A great start to 2024 for PBA. Can it sustain the excellent run?

zaclim

Publish date: Wed, 03 Jan 2024, 10:47 AM

What a way to kickstart 2024. PBA Holdings Bhd jumped as much as 29.5% to a record high of RM1.89 on Jan 2, 2024 after the Penang govt entered into a water deal with Perak. The counter close at RM1.81, paring its gains after profit taking activities.

It is simply an outstanding performance by the Penang water player, which has been trading sideways at around 80 sen for most of 2023. It suddenly shot to life in November to rise to RM1.12 on Nov 8. In the past year alone, the counter gained some 138%.

PBA Holdings Bhd’s subsidiary Perbadanan Bekalan Air Pulau Pinang (PBAPP) is the licensed operator for water supply in Penang.

Penang Chief Minister Chow Kon Yeow announced that the state will be signing either a memorandum of understanding or an agreement on financing with Perak on the Sungai Perak water scheme in 2024. Perak will be supplying Penang with treated water, with Penang requesting for 700 million litres of water per day.

The scheme is part of the Penang Water Contingency Plan 2030, where PBAPP will be spending RM1.18 billion over the next few years to increase the state's water supply to 602 million litres per day. The state had also applied to the National Water Services Commission (SPAN) to increase water tariffs for domestic customers, citing the need to reduce subsidies and ensure sustainability.

PBA saw a 18.4% y-o-y fall in net profit to RM36.8 million for 3QFY2023 despite posting a 26% y-o-y increase to RM114.3 million as it benefitted from the higher water tariffs for non-domestic and special categories that took effect from Jan 1, 2023.

The company said the decline in net profit was mainly due to higher operating expenses and finance costs. It appears that investors are getting excited over PBA’s future earnings as it is in a monopolistic business. If the Penang state allows PBA to raise its domestic water tariff, which is the lowest in Malaysia, this will potentially boost its bottomline by RM100 million or EPS by 30 sen.

This means PBA could see its net profit increase to RM200 million, derived from non-domestic water tariff and the savings on domestic subsidy. Should this happen, the company will be able to commit RM1.18 billion on capex until 2030.

The capex investment is crucial as it can increase 30% the supply of treated water, reduce non-revenue water via pipe replacement, which in turn translates to higher profits.

In addition, PBA stands to benefit from the potential diversification to floated solar farm where it will not only save energy cost, it could also export to TNB grid any excess solar energy.

But on the flipside, there may be some hesitancy by the Penang government, which holds a 69% in PBA, to raise water tariff as it doesn’t want to burden Penangnites and the businesses there. Judging from the share price movements, investors may want to jump in as a water tariff hike seems inevitable and this should be an immediate boost to PBA’s top-and-bottom line.

