Dear Valued Affluent Investors,

As all investors know, the market has recently rallied with most of the glove stocks dominating the market. However, the topic of glove/ healthcare stocks may bore you readers at this point of time. Rest assured, this article is not about glove stocks. We would like to point out on the volume traded on Bursa Malaysia which has reached to all time highs of 9.5 Billion and 9.2 Billion. I believe that the new government and Finance minister is doing a great job in administrating the country at this point of time. However, this pace must continue in future to match financial markets such as Dow 30, Nikkei and Hang Seng Index.

Therefore, this leaves us with Fundamentally Strong Small-Midcaps growth stocks with the largest potential upside. Value shines within a company in this category - MSM BERHAD

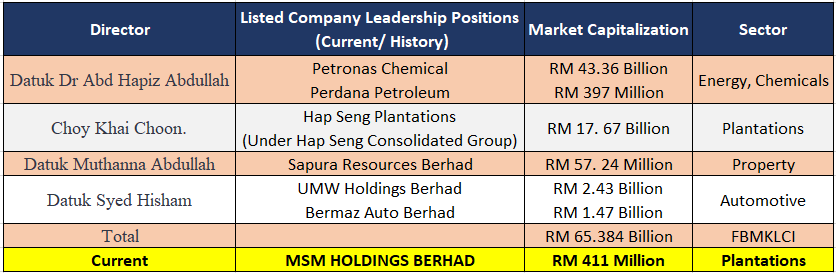

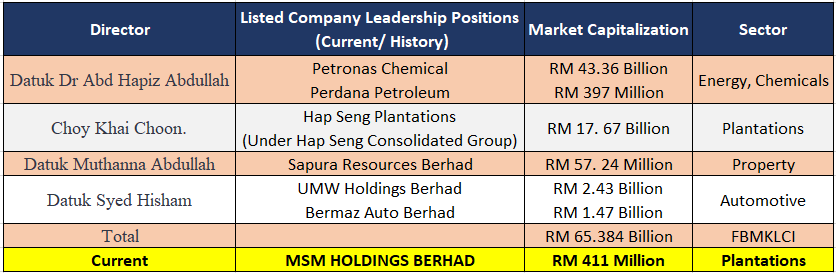

Management is Heart of Company's Value.

As you can see, MSM has just appointed four briilliant directors on their board.

The new directors consist of former Petronas Chemical Bhd President cum chief executive officer (CEO) Datuk Dr Abd Hapiz Abdullah, former UMW Holdings Bhd president and group CEO Datuk Syed Hisham Syed Wazir, Datuk Muthanna Abdullah and Choy Khai Choon.

Yes, your new directors are also on the board of these companies. With their prudence, its not surprising if we can see MSM Average Market cap should be RM 1 billion at least. Lets move on to their earnings potential below.

POTENTIAL EARNINGS TURNAROUND

https://www.nst.com.my/business/2020/02/564491/msm-turnaround-fgvs-biggest-earnings-upside

https://www.theedgemarkets.com/article/msms-new-products-likely-contribute-earnings-fy20

https://www.theedgemarkets.com/article/msm-looking-penetrate-new-markets-segments

Most analyts have said that MSM will turnaround in 2020. We shall wait and see as there is still high demand for sugar. However, market sayers are also not ruling out the possibility of the company entering into different ventures.

Fundamentally, MSM also has a NTA of RM 2.36. This means that the current price is trading at a discount compared to its book value.

Chartwise, Potential Breakout

As investors can see, the price of MSM is clearly at a steep discount if you compare it to those days RM 4- 5. Some reputable Remisiers & Fund Managers have bought at those levels before. Therefore, the current price at RM 0.665 is rather low.

Therefore, fair value of this stock should be at RM 1.50 while strong resistance can be seen at RM 1.80. This stock may also be counted as a GLC play and should be seen for the long term.

CONCLUSION

As mentioned above, the value of an organization should be determined by its management at its core. The Management has first hand ability to lead the company to great heights, drive expansion and generate revenue. Therefore, at these price levels, investors should definitely keep an eye on this stock.

