Public Packages (PPHB) Straightforward Overview

gregorythe2

Publish date: Tue, 02 Nov 2021, 04:53 PM

Public Packages

No part of this writing should be relied upon for investing decisions. I cannot guaruntee accuracy of information, including reported financial data or ratios. At the time of writing, I hold shares in PPHB.

Public Packages Holdings (PP Asia) design and manufacture paper packaging. They have exhibited especially smooth and sustainable growth throughout their history, and 45 years of experience in creating packaging for each stage of the supply chain.

Industry

At first glance, packaging is a boring industry. However, when you consider the way consumers interact with packaging, the potential for evolution in the industry becomes clear. Aesthetically pleasing designs can provide an enhanced purchasing experience for the customer, as well as providing physical protection and organizational benefits.

The industry is well established and widespread. Consumers interact with packaging on a constant basis, and interactions are increasing due to the prevalence of e-commerce. Efficient and high-quality packaging can reduce transport costs, lessen damage during transport, and improve sales by enhancing the consumer experience.

Global packaging is expected to experience a 7.5% CAGR over the next 5 years. Packaging in Malaysia is expected to grow at closer to 2.9%, after experiencing 9.8% for the past 5 years. In isolation, “e-commerce” packaging is expected to experience a 14.59% CAGR until 2026.

Industry profit margins are generally between 5 and 15%. Primary costs include raw materials and labor. Significant investment in plant, property and equipment is required for construction and printing. Distribution is an influential factor, and proximity to raw materials and customers is an advantage.

Because packaging represents an ongoing cost for businesses, they generally work hard to find the lowest price. Optimal manufacturing processes, including technologically advanced printing capabilities, can help companies to expand margins. Customers depend on packaging to be of a consistent quality and delivered on time, and these qualities can demand a higher price. Differentiating products can be achieved with unique designs, and this intangible value can generate even higher margins for suppliers.

The packaging industry has a firm base of essential demand. Producers can generally adapt to inflation by raising prices. In an economic downturn, competition becomes heated due to high barriers to exit.

Social trends are encouraging for paper packaging over plastic. Pulp is created from a combination of recycled paper, wood offcuts, and logs from sustainable crops. With the added benefit of biodegradability, paper is the preferred option for environmental reasons.

Research into alternative packaging methods is ongoing, however no suitable, cost-effective products currently exist.

Packaging is not attractive for potential entrants due to high capital intensity and a perception of low returns on investments. Additionally, new entrants struggle to compete with established companies with strong customer relationships.

Management

|

Average tenure |

14.25 years |

|

Relevant experience |

Decades of experience in current roles |

|

Other experience |

Community service, investing, information technology, taxation |

|

Total director-held shares |

Direct: 9.8m, indirect: 97.9m |

|

Remuneration |

Salary is appropriate to business size, substantial performance incentives account for 33-50% of total payments |

Executive director Koay Chiew Poh founded PPAsia. His two brothers and two sons also serve on the board. The families’ interests are well aligned with the company, collectively owning 5.23%. Non-family directors hold no shares.

Management’s focus is branding and design. Reported strategies include:

· Optimal placement of manufacturing facilities to minimize delivery and distribution costs

· The use of workflow optimization software to highlight potential efficiencies

· Automation of manufacturing

· Constant searching for new opportunities

· Broadening product range

· Maintaining the relevance of their brand.

They are currently pursuing high-margin display items, which are entirely based on design and graphics, maximizing intangible value in the product.

International expansion has been most successful within the Asia-Pacific region, with smaller operations in Europe and USA.

The company mission is to be Malaysia’s leading total packaging and display provider.

Around 2018, management expanded business into hospitality through The Prestige Hotel, located in the UNESCO heritage listed “Georgetown” in Penang. This segment is so far unprofitable.

Quality of Earnings:

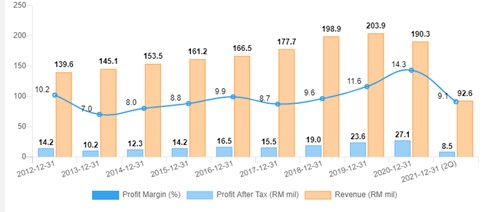

PP Asia have grown revenue in a smooth trend over the years, following the Malaysian packaging industry. They earn gross margins around 30% and net margins around 10%. Net earnings doubled between 2015 and 2020.

