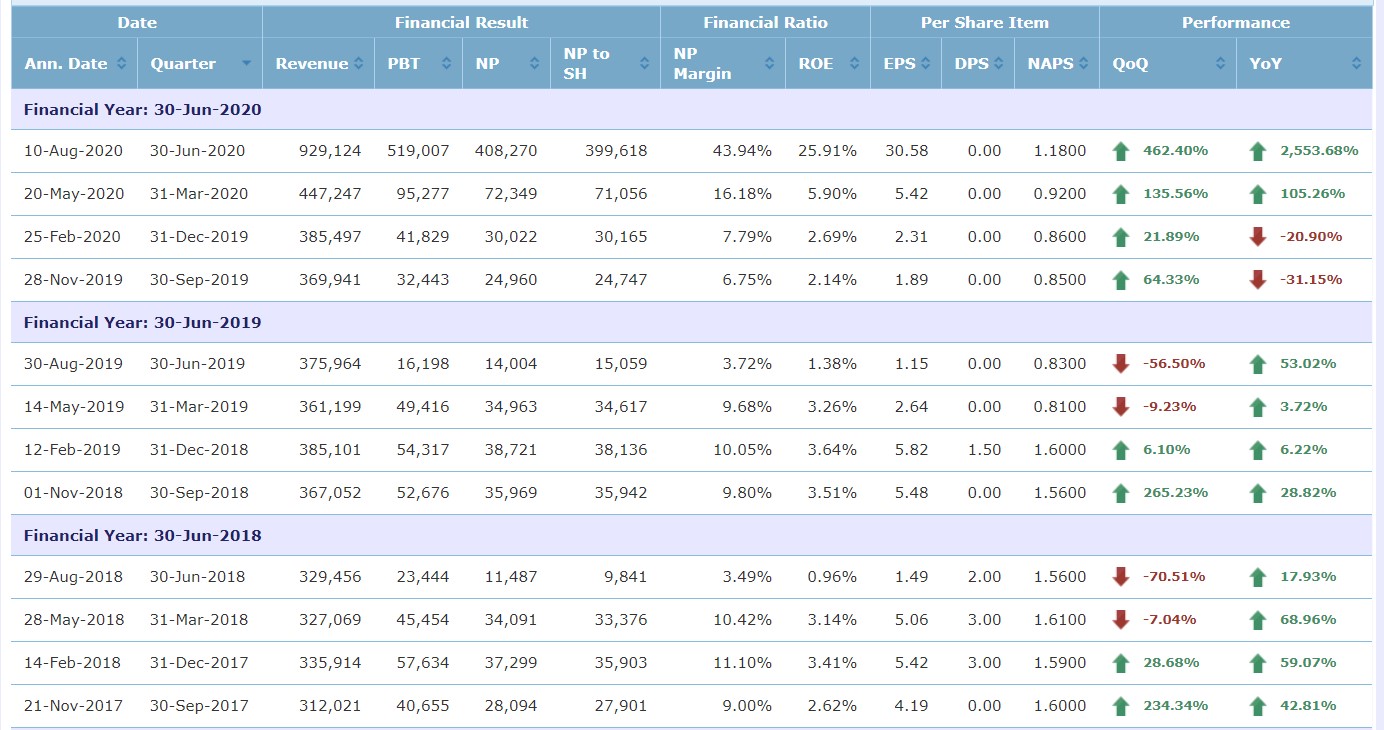

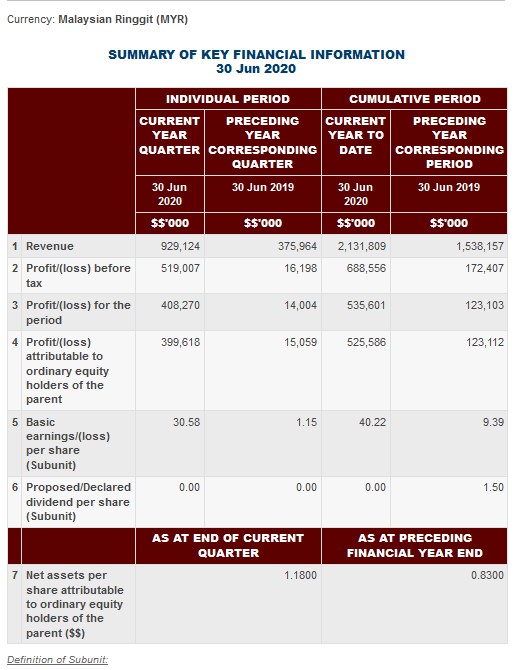

KUALA LUMPUR: Supermax Corp Bhd's net profit soared to RM535.6 million in the year ended June 30 2020 from RM123.1 million in 2019, buoyed by a whopping 2,815 per cent net earnings increase in the fourth quarter.

The fourth quarter's net profit rose RM408.3 million on the back of a 147 per cent growth in revenue to RM929.1 million.

The full-year revenue had risen 30 per cent to RM2.13 billion from RM1.64 billion previously, Supermax said in a statement today.

The company said the higher profits were fuelled mainly by exponential rise in demand for medical gloves and other personal protective equipment (PPEs) as well as higher average selling prices (ASPs).

Group revenue soared because of higher in percentage of Supermax's capacity and global sales to end-users, including sales to governments and government agencies of various countries, and proven business model through own brand manufacturing (OBM) with two-streams of income via manufacturing and distribution.

Supermax said the Q4 financial performance was its best ever in history.

This pushed its financial position dramatically with a net cash position amounting to RM1.18 billion as of June 30 this year compared to RM173.8 million a year ago.

"The increase is mainly due to customers paying 30 per cent, 40 per cent and 50 per cent deposits in advance to secure supply," it said in its local bourse filing.

Supermax said the demand for gloves as a PPE had heightened as the world fights the Covid-19 pandemic with the emergence of new consumers and new consumption not previously seen before prior to Covid-19.

"Currently, we are in the oversold position. The surge in demand has resulted in a rapid rise of ASPs since March 2020.

"Governments all over the world have increased healthcare spending budgets to contain the effects of the pandemic and in preparation of a possible second or more waves," it said, adding that the company expected that the demand to remain buoyant beyond mid-2021.

