Capital A: Ready for Takeoff — Why Now is the Time to Invest

Alex_Kho

Publish date: Mon, 29 Jul 2024, 02:40 AM

Capital A Berhad, the parent company of AirAsia, is on the brink of a remarkable recovery. On track to exit its PN17 status by the end of 2024, Capital A is a stock worth watching. Here’s why it deserves your attention and investment.

Company Overview

Capital A, known for its AirAsia airline operations, faced severe challenges during the COVID-19 pandemic. With approximately 80% of its revenue coming from the airline business, the impact was significant. However, strategic restructuring and a focus on financial health have positioned the company for a strong comeback. Recent financial reports highlight Capital A’s resilience and growth potential.

Reasons to Invest

Strong Passenger Volume Rebound

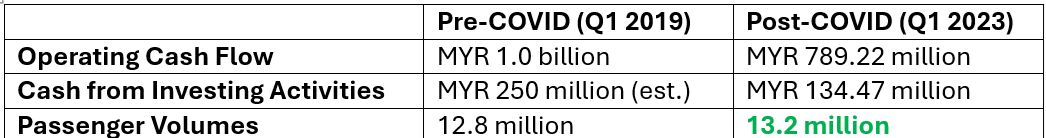

Pre-pandemic, AirAsia carried 12.8 million passengers in Q1 2019. By Q1 2023, this number had rebounded to 13.2 million passengers, surpassing pre-COVID levels. This recovery is driven by a resurgence in travel demand and the introduction of new routes, proving that passenger volumes have made a solid comeback.

Improved Financial Health

Capital A’s financial performance is bouncing back:

- Operating Cash Flow: In Q1 2024, the company generated MYR 789.22 million, showing strong recovery from the pandemic downturn.

- Investing Activities: Cash from these activities was MYR 134.47 million, reflecting strategic reinvestments in growth areas.

Strategic Restructuring

Capital A is considering selling its aviation operations to AirAsia X Berhad. This move aims to:

- Reduce Debt: By transferring some of its debt and operational costs to AirAsia X, Capital A can improve its financial health.

- Focus on Profitable Segments: The sale will allow the company to concentrate on its growing digital and logistics services.

What I Think

Based on the data and strategic moves, here’s my take on why Capital A is a solid investment in the near term.

Passenger Volume Growth: The rebound in passenger volumes to 13.2 million in Q1 2023 from 12.8 million in Q1 2019 indicates strong market demand and operational resilience. This trend suggests that the company is not only recovering but also expanding its market presence.

Financial Turnaround: The significant recovery in operating cash flow to MYR 789.22 million in Q1 2024 demonstrates Capital A’s ability to generate revenue even under challenging circumstances. The increase in cash from investing activities to MYR 134.47 million highlights their strategic investments in growth areas, ensuring long-term sustainability.

Strategic Restructuring: The decision to sell aviation operations to AirAsia X Berhad is a strategic masterstroke. By offloading debt and focusing on profitable segments like digital and logistics services, Capital A is setting itself up for sustained growth and profitability. This restructuring will likely make the company more agile and financially robust, enhancing its market position.

Risks to Consider

Operational Costs: High operating costs remain a challenge. Any unexpected increase could impact profitability.

Regulatory Approval: Delays in regulatory approvals could impact the timeline for exiting PN17 status. The company needs timely approvals to stay on track.

Target Price Analysis

Given Capital A’s recovery trajectory, improved financial health, and strategic initiatives, a higher target price is justified.

-

Conservative Estimate: MYR 1.10 – Reflects a cautious approach considering potential risks and market volatility.

-

Optimistic Estimate: MYR 1.50 – Assumes successful implementation of strategic plans, continued recovery in passenger volumes, and further financial improvements.

Conclusion

Investing in Capital A presents a calculated risk with promising rewards. The company’s strategic efforts, coupled with improving financial performance, indicate significant upside potential.

If you invest MYR 1,000 in Capital A today at MYR 0.840 per share, your investment could grow to MYR 1,500 if the stock price reaches MYR 1.50 in the next 12 months, representing a 78% return.

Disclaimer: This article is for informational purposes only and not investment advice. Please invest prudently.

My Medium Post: https://bit.ly/3Wqldpa

More articles on Finance for All : Demystifying the Stock Market

Created by Alex_Kho | Jun 12, 2024

Created by Alex_Kho | Jun 10, 2024

Created by Alex_Kho | May 21, 2024

In this insightful article, we delve into the golden opportunities presented by the recent surge in gold prices, focusing on two leading Malaysian jewellery retailers, Tomei Bhd and Poh Kong Bhd.

Created by Alex_Kho | May 16, 2024

KSL Holdings Bhd, an undervalued Malaysian property stock with attractive ratios, is poised to soar with the market's anticipated 2024 recovery. Don't miss out on this hidden gem!