[duitKWSPkita] QL Resources Berhad 7084 - Long term value investment

duitKWSPkita

Publish date: Thu, 23 Apr 2015, 12:00 AM

各位亲爱的读者,

股市在短短的七个月里经历了非一般的波动,从2014备受看好的1900点挑战者变成了“牛头马面”的结局,然后又在消费税落实后逆转可能面对大调整的格局有劲而不休的情况下站稳在1830-1850点。

问题是民生都非常的懊恼一直在问为什么大市一直创新高然而我们的股一直回退。只有一些有主题的股项轮流被炒作。其实,很多股友都知道不管在什么情况下有一些股还是能够强稳中求胜。

这一系列的股一定经过了至少一次的经济萧条/股灾和具备以下三大条件:

- 保本

- 成长

- 股息

保本是说明在经济萧条时我们所拥有的股项能够为我们保本(不跌超过12%)。接下来便是成长,一般上成长最好是从销售,税前盈利与净利,赚幅和现金流量增长。股息当然也是非常值得考量的一个主要因素,能够回馈股东红股与股息的公司最值得长远投资。

之前我写过了Boilermech, N2N, SCICOM与几家中型公司,这里我想要向大家介绍全利资源(QL Resources Berhad, 7084)它是东协最大鸡蛋生产商,也是亚洲最大鱼糜(surimi)制造商。全利资源涵盖了海产加工业、综合家畜业务以及油棕业。

这次的讨论不会深入的研究在整个基本面反而会比较轻松的带过一些数据来给市场新鲜人认识这见公司的成绩单。讨论题材如下:

- 近五年业绩报告

- 強弱危機綜合分析法(SWOT analysis)

- 红股、股票拆细等企业活动

- 七年投资赚副(409%)

- 五年交易图表和2015年展望

近五年业绩报告

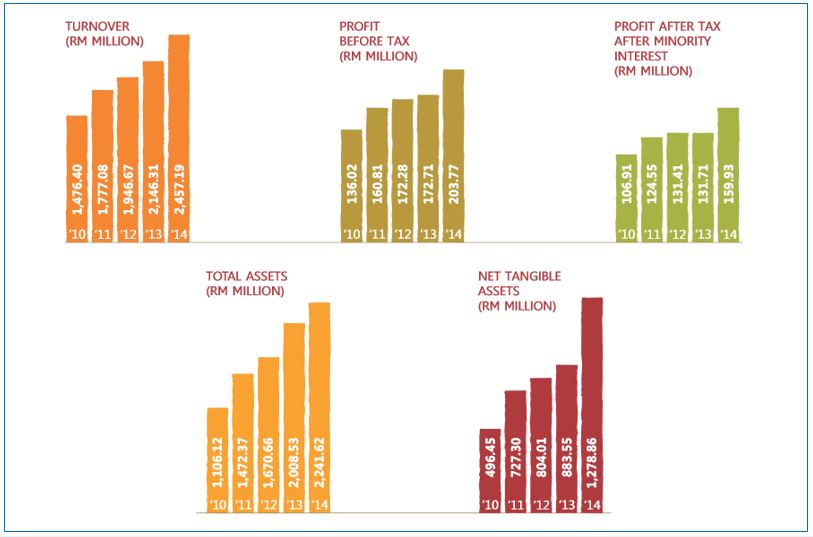

图表1:销售,税前盈利,净利,总资产和有形资产净值报告

从以上图表显示销售,税前盈利,净利,总资产和有形资产净值五年来都取得非常可观的成长。其中销售和总资产更是突飞猛进。复合年税后盈利增长率(CAGR)高达20%与复合年盈利增长率(CAGR)高达14%。

图表2:強弱危機綜合分析法(SWOT analysis)

全利资源本身有着非常特殊的生意模式,它几乎都牵涉于食物链。除了以上的分析,它的长期投资理念还包括:

- 每一次的经济风暴都看到全利集团稳健成长,当大部分公司担心现金流转时全利都在积极夸大与收购

- 印尼与越南都是新兴国家,不止对饮食健康的需求提升,人口的茂密成长将会是为全利净利翻倍的成本

- 拥有亚洲最大鱼肉酱的地位,可以左右上游与下游供应链的价格

- 社会人口与上班族的激进成长为全利的食物加工与冷冻食品带来一定的市场需求

- Boilermech 和 Commonwealth Scientific and Industrial Research Organisation, Australia (CSIRO)的专利权可以为全利母公司带来巨大的财务贡献