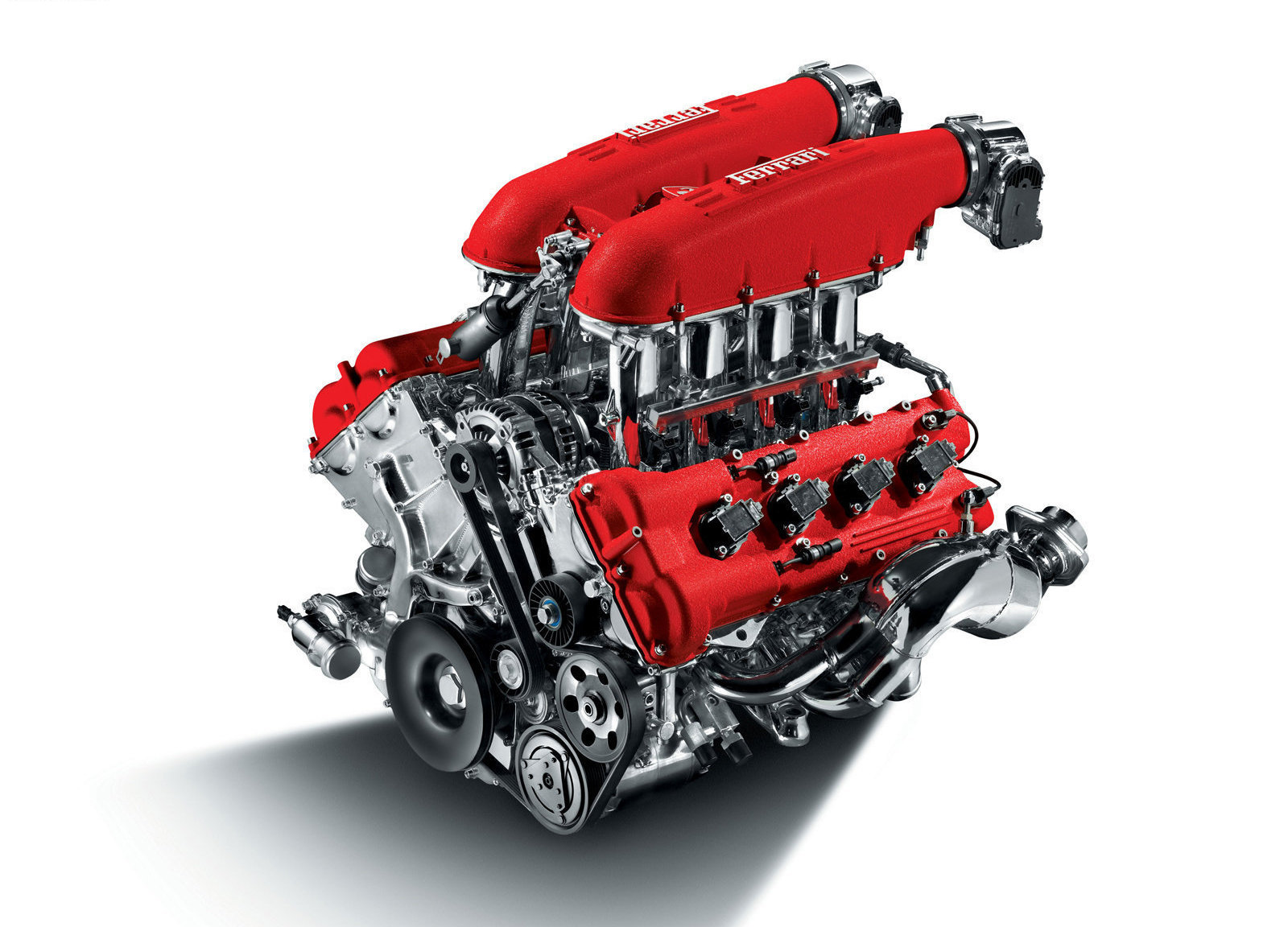

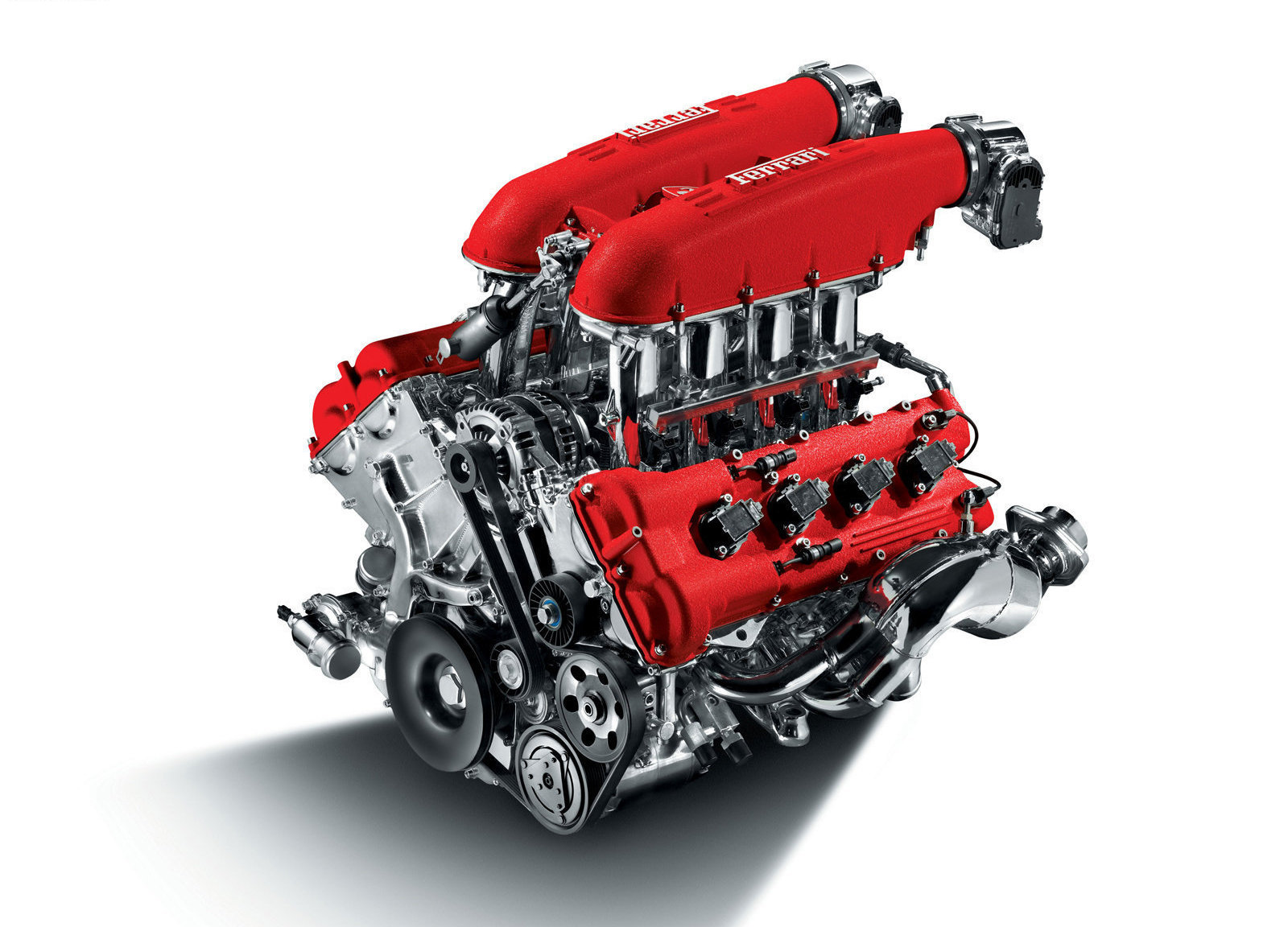

Food for thought : What happens when a Ferrari Engine is placed into a vehicle?

One thing for sure, its going to be pretty damn fast !

Wishing all valued readers an early Selamat Hari Raya !

Thanks for reading.

Best Regards,

Greatwarrants

Disclaimer:

Investing in stocks is a great tool for capital gains. However, all investments come with risk. Therefore, all investment decisions should be borne at your own cost and I will not be held liable for any investment decisions made. Do not buy Equities if you do not know the risk !! Thank you.