[Sponsored Infographic] Huge and fast growing market with inelastic supply are essence to success !

DonkeyStock

Publish date: Fri, 17 Feb 2017, 10:21 PM

Visit http://www.donkeystock.biz/ or https://www.facebook.com/donkeystock/ to get more inforaphics.

Malayan Flour is a company with long dated history since 1961. It business activity comprises of 2 division, the flour division and poultry division. The flour division is involve in milling & selling of wheat flour and trading in grains, whereas its poultry division is involved in manufacturing animal feeds, breeding and sales of broiler, contract farming and processing of poultry products. Malayan flour mill has a long presence in Malaysia and Vietnam. Recently, it has ventured into Indonesia to tap on this fast growing economy.

Malayan flour was incorporated on 24 Jun 1961 with the aim of helping Malaysia in attaining self-sufficiency in flour consumption. In 1980s, Malayan Flour experience its high growth decade. In 1982, Malayan Flour expanded by setting up a feed mill and flour mill plant in both Lumut and Pasir Gudang. Consequently, it venture downstream by investing in Dinding Poultry Processing in 1985. In 1990 Malayan Flour started the production of broiler day old chick. Malayan Flour ventured overseas into Vietnam in 1998 by forming Vimaflour, a joint venture formed with the local partner.

Although being a 50 years old company, Malayan Flour ambitious has never halted. Here is an updated on its capacity expansion plan in both Malaysia and its second overseas market, Indonesia.

Malaysia Operation

· 2012: Completion of manufacturing, packaging and warehousing facilities expansion in Lumut

· 2013: Completion of manufacturing, packaging and warehousing facilities expansion in Pasir Gudang

· 2014: New contract farming arrangement with contract farmers is being negotiated. Day old chicks and feeds are now transferred instead of being sold to contract farmers.

· 2015: Enter into a lease agreement of 6 pieces of land totalling 665 acres with Perak State Agricultural Development Corp (PSADC)

· 2015: Increase its stake in Dinding Poultry Processing and Dinding Soya & Multifeeds via and RM 15.49 million acquisition deal.

Overseas Operation (Indonesia)

· 2011: Formed a Joint Venture with PT FKS Capital and Toyota Tsusho to expand into Indonesia market

· 2013: Commencement of flour trading activity

· 2014: Commencement of flour production activity

Malayan flour has been recording a continuous growth in revenue over the past 6 years, whereas its profit are largely dependent on its raw material prices, which are wheat, soybean and corn. Wheat is the major cost for flour milling and it made up 80% - 90% of flour production cost. A 10% drop in wheat price may increase its flour division profit margin by around 6.7%. Corn and soybean are the major raw material for feed mill, which made up of 75% of the cost for poultry division.

In financial year 2015, flour division makes up of 68% of the firm revenue and 56% of the firm profit. Whereas poultry division makes up the remaining 32% of the firm revenue and 44 % of the firm profit. Over the past 6 years, poultry division has consistently recorded a higher profit margin than the flour division.

In year 2016, despite the huge volatility in Ringgit, the company managed to recorded profit each quarter although Malayan Flour has faced problems such as forex loss and loss in hedging contracts.

Malayan Flour has a relatively strong balance sheet with RM 1.8 billion of assets and RM 1 billion of debt. The debt may seem worrying for investors but 75% of Malayan Flour debt are made up of banker acceptances. Banker acceptance is unavoidable when a firm is actively importing goods from overseas and hence the actual debt raised by Malayan flour is only a mere RM 50 million.

