06-May-2024-Mon: Stock Analysis – SEALINK (5145) – RM0.210:

zaclim

Publish date: Tue, 07 May 2024, 08:47 AM

- TTM Q4-Dec-2023: PBR=0.47, EPSG=38.21%, NGR=0.09, DER-ST=0.18, TLER=0.47;

- XChart’s Trade Signal has been triggering 6 real time in the morning session as shown above indicating the stock is on “LD01: MACD(>0) Crossing up Signal”; & “CB05: Uptrend Pullback Rebound”;

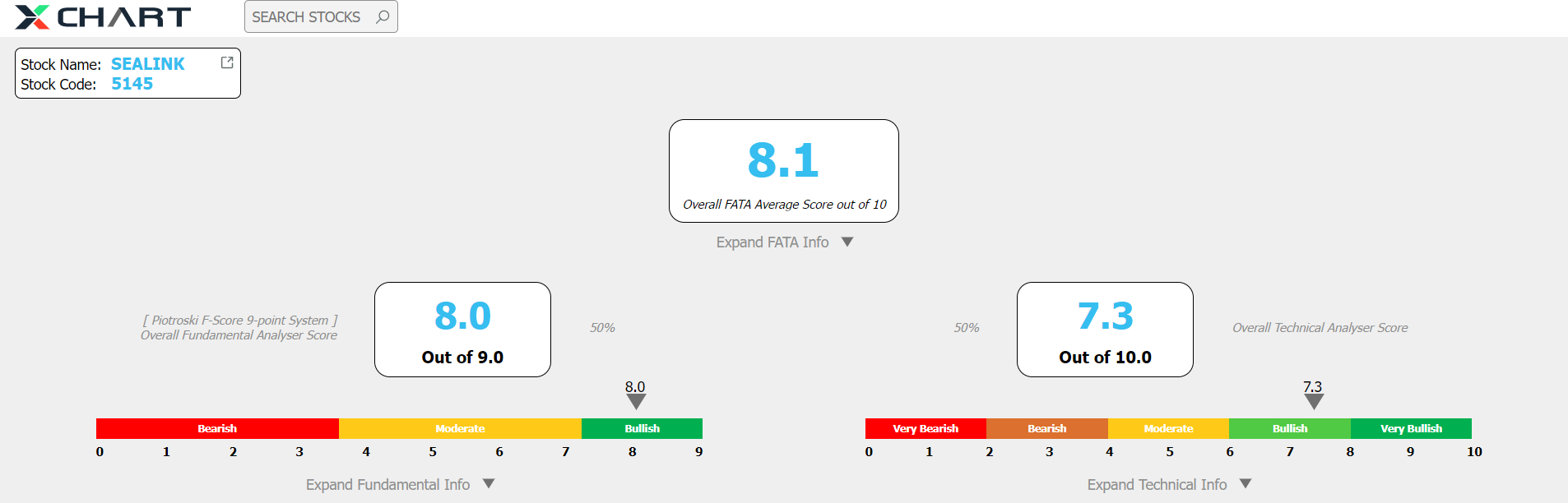

- XChart’s Stock Analyser as shown above is fundamentally PFS9=8 indicates FA is very good, and technically TAS20>70% indicates that the stock price may biased for further rebound and is preparing to breakout the symmetrical triangle near apex and may resume its uptrend along with its markup phase;

- Based on daily technical view, the stock price has been consolidating within a symmetrical triangle for almost the past 7 months above SMA200 line. Let’s monitor for the stock price to breakout and stay above RM0.215 to resume uptrend. Today, is the first day that the stock price is riding above all EMA lines which are arranged in uptrend order above rising SMA200 line. This indicates that the stock price is preparing to resume uptrend upon breakout of symmetrical triangle along with its markup phase;

- Possible short-term targets: RM0.220, 0.235, 0.320, 0.335, and 0.350;

- Possible long-term targets: RM0.380, 0.400, 0.425, 0.435, 0.485, and 0.500;

- Short-term stop loss below RM0.190, or worst case below RM0.175.

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 25, 2024

Sunway is hitting the right notes given its exposure to rising property sector and booming data centre-related deals. Investors are also awaiting the spinoff of its medical arm.

Created by zaclim | Jul 24, 2024

RCECAP, non-bank financial institution, might see further upside on expectations of a hike in civil servants’ salaries. With a proposed bonus share issue, this might propel the counter even higher

Created by zaclim | Jul 22, 2024

Optimax Holdings Bhd has set its sights on an upturn in its result after a less than desirable year end This augurs well for the company and investors may want a piece of the boom

Created by zaclim | Jul 22, 2024

Total logistics solutions provider has been hit by freight rates that fell to pre-pandemic levels. Hopes are high that the company will recover and trend higher.

Created by zaclim | Jul 19, 2024

Integrated layer farming company Teo Seng Capital Bhd is garnering much attention as it has almost doubled in terms of share price in the past year. Shold investors continue to hold on to it?

Created by zaclim | Jul 18, 2024

Price rose to a 52-week high of RM1.45 as it posted more than 3-fold increase in its net profit 4QFY24. Now that the counter has trended lower, indicate a good time to consider investing in Superlon

Created by zaclim | Jul 16, 2024

Unisem (M) Bhd is slowly but surely regaining its lustre. All things are moving towards better days for the manufacturer of semiconductor devices.

Created by zaclim | Jul 15, 2024

Texcycle has been on the upcycle in terms of share price, touching a record high of RM1.49. It has lost some ground since its high but the counter is trending out recently.

Created by zaclim | Jul 15, 2024

Electronic manufacturing services provider ATA IMS Bhd has been trading higher in the last couple of weeks and looks to be able to sustain its upward momentum. Is it still time for investors to enter?

Created by zaclim | Jul 11, 2024

Kobay Technology Bhd is seeing upward traction again after trending lower since touching a year high of RM2.58. Can it surpass its recent high?