RHBBANK - Should you buy the C53 warrant?

DividendGuy67

Publish date: Sun, 21 Jul 2024, 01:47 AM

Introduction

Firstly, I am not a fan of warrants and derivatives. The last time I bought a warrant was 2 decades ago and over the long term, I did not make money net net, after dozens of trades spanning years, even though I was a fairly skilled trader in stocks and a winning investor. So, I haven't touched it for 2 decades now. And I cannot recommend anyone to buy it because:

- In the long run, you will lose monies - which means there's no long term future here to make monies.

- In the long run, you'll find the size of the loss is not small, but big - which means there's no long term future here for you to make reliable monies in a big way.

- The longer you play, the harder it is to control your emotions. Eventually, greed sets in, and when you bet the biggest amounts, that's when the other side steals it all away from you, when you least expects it.

Why is this the case?

Short reason why retailers lose is because warrants are legally approved gambling contracts that provides massive leverage to retailers, but retailers often don't realize that it is a zero-sum 2 party game.

- Zero sum two party means if you win, the other side loses.

- The "other side" is often not mentioned, but it is really the big institutional investor who issued the warrants in the first place.

- Yes, you are gambling against them. Didn't you know?

- And long term, because these institutional are businesses, the odds of winning against them are worse than buying lottery tickets.

- These professionals live to make a profit against the ignorant warrant buyers. It's their business objective. Their fat yearly bonuses depends on winning against you. And they have much more resources, tools, funds, capital, knowledge, experience to make sure they win against you.

Why it is a sucker game?

Because there are so many aspects of warrants that always find ignorant retailers to buy. Because small retailers have limited capital. Because a few sen looks cheap. Because of that win that looked big relative to the outlay. Because of the high leverage.

The hidden party betting against the ignorant retailer loves this business because it is highly profitable for them.

So, what is it about the C53 warrant?

Short Summary Features of C53 Call Warrant

- Call Warrant (if you don't know what this is, avoid it).

- Maturity date = 30 October 2024 (Wednesday).

- Ratio = 3:1 (3 call warrants for 1 share)

- Issue size = 150,000,000 warrants (equivalent to 50,000,000 shares).

- Exercise price = 5.60. (compare to current price of 5.70).

- Warrant type = European Style, non-collateralized, cash-settled (it means at the maturity date, you don't get the shares but is "cash-settled" - if don't understand, avoid).

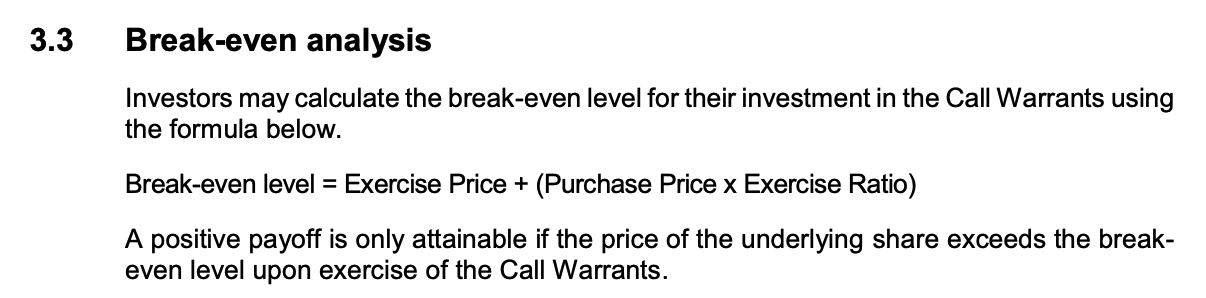

C53 Warrant Break-even Level

Let say you bought the warrant at 6.5 sen closing price. The question is what price do you need RHBBANK to close, so that you don't lose monies?

The Break-even formulae above says that you need RHBBANK to close at 5.60 + (6.5 sen x 3) = RM5.795 or RM5.80 on 30/10/24 so that you don't lose this gamble against the institutional issuer.

However, if RHBBANK really closed at 5.80 on 30/10/24, depending on your "transaction costs" (brokerage fees, clearing fees, stamp duty), you could still lose monies because you haven't factored in "transaction costs" yet.

Do you know how to calculate the real "break-even price" after transaction costs? If not, then, avoid it.

So, how can how you lose everything?

Simple. If RHBBANK close at RM5.60 or lower on 30/10/2024, you lose EVERYTHING. It didn't matter that RHBBANK traded higher before that day, or traded at RM8 after that date, but on 30/10/2024, if it closed at RM5.60 or lower, you lose everything.

What happen to your monies that you lost entirely?

