Why is this stock losing money?

FIREFIRE

Publish date: Fri, 10 Dec 2021, 02:39 AM

Why is this stock losing money?

Well, I guess there are lots of missing context here, but we will fill them in one by one. We will be looking into OCR Group Berhad latest quarterly results and try to undermine why is this company still losing money.

For those who are new to OCR, the company is mainly involved in property development and construction business. Annnnnnnnnd you might have guessed it, the lockdown had adverse impact on their financial performance.

Well, thanks to the government’s effort, this is all behind us now (fingers crossed).

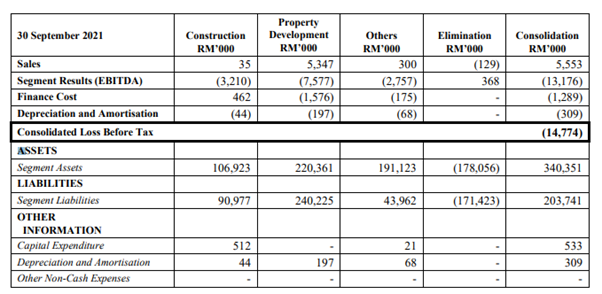

Now if you look at the segment information by the group, they had close to zero revenue from construction and others business segment. As property development and construction requires high working capital, locking down had effectively paralyzed them and prevented them from operating in this quarter.

I quote:

The revenue in the current and cumulative periods under review were derived from the sales by Isola at KLCC, PRIYA at Kuantan and The Mate at Damansara Jaya. Apart from the slower sales and billings, gross loss in property development segment was also contributed by PRIYA project due to additional cost incurred for termination of the main contractor during the year.

The revenue in the current and cumulative period were recognised mainly for the YOLO Signature Suites at Bandar Sunway and Pano at Jalan Ipoh. Loss before tax was mainly due to temporary closure of construction sites, and construction activities were stagnant for most of the time during the quarter.

However, most construction and property developers had resumed their work in September alongside with several phases of National Recovery Plan. With sales pending to convert from existing projects as well as normalized operations for OCR, they should turn to black easily in the next quarter.

As of now, the group had slightly over RM200 million in unbilled sales excluding the construction of YOLO project. Together with the YOLO project, this would boost their unbilled sales to more than RM300 million.

And what was their revenue in this quarter?

OCR had just accounted RM5.55 million in this quarter.

Now, let’s say that the RM300 million unbilled sales was for the next 3 financial year, this would equate to RM100 million revenue to OCR on each year – assuming that the group did not launch any project moving forward. And for the industry, the norm of net profit margin is hovering in the range of 15%, so a simple calculation would make OCR to have an annual RM15 million bottom line on normalized basis.

Not to mention they had a RM750 million in GDV terms project based in shah alam pending to be launched.

If we take the sum of parts approach, the company current had a net asset per share of 23 cents. Take a 50% discount and we will be left with 11.5 cents in terms of per share value. And on the net profit level? A simple 10 times PER would result in 22.0 cents in value, and when we sum it up, the true value for OCR should be 33.5 cents.

Based on the current price of 15.5 cents, we are now talking about an over 50% margin of safety cum recovery themed stock.

Is OCR undervalued? I don’t know, to me, buying OCR now is like buying RM1 with 50 cents.

I rest my case.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|