OCR – An interesting fund-raising activity

FIREFIRE

Publish date: Tue, 18 Jan 2022, 05:36 PM

OCR – An interesting fund-raising activity

If you are a trader who follows the market closely, then OCR must have already gotten your attention for the past week. There is a spike in share price and volume for the past week – right before their completion of private placement.

So, what does this mean for the company?

Being quite an active guy amongst the bankers, normally we would get offers from private placement exercise at a discount. But for OCR, things seem a little different. There were little to none marketing of the placement and the shares were sold almost INSTANTLY. This could only mean the demand for the share is strong.

But why?

A quick pickup of shares in private placement usually indicates that there is something brewing in the company. In OCR’s case, we had a quick check on the background of the company. They are primarily involved in the property development and construction segment, which is exactly the industry that is going to recover in 2022.

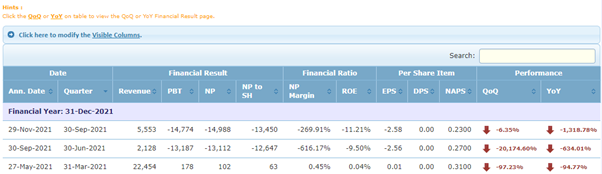

Ordinary investors might shy away from their loss making results, but the swift demand in private placement and the historical loss-making nature is hinting strongly that the company may make good profit or turnaround in the coming quarter.

Do bear in mind, it is always the “anticipation” that shape the valuation, which shapes the share price, and the best rerating catalyst there is, is a company turning from loss making to profit and cash generating.

In this case, could we see more price movement from OCR in the coming week?