davidleetgy.com

Weekly Futures Market Outlook 8 to 12 Oct 2018

davidleetgydotcom

Publish date: Tue, 09 Oct 2018, 12:14 PM

Announcement

Before I begin, I have a small announcement to make. We will be having a free workshop on the 27 October. I will reveal to you some of the techniques which can further boost your trading performance. Let's secure your seat now!

Let's us get started with this week's analysis.

FKLI

Last week was an exciting week for us! FKLI finally broke out of the triangle, specifically broke the 1,790 level. Subsequently the market had a strong downtrend. On Friday FKLI settled at 1775.5. Congratulations to those who patiently waited (expecially our Intensive Futures Program Students) for a quality signal and I am sure FKLI had rewarded you with nice juicy profits. On a weekly basis, prices suffered a 21.5 point lost. In between prices went as low as 1,774 and as high as 1,802. Based on the day chart we are seeing so far, here is how we are going to plan our trades.

We will remain on the sell side of this market as long as prices stays below 1,784 (which is also the EMA200 days). This is because if prices remain below this level, it means sellers are still strong with potential of further downtrend momentum. Shall this scenario occurs, these are the support zone we have to keep an eye on. First downtrend target is 1,764 structure, which acted as a strong support in Aug and September. The next downtrend target after that is the 1,740 support level. To limit our potential losses, stops can be considered at 1,784. This is because a close above this will cancel out our downtrend analysis.

Besides that, a close above 1,784 will expose FKLI to buying pressure. Therefore we can also look for buying opportunities to trade in line with this uptrend potential. We also can use the TLSC or MTF method covered in our Intensive Futures Program to find the best buy in price. Shall the market triggers this uptrend potential, these are the key resistance area we have to keep an eye on. First one is the 1,800 psychological level. If that gets taken out by the buyers, the second target is the 1,814 level. For risk management, stops can be placed at 1,784 and below. A close below this level will negate this uptrend analysis.