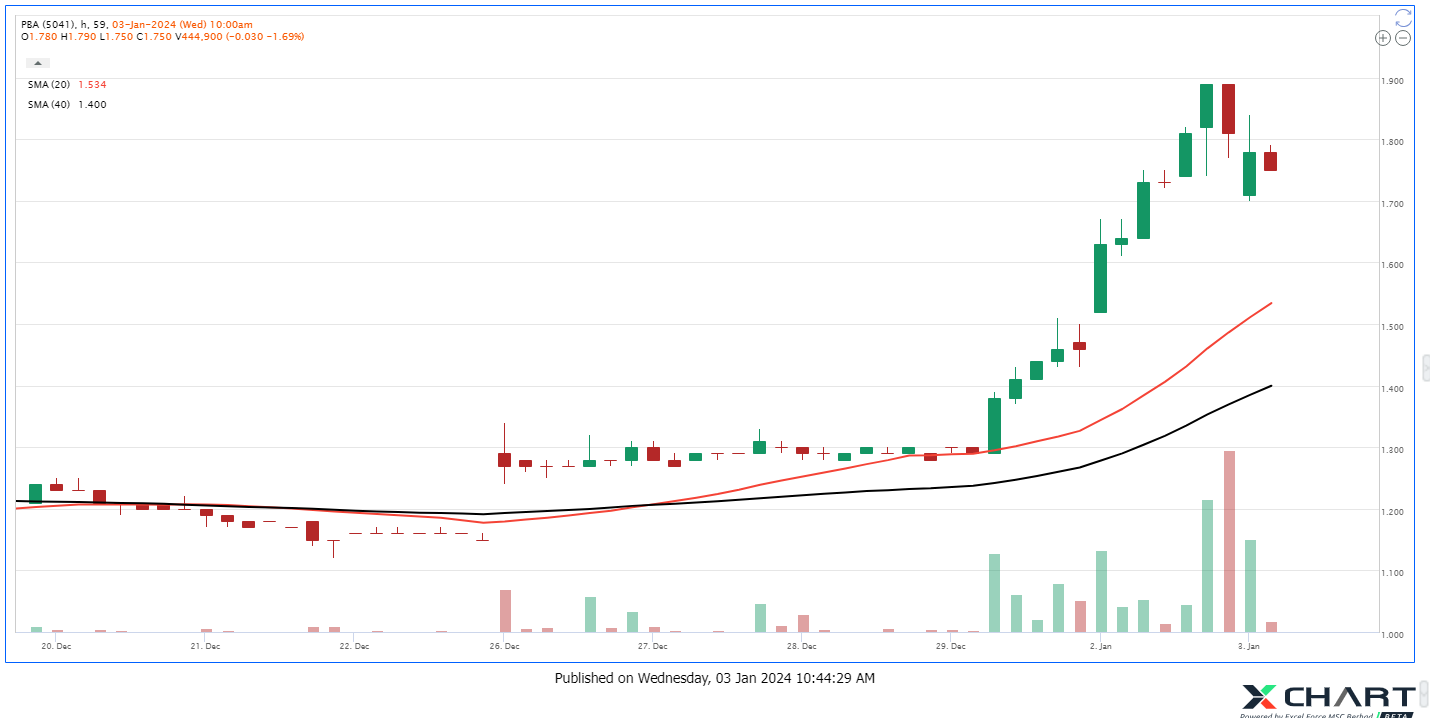

Here are some of the setup in Hourly Chart:

1. Price trading far from 20MA

2. High volume downbar at the top. Expect deeper pullback

Looks out for strength signal near 20MA in hourly chart

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 22, 2024

Optimax Holdings Bhd has set its sights on an upturn in its result after a less than desirable year end This augurs well for the company and investors may want a piece of the boom

Created by zaclim | Jul 22, 2024

Total logistics solutions provider has been hit by freight rates that fell to pre-pandemic levels. Hopes are high that the company will recover and trend higher.

Created by zaclim | Jul 19, 2024

Integrated layer farming company Teo Seng Capital Bhd is garnering much attention as it has almost doubled in terms of share price in the past year. Shold investors continue to hold on to it?

Created by zaclim | Jul 18, 2024

Price rose to a 52-week high of RM1.45 as it posted more than 3-fold increase in its net profit 4QFY24. Now that the counter has trended lower, indicate a good time to consider investing in Superlon

Created by zaclim | Jul 16, 2024

Unisem (M) Bhd is slowly but surely regaining its lustre. All things are moving towards better days for the manufacturer of semiconductor devices.

Created by zaclim | Jul 15, 2024

Texcycle has been on the upcycle in terms of share price, touching a record high of RM1.49. It has lost some ground since its high but the counter is trending out recently.

Created by zaclim | Jul 15, 2024

Electronic manufacturing services provider ATA IMS Bhd has been trading higher in the last couple of weeks and looks to be able to sustain its upward momentum. Is it still time for investors to enter?

Created by zaclim | Jul 11, 2024

Kobay Technology Bhd is seeing upward traction again after trending lower since touching a year high of RM2.58. Can it surpass its recent high?

Created by zaclim | Jul 09, 2024

The company recently ventured into the manufacturing of power cables and wires following a takeover exercise of Central Cables Bhd.

Created by zaclim | Jul 09, 2024

OCK Group Bhd continued its upward momentum on anticipation of a record breaking year in terms of earnings. Can the good run be sustained?