Having adopted OBM model since its establishment, Supermax said it manufactured its products, packages and markets under its in-house brands.

"We currently export 55 per cent of production under our own brands via our own distribution centres and 40 per cent through independent distributors, while the remaining 5.0 per cent is for original equipment manufacturer (OEM) production."

Supermax plans to build new relationships with new customers and distributors in anticipation that they will continue with repeat orders post-pandemic.

"Our products are sold to over 165 countries, the largest contributor being the Americas region which contributed 51 per cent of revenue in FY20. Asia/Oceania and Europe each contributed 23 per cent to FY20 revenue."

In terms of product segmentation, Supermax said 72 per cent of was from nitrile powder free gloves, followed by 18 per cent from latex powder free and 7.0 per cent and 3.0 per cent from powdered latex and surgical gloves respectively.

Supermax said it had executed expansion plans of building total of five glove manufacturing plants between now and 2022 with additional production capacity of 22.25 billion, making total of 48.42 billion gloves by end-2022.

"The Supermax Group would invest total capital expenditure of RM1.3 billion for the new plants," it added.

Meanwhile, Supermax proposed a final dividend via the share dividend distribution on the basis of one treasury share for every 45 ordinary shares held in the company.

Supermax shares were traded at RM21.20 today, 7.50 per cent lower than last Friday's price at RM22.92.

A total of 43.35 million shares changed hands today, giving a market capitalisation (market cap) of RM27.4 billion.

Supermax, being one of the beneficiaries of the Covid-19 pandemic, has seen its share prices rallied since April 15's closing of RM1.84 with a market cap of RM2.43 billion.

Its highest price was RM23.8 recorded on August 6 this year, with its lowest at RM1.30 on January 14, 2020.

gloveharicut

supermax figure release https://klse.i3investor.com/blogs/gloveharicut/2020-08-10-story-h1511622021-SUPERMAX_Net_Profit_XXX_million.jsp

2020-08-10 18:24