Dude, Gamuda-WE is seriously UNDERVALUED

cephasyu

Publish date: Mon, 21 Mar 2016, 06:46 PM

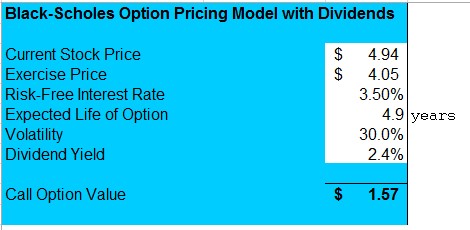

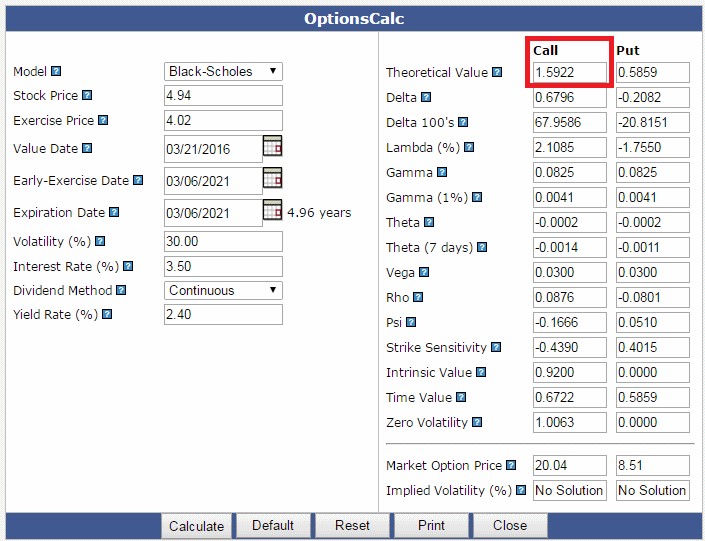

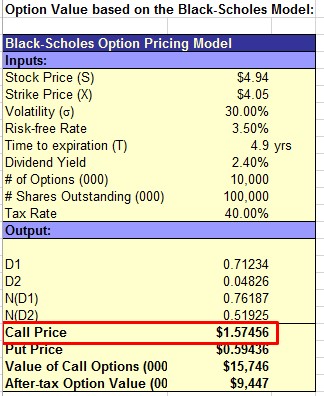

Okay guys, so let me lay this down real quick. According to the Black Scholes model, Gamuda-WE (“WE”) is worth RM1.58 and I am recommending a trading BUY.

I ran a few models even from several websites and even from Universities such as NYU and got an average WE value of RM1.58! Today’s closing price at RM1.08 is a MASSIVE discount over the intrinsic value offering an upside of 46% if you buy the WE.