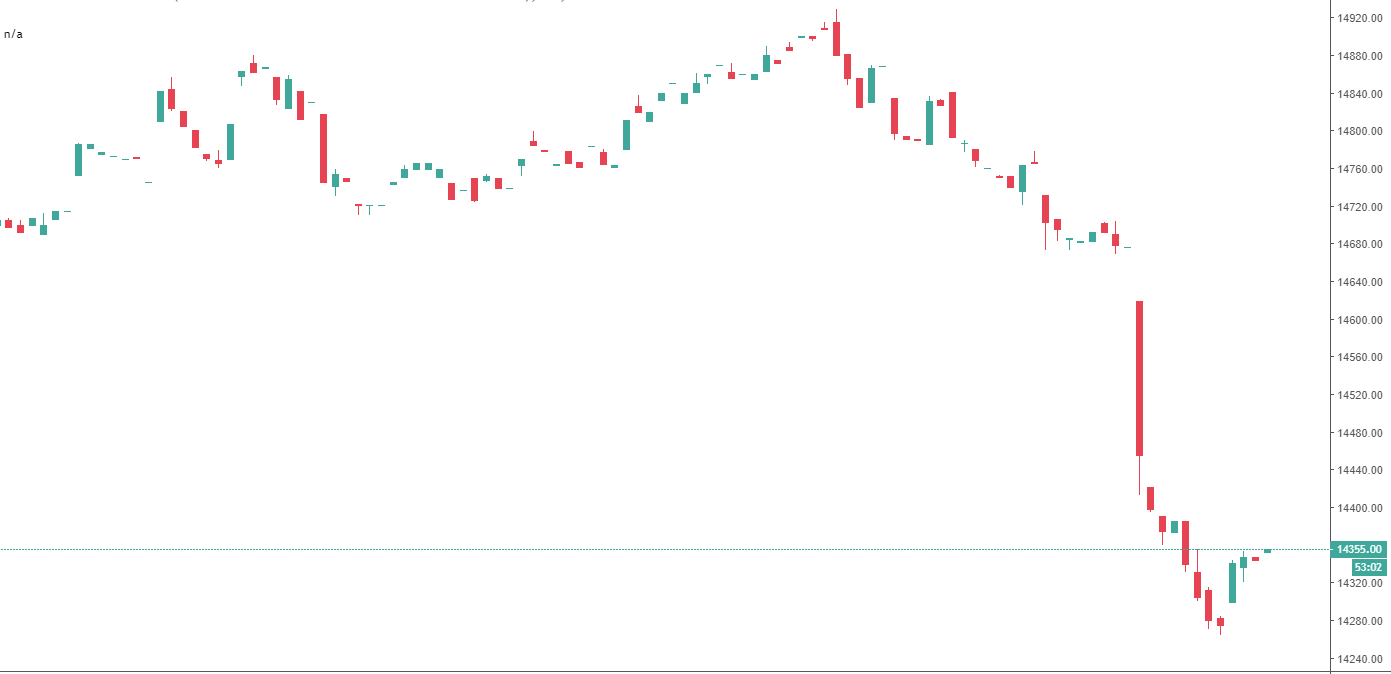

FM 70

We had covered FKLI, let us check out FM70. The market remained supported around 14,660 zone. But it is still early to the say that the market had bottomed out. This is because if you look towards the left, the underlying trend is downtrend. The market does not change its trend in an instant. It will take some time if the market wants to have a trend reversal. So if the market can sustain above 14,800, there will be a small technical rebound potential. First target will be around 14,930 level, while the second target will be 15,120 level. However a close below 14,660 zone will cancel of this analysis.

This is because a close below 14,660 will expose FM70 to further selling pressure. The market could either go down towards 14,510 level or even the 14,330 level. On the other hand, a close above 14,800 will negate this downtrend analysis.

FCPO

We had covered FM70, lets check out the last market: FCPO. Price were sideways for almost a week before it had a strong breakout towards the upside on Thursday. Then it went all the way up to 2,235 before finally settling at 2,221 on Friday. Going forward, here is how we are going to plan our FCPO trade. We will look for buying opportunities if prices can stay above 2,220. First uptrend target then will be 2,241 level, while the second uptrend target will be 2,300 level. To limit potential losses, stops can be placed at 2,200 and below. This is because a close below this level will cancel our uptrend analysis.

In addition, a close below 2,200 will also attract selling pressure. We then can look for selling opportunities. We can use the TLSC or MTF method taught in our Intensive Futures Program to find the best selling price. Shall this downtrend scenario materialized, these are the targets we can aim for. First downtrend target is 2,140. This level is very important because it was this year's low. The second downtrend target is 2,120. For risk management, stops can be placed at 2,200. This is because a close above it will expose FCPO chaos and get stuck in sideways.

Alright, that wraps up this week’s analysis. Feel free to check out how the Intensive Futures Program can help you find high probability setups.

If you would like to meet me in person to understand how I trade the Futures and forex market, you are invited to join our upcoming workshop at 27 October. Click the link here to secure your seats.

Trade well my friends.

To Open a trading account under our care or to receive in depth analysis click here!

More articles on davidleetgy.com

FCPO, FKLI, S&P500, Soybean Oil Futures Market Outlook 8 to 12 April 2019

Created by davidleetgydotcom | Apr 08, 2019

FCPO, FKLI, S&P500, Soybean Oil Futures Market Outlook 1 to 5 April 2019

Created by davidleetgydotcom | Apr 01, 2019

FCPO FKLI S&P Crude Oil Soybean Oil Futures Market Outlook 26 March 19

Created by davidleetgydotcom | Mar 26, 2019

FCPO FKLI S&P Soybean oil Futures Analysis 18 - 22 March 19

Created by davidleetgydotcom | Mar 19, 2019

What to do in sideways market? | Weekly FCPO FKLI FM 70 Trading strategies 3 -7 Dec 2018

Created by davidleetgydotcom | Dec 03, 2018

Discussions

Be the first to like this. Showing 0 of 0 comments