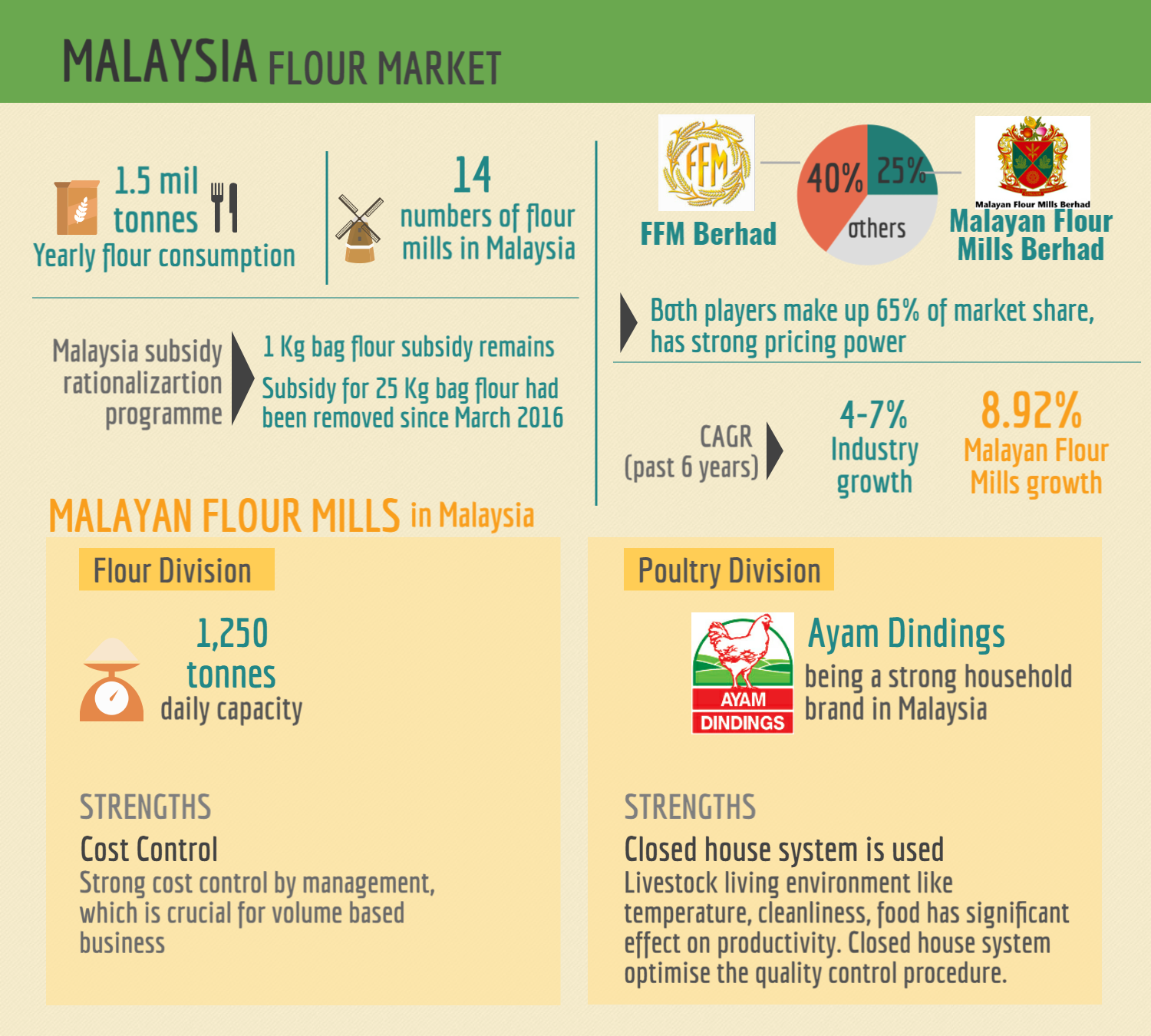

An Overview of Malaysia Flour Market

· Malaysian consume 1.5 million tonnes of flour a year

· n March 2016, wheat flour subsidy for 25 Kg bag flour had been removed by the government while the 1Kg packet flour subsidy remains unchanged based on subsidy rationalization programme. This is positive move towards a free market environment.

· The major player in Malaysia market are Federal Flour Mill Berhad (FFM) and Malayan Flour Mill. Both command 40% and 25 % of Malaysia market share which makes both player has a strong pricing power.

· There are 14 flour mills in Malaysia

Malayan Flour Mill has a milling capacity of 1250 tonnes daily. For the past 6 years, the management has shown a good track record in cost control, which is crucial for volume based business. Besides, Malayan Flour Mill owns Ayam Dindings under its poultry division .It has been a strong household brand in Malaysia for many years in the processed meat segment.

An Overview of Vietnam Flour Market

· Vietnam consume 2.275 million tonnes of flour a year.

· Most of the flour are used in manufacturing noodles and bread while other wheat flour product such as cake or pastries has an increasing trend in consumption. We expect to see a gradual change in food consumption behaviour in Vietnam as long as their economy continues to grow.

Vimaflour, which is a Joint Venture between Malayan Flour and a local partner, command 25% market share of Vietnam flour market. It has a milling capacity of 1500 tonnes daily.

An Overview of Indonesia Flour Market

· Indonesian consume 5.3 million tonnes of flour yearly, which is relatively low despite their huge population based.

· In the past 6 years, the compounded annual growth rate (CAGR) of flour consumption is 9.1%.

· There are 29 flour mills in Indonesia.

In 2011, Malayan Flour has entered into this enticing market by forming a JV with PT FKS Capital and Toyota Tsusho. This joint venture has started to bear fruit and provides a good opportunity for Malayan Flour to grow with this market.

Catalyst

· Vietnam and Indonesia have a huge consumer base with Indonesia has 250 million population and Vietnam has a population of 90 million. Both countries has a low flour consumption per capita compare to most developing nation. If both countries has the same flour consumption as Malaysia, the flour market in Vietnam will increase by 2.5 times while the flour market in Indonesia has a potential of growing 2.3 times.

· The emerging middle class in Vietnam, Indonesia and Malaysia has spur demand for wheat flour products such as cakes, bread and biscuit.

· Western food, especially fast food like Burger King, McDonald or Pizza are gaining popularity in Vietnam and Indonesia. This secular change in food consumption pattern will not reverse in the short term and will increase and will only increase more demand for wheat flour.

· With raw material prices being low for a prolonged period, not to mention Vietnam and Indonesia growing middle class, we believe in Malayan Flour will continue to create more value for its shareholders in the next decade.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

tradminator

nice infographic presentation

2017-02-20 12:01