A “Baby” Step Towards Turnaround – OCR GROUP BERHAD

FIREFIRE

Publish date: Tue, 01 Mar 2022, 03:41 AM

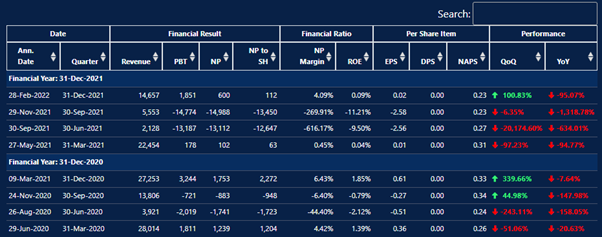

As per my conversation to some of our friends in the forum, OCR had successfully turnaround in their Q4FY21 results as there are no longer negative impact from the Movement Control Order, as well as the completed kitchen sinking exercises.

Props to them for creating this beautiful interface.

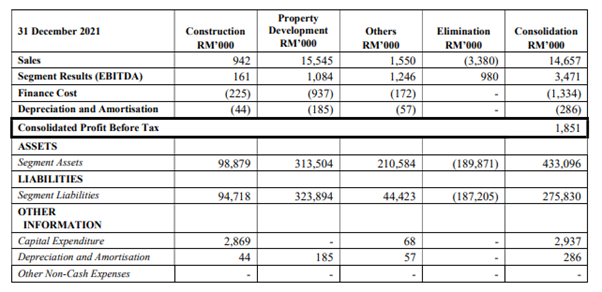

Under the reporting quarter, the company had recorded RM14.65 million in revenue and RM6.44 million in gross profit. This is a very good indication of the upcoming profitable operation for their construction, property development, as well as other contribution such as project consultancy management income for the quarters to come.

Alongside with the improving vaccine administration activities by the government, as well as accommodative and substantial fiscal support that cushioned the recovery of economic and social activities, the were substantial increase in both property sales and progressive billing under Isola @ KLCC, PRIYA Kuantan as well as The Mate @ Damansara Jaya.

There were also much better revenue recognition for the YOLO Signature Suits project for the company, which had contributed a positive EBITDA for the quarter under review.

The management had also taken the initiatives to explain in depth in terms of the prospects of the company. Moving forward, the management expects construction activities to be normalizing albeit at a slower rate, which means there should be better results reported from the company in FY22. There is also significant improvement in sales for OCR due to positive signs of recovery, which the group also expects the sales momentum to continue.

In other words, barring unforeseen circumstances such as Movement Control Order 4.0, OCR should return to black for the full FY22.

And in my humble opinion, the sharp turnaround as compared to Q3FY21 should result in a spike in investors’ interest for the upcoming trading days.

Due to the rising interest rate, one of a better hedge against inflation is property. Hence, we are seeing an uptick of fund flow interest into the properties sector, while OCR is being left out due to the uncertainty of earnings.

Obviously, this would change as the company will be reporting much better results moving forward.

The mispricing between the uptick of properties stocks and OCR had presented a good opportunity for investors to trade, and my personal TP for the company should be around 30 cents as the EGM had gone through and investors had already approved the yield accretive industrial land acquisition, and not to mention, there is a RM4.27 million profit to be recognized due to the bargain purchase.

Cheers.