A 2022 Stock Pick That You Must Not Miss Out From

FIREFIRE

Publish date: Wed, 05 Jan 2022, 10:45 AM

A 2022 Stock Pick That You Must Not Miss Out From

2022 is a sacred year for investors to restart and reset their portfolios. As there are multiple stock picking events that are ongoing, I would like to weight in and share with you one of my highest portfolio weightage stocks that I’m still buying today.

And what I will be sharing will be controversial to what you heard learn in value investing guru classes, so, buckle up.

1. High foreseeable earnings

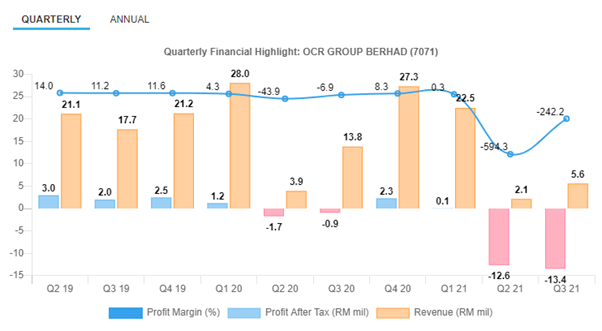

From what you can see in the chart below, the company had dipped into red for the past 2 quarters. Of course, this had also caused a negative reaction in share price, but what the market have not realize is that the company is currently clearing up their balance sheet by executing kitchen sinking activities.

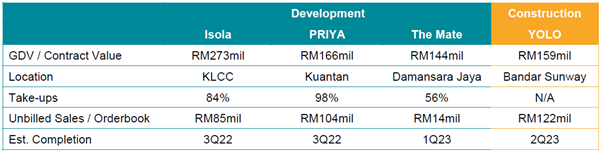

Despite the losses, this company had a few development and construction projects on hand, which total up to RM325 million unbilled sales as at the LPD. For seasoned investors, once they saw the figure, two question will come into mind:- How long would the unbilled sales or contract value last? What is the historical performance on quarterly and on an annual basis?

Well, some of the projects that is on this company’s hand, namely Isola, PRIYA and The Mate, had a total RM325 million unbilled sales up until the end of 2023. In other words, this RM325 million could be divided by 8 financial quarters which would result in RM40.6 million in revenue per quarter.

And we know that historically, the company had less than RM30 million in revenue, and this figure would represent 45% jump in revenue from its Q1FY2020 results. And by giving a conservative 10% net margin to the revenue, this company may report up to RM4.1 million in net profit and a total of RM16.2 million per annum.

This represents a huge profit turnaround based on the current loss-making situation that the company is having.

2. Additional income from PMC business

In fact, this company had actually been involving in the consultation business for ECRL in Pahang package and pending finalization for now. They had also collaborated with Yayasan Pahang to project manage over 25000 units of affordable homes for the next 15 years.

Despite the numbers contributed by the PMC segment is unclear for now, we know that the segment requires minimal capital expenditure and/or working capital as the costs involved are manpower in the consultation work, which were already sunk in into the costs of the group.

But looking beyond the existing project, the company also demonstrated a good connection with the government which was not valued in neither NTA nor the net earnings of the company. As 2022 will be the year for development expenditure, we expect more contract or collaboration win by the company in this year, which would boost their upcoming financial quarters performance.

3. Sensible valuation

Let’s first look at the chart of the company.

You may have already noticed the name of the company, which is OCR GROUP BERHAD. But I want you to focus on the price movement of the company – clearly it had not reflected its future earnings at this juncture.

As of now, the company had RM0.230 in NTA, which represents a 39% discount to the current price level. And if we take account of the future earnings of the company, which is RM16.2 million per annum with 8 times PER, this company easily worth RM129.6 million without even factoring in the net assets.

Based on the conservative calculation we did for OCR, the current price level represents a 26% discount in their forward earnings, without factoring in the PMC or any future projects that the company would launch, or any potential contract wins at this juncture.

Conclusion

I can only do so much on education investors on ways to dissecting a company, but once again I, by all means cannot predict the share price movement. However, for a prolonged period of time, the share price of a company will fluctuate close to its true value. And based on our analysis, it is not hard to achieve 30% ROI by investing in OCR at the current price level.