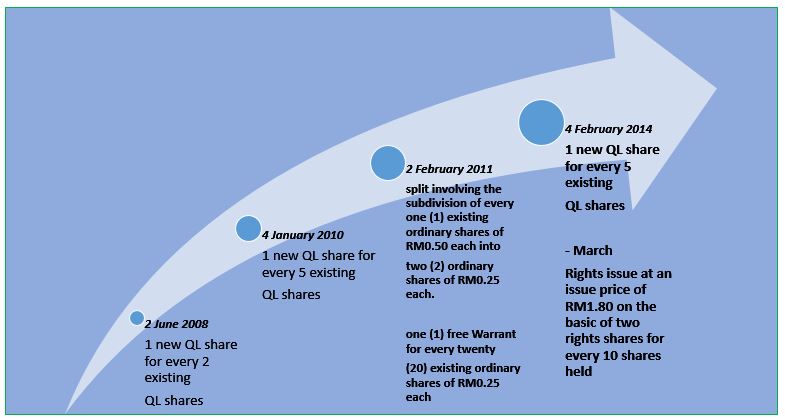

图表3:红股、股票拆细等企业活动

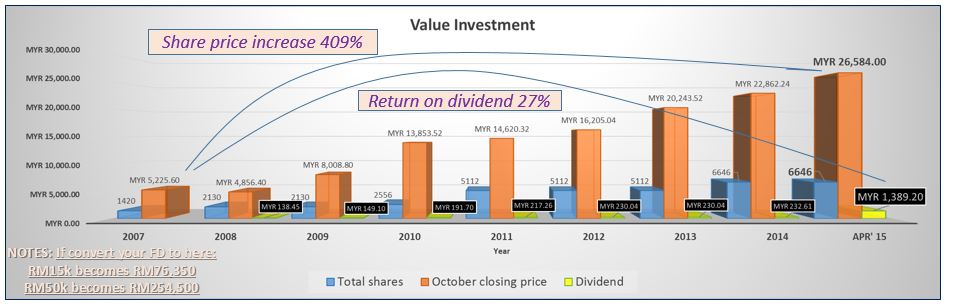

图表4:七年投资赚幅(409%)[2014年还没加上附加股认购所得股票数量]

如果一位大学生刚毕业以最初的储蓄RM5300买进了QL Resources的股,他的本钱是RM5225.50和拥有1420股。在经过8年后他将把他的投资翻四倍变成RM26,584以及总股息收入RM1,389.20。这其中他得过了每一年的股息,三次的红股以及一次的拆股加凭单。以上图表四所显示为每一年九月的闭市价X股票数量。见证了十年的成绩表,我们有理由相信印尼与越南的业务会在接下来7年同样把股值翻多四倍。这是非常安稳的一项长远投资。

十四年来全利集团在每一年都宣布派息,而也符合了25%以上的派息率。

图表4:五年交易图表和2015年展望

全利管理层谢氏家族不曾让股东失望而不明文规定约每三年都派一次红股,数学专才的谢松坤博士更是能在股票价位来到瓶颈时来个折股再来用低价刺激股票交易量而提高股价。以上一次的红股价位与期限来看我们有理由全利公司会在股票价位达到RM4.30时来个折股送凭单或大方派红股回馈股东。相信全利公司会在七个月内有重大企业活动宣布。

我个人认为以全利今天的上市地位如要更强大的扩大企业业务最适当的策略是1)折股(share split) 然后再 2)把其主要业务如海产加工业包装上市(new listing of core division for economic of scale & market leader sustainability initiative)。这可以确保全利资源公司在最短的时间完成筹资与扩大它的霸业。

最后,希望你们可以详细研究这几年公司财政报告来加强您的长期投资策略。

其他的分享如下:

duit 部落http://klse.i3investor.com/servlets/cube/blog/duitkwspkita.jsp

N2N http://klse.i3investor.com/blogs/duitN2N/

Boilermech http://klse.i3investor.com/blogs/duitBOILERMECH/

谢谢阅读!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

A Buddhist or if you believe karma, I don't think he dare to become shareholder. Even though he know very well tomorrow limit up.

2015-04-23 00:21

Thanks abang duit ..but next time can write both language cause iI banana...paiseh ..:)

2015-04-23 07:05

yes,please English will be the better language.alot of us Chinese are bananas...he,he,he.

2015-04-23 08:50

ql,the only one stock to buck the trend, in this bearish market.those who own this stock had never lost money.

2015-04-23 16:01

duit

my sincere advice, do not choose such counter to write if you are buddhist

2015-04-23 17:05

Halo abang duit ... Wah .. Ni macam bo beli mana aeh sai ... Hehhehe

" Wink wink " tony ... Huat huat bo ? GU lai liauuuuuuu

Kikikikikikiiii

2015-04-25 23:45

Put Thai au mai ?Hahahaha

Halo Christine .. Hahahaha ..pakai words fuyoh baru GAM ...Hahahaha.

Good luck la

2015-04-25 23:47

DO NOT BUY !

the business activities involve KILLING

whatever you take away from other you got to pay back, whether life or money.

why choose to be a shareholder of a killer company

you can make a lot of money from evil works , but do you want to pay back by your own life or your family members' life

think carefully

what to do, you decide and you be responsible. if you are not sure KARMA is true or false, please do not be that foolish to talk nonsense and mislead people with your ignorance unless you think you have more wisdom than Buddha.

2015-05-11 14:23

bintang21,,,,,,,,,,

I value your opinion on the "killing" business nature.

NO deny. I got your point.

OKAY. I shall make necessary move.

Thanks for valuable feedback.

2015-05-11 14:30

cherry tomato

Good morning DUIT. Thanks for your write up.

2015-04-23 00:03