PP Asia were affected by working restrictions and lower demand during COVID. 2021 has been stronger, and their annual result is likely to improve. They appear likely to resume revenue growth this year.

Geographical contributions were 93% from Malaysia, 6.3% from Asia Pacific, and the remaining <1% from Europe and the USA.

91% of revenue comes from the manufacture of packaging- corrugated cartons, gift boxes, display items, and other packaging materials. Trading of non-packaging paper products provided 5% of total revenue. These segments generate similar profit margins, around 17%, with costs primarily driven by the price of paper.

PP Asia have a high-quality focus, which may expose them to global e-commerce trends as businesses become more reliant on packaging to enhance the customer experience. There is an opportunity to increase higher-margin sales of their premium goods.

Hospitality revenue from The Prestige was 4% of their total, but made a loss for the year. Given the prime location of their hotel, hospitality may provide more substantial contributions in the future. PP Asia’s investing and property segments also made a loss, although they are of negligible size.

PP Asia have well controlled administrative and distribution costs. Combined, they comprise about 25% of total costs, and remained unchanged during COVID. This may indicate that PP Asia had already achieved maximum efficiency before the events of 2019. Distribution costs are set to increase due to external forces, and PP Asia have responded with a “Lorry Scheme”, which provides long-term benefits to distribution staff and helps to control short-term costs.

Financial Strength and Capital Allocation

A breakdown of PP Asia’s balance sheet as of the last audited FY report is as follows:

|

Freehold land |

25.6mMR |

|

Investment properties |

4.9mMR |

|

Equity investments |

1.6mMR |

|

Buildings |

74.4mMR |

|

Cash |

80.1mMR |

|

Debt |

(30.3mMR) |

|

Total liabilities including debt |

(66.5mMR) |

|

Joint venture net value excluding non-cash assets |

(3.3mMR) |

|

Joint venture net value |

28.8mMR |

|

Net company value excluding buildings and joint venture non-cash assets |

42.3mMR |

|

Net company value including buildings and all joint venture assets |

148.9mMR |

The company have a secure balance sheet. They hold substantial cash reserves, with large portion of land and buildings assets. In the past, PP Asia carried debt roughly equivalent to their annual revenue, but since 2019 this has been reduced by 54%.

Most of PP Asia’s profits are reinvested to increase core capacity, efficiency, and quality.

They seek strategically located plants, with seven currently operating. They are in the process of integrating new technology in both manufacturing and administration to optimize workflow and maximize automation. Distribution capacity is increased with the addition of motor vehicles in their fleet.

The Hotel Prestige was a significant investment in a new line of business. It is well located and growing revenue but is yet to deliver a profit.

PP Asia own 50% of two joint ventures. PPH Teckwah Value Chain is a supply chain manager that includes e-commerce and is synergistic with packaging. They delivered PP Asia a profit of about 1mMR in FY20. New Merit Development is a property developer, providing just under 7mMR of profit in FY 20. Both ventures have satisfactory balance sheets.

PP Asia do not usually issue dividends, although they did so in 2019 and 2020 yielding 0.23%. They do not repurchase shares.

Their capital allocation strategy has produced a return on equity of around 10% per year. The company have a few paths available to increase this. They include making more sales of premium and display packaging and completing the integration of new technology to increase margins. Their joint ventures may also provide improved returns, but they are so far unproven.

Valuation

The current share price represents a PE of 5.22.

The price to reported book ratio is 0.55. A book value comprised of their cash, property, and equity assets less liabilities would provide a PB of around 1.05.

Given these ratios, PP Asia shares appear to be good value for a company with a net margin of 10%, stable revenue, and the potential to grow. The price ran up on good quarters at the end of 2020 and 2021, before returning to a higher base each time.

In my estimation, PP Asia need only to perform at their current levels and adjust prices for inflation for the next 5 years to make an investment worthwhile. Any additional level of success should provide additional returns.