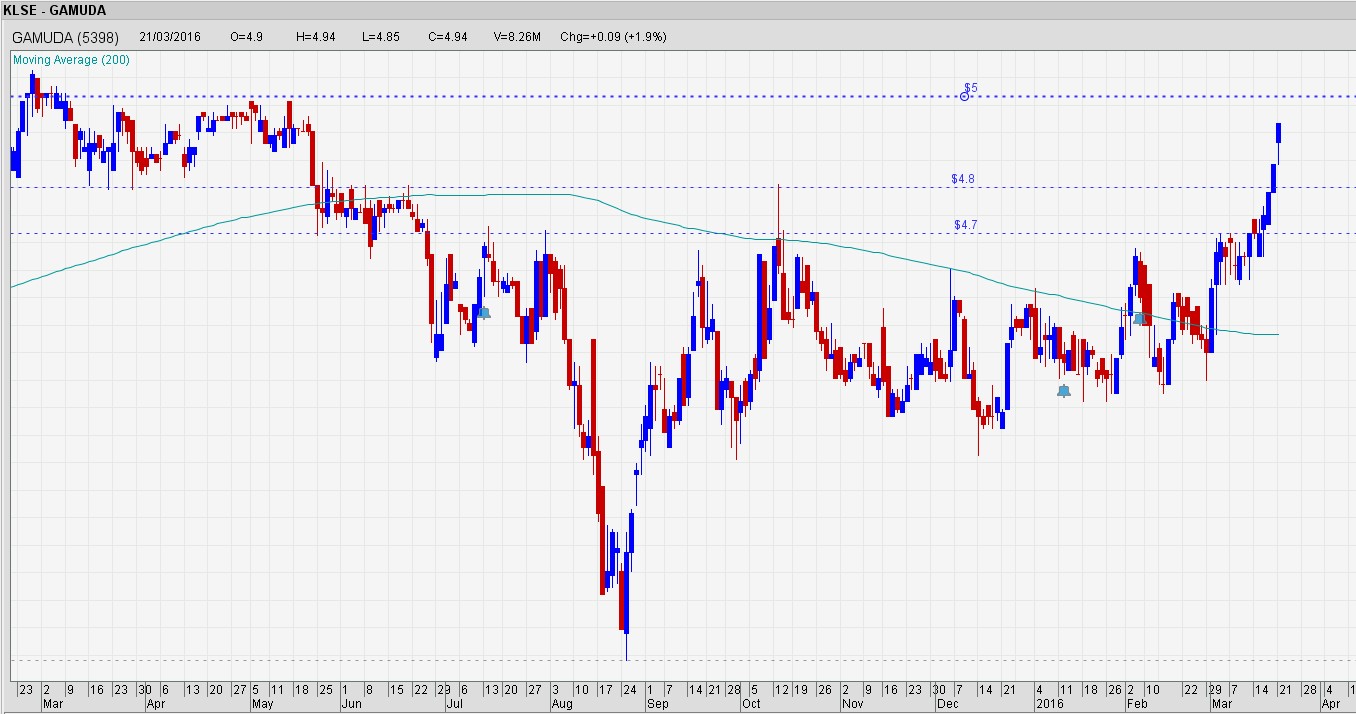

Okay, so I get it, you don’t believe the Black Scholes model and you call it the BS model (quite ironic) so let’s try looking at other factors. First of all, let’s try looking at Gamuda because if the mother moves, so will the son right? Let's start with the technical analysis.

First of all, it has broken two major resistance lines at RM4.70 and Rm4.80 and it looks like it’s getting ready to break the next resistance at RM5.00. Furthermore, today it up-gapped showing a strong bullish indicator. Also, if you think you’re too late, really you’re not because the share price is still lower than where Gamuda was in May 2015. Gamuda hasn’t even returned to its previous trending level of RM 5 yet.

Now I must confess that I haven’t done the fundamental analysis for Gamuda but really, the major catalyst in the short term is the award of the MRT 2 project. I think I’ve read that the announcement on the MRT2 award is due by the end of March and by the looks of the technical chart, I suspect that insiders are starting to buy (I’m guessing). If you’re unsatisfied with this, then please please please read one of the many research reports published on Gamuda and make the decision yourself.

However, what I am advocating here is not that Gamuda is an excellent buy (while it may well be), but that the WE is at such a deep discount to intrinsic value that it’s unthinkable to pass this trade.

Looking at WE, the premium is currently only at 3.9%. That is so low! Let's look at other warrants. Sunway-WA has a 15.6% premium and expires in 2016 August (what. the. hell.). Mitra-WD a construction player has a premium of 25.2% and expires in 2020. Just look at any warrant and you'll see that a 3.9% premium on a 2021 warrant is very unjustified. Even if Gamuda-WE has a 10% premium, the WE will be worth RM1.38.

Finally, I must confess that I have made mistakes in my past. I didn’t use to score 100% in math at school, so if you’re reading this and you are skeptical and find mistakes in my calculation/ article please let me know where I have gone wrong. The models I’ve used are linked below and my parameters are clearly stated. I want to learn from you as much as you learn from me.

Happy investing ya’ll.

Cephas

Appendix:

Parameters:

1. Mother price: RM4.94

2. Exercise price: RM4.05

3. Time to expiry: 4.9 years

4. Volatility (standard deviation): 30%

a. Here I used 1 year of Gamuda price movement and using excel, I ran =stdev.p to derive the standard deviation

5. Dividend yield: 2.4%

6. Risk free rate: 3.5% (Actually if you look at the 5 year BNM MGS rates, it is 3.66% but I used a more conservative 3.5%)

Ps. When you use a Black Scholes template online, make sure there are fields for dividend and risk free rate in the model.