Legally, it will have gone to the hidden party that bet against you that you didn't see. They collect everything and keep everything. Your loss = their profit.

Which has better odds - buying a lottery or buying Call Warrants like C53?

Sadly, small retailers are actually better off buying lotteries. Why? Because in lotteries, typical regulatory payouts is something like 60% of total collections in the long run. So, you the lottery operators win 40% only.

However, with financial derivatives, typically, something like 80% of these derivatives expires OTM ("out of the money") i.e. 80% retailers are wiped out completely.

So, if you have only a small amounts of monies to invest and cannot afford to buy the shares, then, don't bother to gamble in Bursa with derivatives. Just keep saving up so that eventually you can afford the shares. If you are impatient, then, just go and use that small monies to buy lottery tickets - your odds of winning is better there than in warrants over the long run.

The Other Ugly Sides of Derivatives

It has to be said that the other hidden side of the bet, can even influence/control the mother share price at expiry date.

The pricing of the warrant is so complex after issue, that retailers have absolutely no chance to understand what the real theoretical price should be. Who amongst you - dear readers - have worked with an option-pricing model? If not, you are already at a huge disadvantage because you are now gambling and betting against a much more sophisticated institutional issuer.

In short, if you don't know who the sucker is in this zero-sum 2-party bet, odds are you are the sucker.

Most retailers are lazy. I won't be surprised if some of the C53 warrant buyers didn't even consider RHBBANK upcoming dividend payments before 30/10/24 expiry date that will cause the mother share price to drop after ex-div. Whereas the professional will have already allowed for it in their option pricing model.

Summary and Conclusion

In my view, buying warrants like C53 are worse than gambling, or going to a Casino or buying lottery tickets.

- The reason they are worse is because this is a zero-sum, 2 party game where the small ignorant retailer are not even aware of who is on the other side betting against him. In the long run, the retailer have no chance.

Contrast owning the mother shares RHBBANK. Your odds of winning is so much better, for many people, maybe even better than EPF in a diversified portfolio of similar businesses.

- When RHBBANK goes ex-div with 15 sen of 25 sen, you don't really lose anything permanently, but if you owned C53, you risk losing big time, maybe 100% wipe out.

- When RHBBANK makes monies, as shareowners, you own a piece of that profit because you own a piece of that business. The warrant institution can't do anything to you. Whereas as buyer of C53, when RHBBANK makes monies, the other side of the bet can do things to win, including but not limited to temporarily depress the market price on 30/10/24 to ensure they win. In other words, the C53 buyer can still suffer 100% wipe out when RHBBANK shareholder wins.

Disclaimer: As usual, you and only you are fully responsible for your own trading and investment decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Feb 02, 2025

Created by DividendGuy67 | Jan 25, 2025

Created by DividendGuy67 | Jan 24, 2025

Created by DividendGuy67 | Jan 22, 2025

Discussions

"ahbah > Always think RHB is a high dividend stock."

Please understand the below statement of the article:

'Contrast owning the mother shares RHBBANK. Your odds of winning is so much better, for many people, maybe even better than EPF in a diversified portfolio of similar businesses.

When RHBBANK goes ex-div with 15 sen of 25 sen, you don't really lose anything permanently, but if you owned C53, you risk losing big time, maybe 100% wipe out.'

The IB CW issuer usually chooses Good Fundamental and/or Dividend Companies to attract buyers. The attraction of low CW prices of High Price Counters will ensure 'gamblers trapped'... If the 'punters' know the game well, the leverage will be very rewarding compared with buying mother shares; discounting the Dividend..

2024-07-29 12:00

BLee

“In my view, buying warrants like C53 are worse than gambling, or going to a Casino or buying lottery tickets.”

Very good write-up. I agreed with 99% of what's written; except..

‘- can't compare gambling with any type of investment instrument. In gambling, the duration is short; either you win all or lose all in one trade with various permutations. With warrants, either the Company free warrants or IB Call Warrant, the Term and Condition all spelt-out with The Duration, The Odds, The Issuer (who you bet with?), who is the Market Maker, and so on and so forth..as I read in their Term Sheet, the Market Maker will Buy the Company Share to ‘Normalize’ their trade so that All will win in a bull market. It is the reverse for a bear market.

‘- The buy and sell bids by Market Maker are available for trading. There is a chance to cut-loss or run-with-gain; unlike gambling..

I am Not advocating Call Warrant as I can't take the risk, and with my one time lost in Company’s Warrant, will sell at any price for any given Free warrant. As always, Happy Trading and TradeAtYourOwnRisk.

2024-07-29 09:09