British American Tobacco (BAT) - SURGED DURING AND POST 2003 SARS CRISIS

GreatWarrants

Publish date: Mon, 03 Feb 2020, 12:59 AM

Dear Valued Affluent Investors,

First of all, deepest condolonces and symphathy goes out to the ones affected by the recent outbreak of the Coronavirus.

History Repeats Itself in the Market

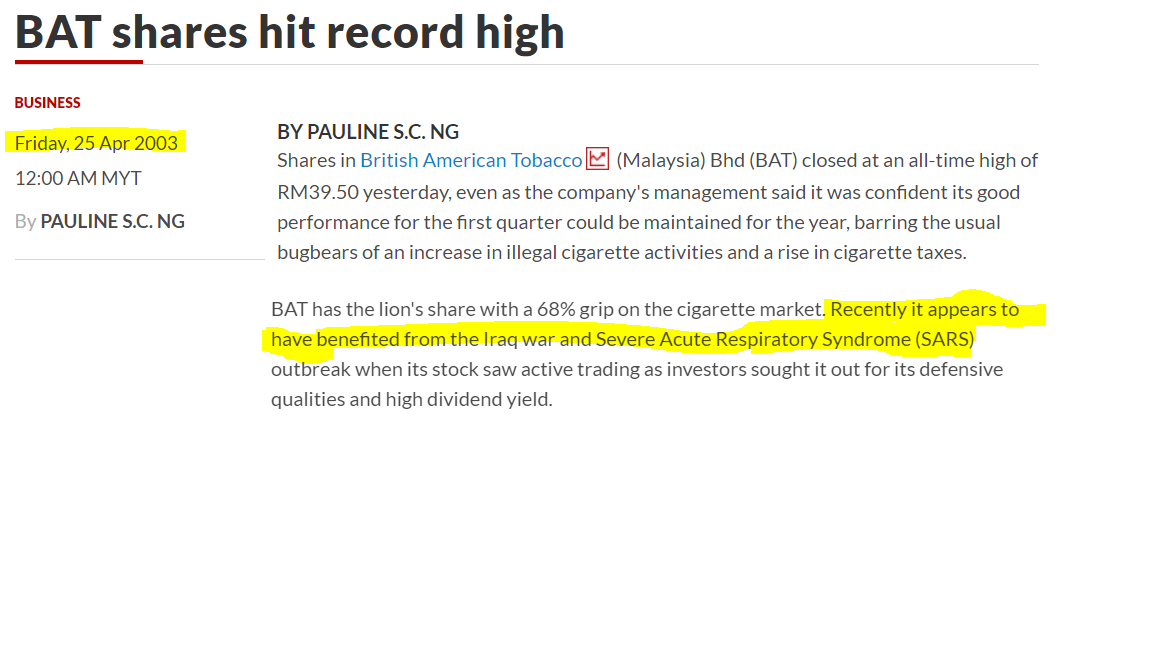

As you look back to the SARS Event in February 2003, BAT has actually surged by 80% during this severe crisis. BAT Continued to rally even after the Sars virus was contained.

Source : The Star 2003

Fundamentally Strong - Seeking Treasured Dividend Yields

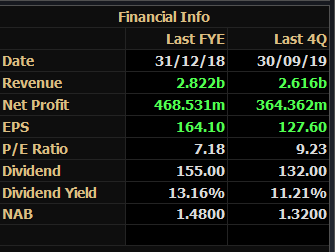

This company still managed to generate a whopping RM 364.36 Million the past 4 quarters.

PE Valuation is rather low at 9.23x with a stunning Dividend Yiled of 11.21%. Fund Managers and Affluent Investors should pay close attention to the dividend yield rate - and potential capital gains when investing in this stock at this price level.

As compared to your FD rate of approximately 3.0-3.8% p.a (After BNM Rate Cute), Or purchasing retail bonds at 5-7% Coupon yield p.a, (Whereby the bonds have a possibility to default in this healthcare crisis situation / face liquidity issues). - BAT remains highly attractive at this point of time, with high liquidity and large upside potential.

BAT SOARING INTERNATIONALLY

As you can see, British American Tobacco shares are considered a good proxy to this virus internationally and the current price of BAT is HIGHLY Undervalued.

British American Tobacco (London Stock Exchange)

British American Tobacco (OTC, New York Stock Exchange)

What Happens to BAT after this Virus?

There will be still an ongoing contest to Ban the trade of illegal ciggarettes. In fact, internationally, vaping and illegal ciggarettes bans are happening worldwide, Long term - This will be a win win situation for the government and BAT to combat illegal cigerrates. Government would be able to collect more taxes, AND reduce the distribution of illegal / toxic inhalent devices which poise a huge health risk to the Rakyat. Illegal smoking devices may consist of chemicals which are unregulated or verified by official health organizations.

Therefore, there is large potential upside for BAT at this point of time.

Rebound Play in BAT

As You can see , Bat shares has been DUMPED and has plunged almost 80% from its highs of RM 60 range in 2014. This share is a clear example of a blue chip which has been oversold. Veteran market players will only know what true value investing is.

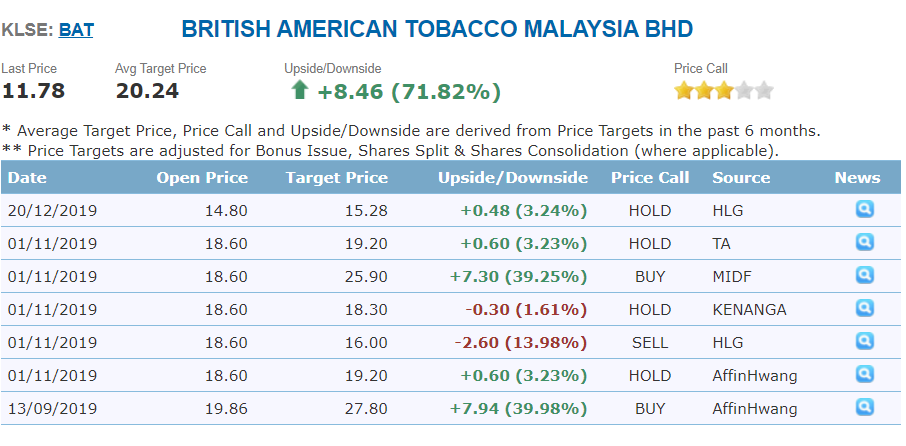

Investment Bank Price Targets : Average RM 20.24

As you can see, Fund Managers and institutions may have already bought at higher price ranges. The average price target of these investment banks are RM 20.24 which shows some huge upside (+71.82%) from this current price of RM 11.78.

Therefore, why not consider this share as a potential medium to long term investment to be added to your overall portfolio?

Thank you for reading,

Best Regards,

Greatwarrants

Disclaimer:

Investing in stocks is a great tool for capital gains. However, all investments come with risk. Therefore, all investment decisions should be borne at your own cost and I will not be held liable for any investment decisions made. Do not buy Equities if you do not know the risk !! Thank you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|