Risks and Threats

Investments: PP Asia’s investments in other lines of business could ultimately fail. They may have been better off sticking to their strengths. Additionally, they motivation for these investments could be a lack of confidence in the future of their current business. On the other hand, the company may simply view their core capacity as limited rather than doomed, and their ventures into other lines of business may be an intelligent use of excess capital, providing exposure to a potentially higher ROE.

Competition: The packaging industry is flooded with competitors. While suppliers can generally defend established customer relationships, they may struggle to grow into new markets. The most surefire way to compete is to lower costs. PP Asia have ongoing investments in technology that aims to improve efficiency.

Paper costs: PP Asia are highly exposed to paper prices, which comprise 60% of productions costs. Paper reserves worth 7mMR help to minimize the impact of price fluctuations, but a long-term cost increase could negatively affect industry-wide conditions.

Manufacturing and human capital: Manufacturing is always at risk of accidents that destroy property or cause injury. Assets can also be destroyed by external catastrophes. Avoidable injuries and mistreatment of workers are more probable and can have long lasting negative effects on the company’s reputation. Manufacturing failures can also lead to faulty products, damaging the perception of reliability.

Brand: Customers depend on consistent and on-time products for their own operations. In many cases, a reliable brand is better than a cheap one. Brand value can be damaged by specific events or eroded over time with poor performance. Should this befall PP Asia, they would invariably lose sales to competitors, and may not be given the chance to recover.

Demand: Packaging suppliers are heavily reliant on strong demand. Fierce competition would result in a reduction of demand, with companies sacrificing significant value to avoid failure. There is some movement away from packaging use due to environmental concerns. Paper is less environmentally damaging than plastic, however, and packaging provides irreplaceable value to consumers. The current expectation is continued growth in demand.

Distribution: Freight costs have grown significantly of late. The result is increased costs for delivery of raw materials and finished goods. These effect the entire industry, and PP Asia have an advantage with some distributive control in Asia, and a joint venture in a supply chain management company that may benefit from this trend.

Conclusion

PP Asia have longstanding experience in the packaging industry. They are family and founder led and have sustainably grown revenue for decades. The industry in which they operate is well established, and price competition is fierce. PP Asia appear to control costs very well.

Net earnings are around 10%. PP Asia could expand their margins with higher levels of automation and premium products. However, the pace of growth in packaging is limited, and management have chosen to allocate capital to alternative potential revenue streams in hospitality, property development, and supply chain management.

COVID negatively affected PP Asia’s businesses, and lead to a rare decrease in revenue. Ongoing cost increases are a significant threat. These cost increases are weighed against increasing product demand, and the evolution of paper packaging through e-commerce.

Shares of the company appear cheap. They have amassed substantial assets, and the reported book value per share is almost twice the current price. Even the most conservative estimate of their true book value provides significant downside protection.

With their strong balance sheet and successful history, PP Asia are prepared for successful navigation of the post-COVID environment. Their future is exposed to economic conditions in Malaysia and China, but should no significant interruptions occur, it is probable that PP Asia will resume their growth in both revenue and margins. Their alternative investments appear likely to contribute positive returns in the future.

More articles on Gregorythe2 writing

Created by gregorythe2 | Jan 03, 2022

Discussions

I haven't looked at other packaging companies, my method is to find the most stable, long term growth stories. Very basic, but if I can find a 30-year stock chart that just goes from bottom left to top right, I look hard at the company.

I will be sure to post if I look more deeply at the packaging industry, but right now I'm not certain of PPAsia's specific advantage. Definitely a worthwhile area of future study.

2021-11-12 16:33

observatory

Thank you for another very well written piece with detailed analysis and a lot of useful information.

Comparing Public Packaging against its peer Master Pack, and Muda Holding (which also has paper mill operation), PPHB appear to to have lower valuation at ~5X historical PE versus ~7X for the other two. This is despite past 10 year record showing Public Packaging managed to achieve better ROE and net margin.

I wonder whether it has to do with Public Packaging poor dividend records. Unlike its peers it has not paid dividends for almost 10 years before some token of appreciation recently. My view is given its ROE is just about matching cost of equity, a good manager would have returned a higher percentage of earning to shareholders.

Any thought on the comparison across there few corrugated packaging companies, and also comparison across flexible plastic packaging companies (besides the sustainability issue)?

2021-11-06 11:45