NYU Black Scholes model

http://www.stern.nyu.edu/~igiddy/spreadsheets/black-scholes.xls

Fintools.com

http://www.fintools.com/resources/online-calculators/options-calcs/options-calculator/

University of Notre Dame

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=4&ved=0ahUKEwjUxteSwdHLAhXFxY4KHf5fDNMQFggxMAM&url=

https%3A%2F%2Fwww3.nd.edu%2F~scorwin%2Ffin40610%2FBlackScholes.xls&usg=AFQjCNHrqlS_Sxv32Dh

Rg0YO9c_VHFjU5A&sig2=0iB6tjZXND5IdsZjsnZT1w&cad=rja

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-11

GAMUDA2024-11-11

GAMUDA2024-11-11

GAMUDADiscussions

Sorry I have a full time job :(

Don't worry, I don't think the WE will open up at 1.57 tomorrow. There will always be chance. Maybe US markets are bad tonight?

2016-03-21 19:04

The huge discount was mainly due to extremely cheap Gamuda WRs that were traded within restricted number(5 days only) of trading days previously.So now It will take times to reach the equilibrium

2016-03-21 19:29

At one time OTB sets a TP 10% premium for WE, after a while he quietly revised to 6%...

2016-03-21 19:34

In order for WE to go up further mother has to move up.....no 10% premium....

2016-03-21 19:35

already up so much since the warrant rights 1st traded......very overvalue now

2016-03-21 20:02

Overvalued? I can't stop laughing.With premium on 3.85% and 5 years of period, it is overvalued? Genting-wa also traded with premium 5.58% at 2.07 and will expire in 2018. Don't you think Gamuda-WE is much worth it? With the coming MRT2 tunneling job worth at RM16 billion which is going to award end of this month, and many projects like Pan Borneo Highway, LRT3, Penang Transport Master Plan and Gemas-JB Double Tracking, Gamuda will move pass 5.00 and towards 5.50 soon. So Gamuda-WE is overvalued?

2016-03-21 20:12

It is up to your judgement. Don't you see someone say is undervalued, another say is fairly valued and other say is overvalued. No matter what they said, the share price will perform accordingly to the company fundamental.

2016-03-21 20:19

Hi Murali, first of all, thank you for your guidance :)

Indeed it is true that warrants > RM1 have low premiums. The Black Scholes model does address the implied leverage, however on a peer comparison basis, you are right in pointing out the observation that absolute value warrants (on Bursa at least) command lower premiums. I think that using an arbitrage "if > RM1, low premium" is a little odd, but the market does behave that way.

Shaun, thanks for your very articulated comment. I need to think about it for a little longer as I am under the impression that since the ex of the WR, the market has auto-adjusted the price of the mother. We would calculate the adjusted mother price if we wanted to compute the value of the warrant cum-WR but at ex, I think using the market price of the mother is sufficient.

Nevertheless, I will investigate your point. Thank you.

2016-03-21 20:22

Pe 17+,div yield 2%+...how much can be improved if they can get all the contracts??

2016-03-21 20:25

Gamuda mother is an elephane....that's why they have gamuda we to goreng goremg

2016-03-21 20:27

Gamuda's mother at $5.00 is the burning point. Stay closely ! To track the reaction..

2016-03-21 23:15

apollo, both gamuda-we and genting-wa overvalue? What makes you say so? because of almost 100% gain in Genting-wa?

Having say that, getting-wa price is around RM2.8 when the mother is RM10.

Could you explain more? thanks

2016-03-21 23:38

can go up but the risk is there. later make 10% lost 30%. this type of risk i won't take

2016-03-22 09:38

Perhaps should read this:

http://klse.i3investor.com/blogs/oldschool_jaejun/93538.jsp

A derivative can not have 'intrinsic value'

Black-Scholes is a PRICING formula.

Just to clear the terminology. cheers

2016-03-22 20:16

cephasyu, this provides an arbitrage opportunity. You just arbitrage lah

“套戥”, you know?

2016-03-23 08:43

Are you sure its really undervalued? Many people could get trapped.. pity em..

2016-03-23 15:29

Probability

Dude...aren't u little too late to inform us this discovery.. now? :(

2016-03-21 19:02