Evergreen maximising golden potential in pawnbroking and gold trading businesses

zaclim

Publish date: Mon, 27 May 2024, 07:58 AM

Evergreen Max Cash Capital (EMCC) has been enjoying a good run as it continued to rise to close at its 1-month high of 48 sen on May 24.

This was backed by higher trading volume, likely suggesting that the stock’s longer-term uptrend may have resumed.

Follow-through buying may lift prices towards the historical resistances at 54.5 sen and 56 sen next.

The counter hit a high of 56 sen from a low of 30 sen.

EMCC became only the second pawnbroker to list on Bursa Malaysia's ACE Market, after Pappajack Bhd.

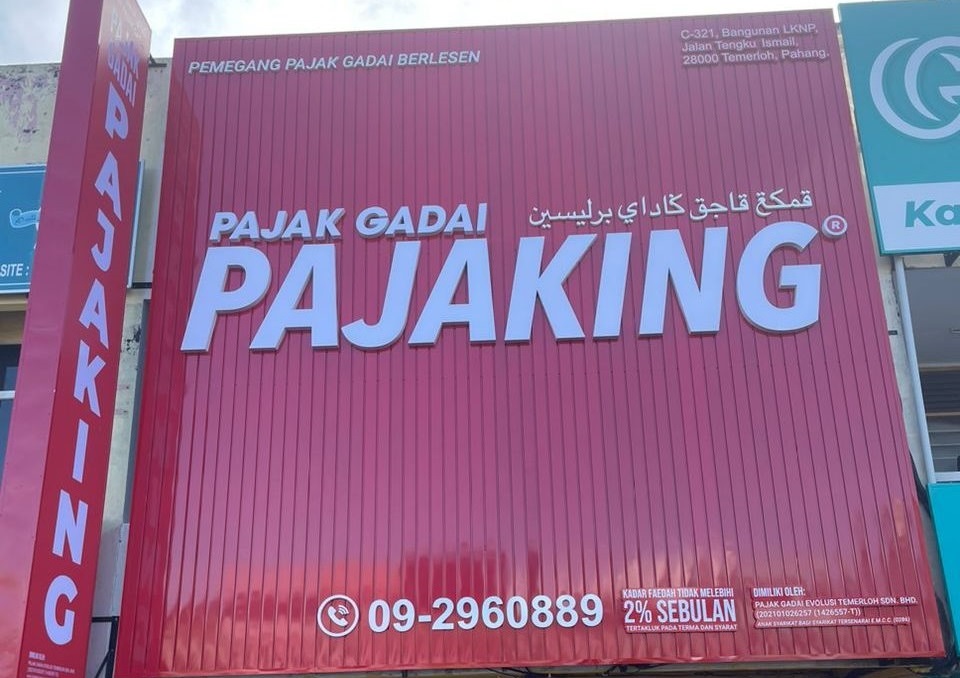

EMCC, which was established in 2012, is also involved in retail and trading of gold and luxury products.

It also offers pawnbroking consultancy and IT solutions services to third-party pawnbrokers who are “not in direct competition with the “Pajaking” pawnshops.

The company saw a 33% premium on its IPO price of 24 sen in September 2023.

The bullishness on the counter is likely due to anticipated higher demand for pawnbroking services amid escalating costs of living.

EMCC executive director Low Kai Loon said the company is looking to grow its market share to 10% in the next few years, from over 3% currently.

The pawnbroking industry in Malaysia is expected to grow at a compounded growth rate (CAGR) of 5.9% between 2022 and 2024, and to reach RM12 billion in 2024, Low said.

To capture the growing slice of pie, EMCC has allocated RM20 million from proceeds raised from its listing exercise to open up five new pawnshops.

It will focus on existing 22 existing “Pajaking” pawnshops in Kuala Lumpur, Selangor, Negeri Sembilan and Pahang.

Among the criteria for setting up new shop includes communities with a significant Bumiputera population since they contribute 70% to 80% to its client base.

It will also focus on the four states where EMCC is already established, particularly in the Klang Valley as there will be more people from other states moving to the Klang Valley.

While pawnbrokers seem be everywhere but the fact is, the entry barrier is high, given the regulatory requirements.

They also need to meet the cash requirement needed to establish the business, as well as good management to run the business, as all transactions are done in cash.

For the first half ended June 30, 2023, EMCC registered a 23% jump in net profit to RM7.21 million from RM5.87 million a year ago.

This was on the back of a 72% rise in revenue to RM52.03 million from RM30.26 million.

The increased financial performance was mainly due to higher pawn loans disbursed.

The company also saw higher sales volume of unredeemed pledged gold items from the pawnbroking business, as well as pre-owned gold products sourced from other third party pawnshops.

Investors should be excited over the prospects of EMCC given its stronghold in the pawnbroking segment as well as escalating gold prices, which should boost its bottomline further.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 25, 2024

Sunway is hitting the right notes given its exposure to rising property sector and booming data centre-related deals. Investors are also awaiting the spinoff of its medical arm.

Created by zaclim | Jul 24, 2024

RCECAP, non-bank financial institution, might see further upside on expectations of a hike in civil servants’ salaries. With a proposed bonus share issue, this might propel the counter even higher

Created by zaclim | Jul 22, 2024

Optimax Holdings Bhd has set its sights on an upturn in its result after a less than desirable year end This augurs well for the company and investors may want a piece of the boom

Created by zaclim | Jul 22, 2024

Total logistics solutions provider has been hit by freight rates that fell to pre-pandemic levels. Hopes are high that the company will recover and trend higher.

Created by zaclim | Jul 19, 2024

Integrated layer farming company Teo Seng Capital Bhd is garnering much attention as it has almost doubled in terms of share price in the past year. Shold investors continue to hold on to it?

Created by zaclim | Jul 18, 2024

Price rose to a 52-week high of RM1.45 as it posted more than 3-fold increase in its net profit 4QFY24. Now that the counter has trended lower, indicate a good time to consider investing in Superlon

Created by zaclim | Jul 16, 2024

Unisem (M) Bhd is slowly but surely regaining its lustre. All things are moving towards better days for the manufacturer of semiconductor devices.

Created by zaclim | Jul 15, 2024

Texcycle has been on the upcycle in terms of share price, touching a record high of RM1.49. It has lost some ground since its high but the counter is trending out recently.

Created by zaclim | Jul 15, 2024

Electronic manufacturing services provider ATA IMS Bhd has been trading higher in the last couple of weeks and looks to be able to sustain its upward momentum. Is it still time for investors to enter?

Created by zaclim | Jul 11, 2024

Kobay Technology Bhd is seeing upward traction again after trending lower since touching a year high of RM2.58. Can it surpass its recent high?