line.

另外,年报也提起股票投资在几个国家。如下。

基本上计算,从去年Q3~Q4, 都赚钱了,主要是这些国家指数上涨,涨幅已经延续至4月尾。所以今年Q1赚钱, 已经是囊中物。

去年

Q3 : Investment + lending = 85,813

Q4 : Investment + lending = 110,058

今年

Q1 : Investment + lending = ???

再次声明: 次文章摘自Investalks-都督专区,并无盗用的意思,只是分享好文,所以买卖自负。

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

nicky11

Good sharing....

2017-05-02 22:47