Airasia (AIRASIA) Straightforward, objective overview

gregorythe2

Publish date: Mon, 08 Nov 2021, 04:25 PM

Airasia is a notorious topic of conversation among Malaysian investors. Recent events have had severe consequences for the company, and many people have been personally let down. The company are frequently exposed in the media, and have a long history of generating excitement, perhaps even hype. With all that said, I have written this report as a straightforward overview of Airasia, free of distractions. I cover the industry, management, financial strength, capital allocation, valuation, and risks & threats. I aim to be objective, but it must be said that I like this company and own a small position at the time of writing.

Please be aware that I am not a professional investor- I do this because I enjoy it. This is not advice, and I cannot guarantee accuracy of information included. I make no recommendations for your investing practice.

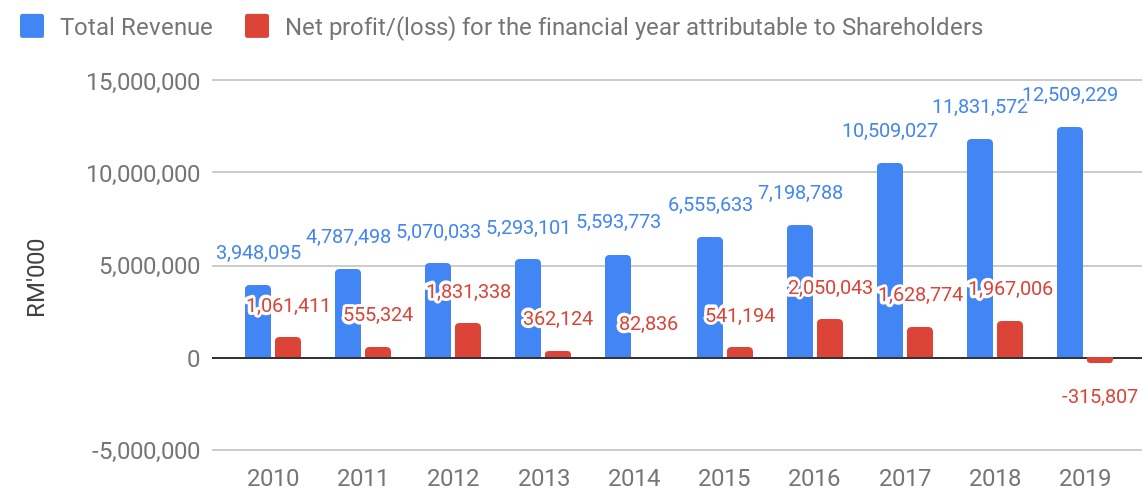

Airasia began as a government-owned venture, accumulating RM11m worth of debt between 1993 and 2001 before being handed to the current managers. The airline grew as a low-cost carrier (LCC) to become the largest in Malaysia, won various accolades for their performance, and is one of the lowest cost-per-passenger airlines in the world. Revenue topped out in 2019, and since the third quarter of that year, Airasia have made consecutive losses.

The company have shifted toward digital technology with a “super app” that provides a one stop platform for travel related goods and services. They run a financial technology service “BigPay”, and a package delivery service “Teleport”.

Industry

Airlines add value to society by providing the fastest and easiest way to transport people and small cargo. The industry has matured over many decades, and the most important factors, safety and speed, are standardized.

Air travel has saturated its wealthier markets, and many carriers have settled on an appropriate mix of customer service and capacity. In emerging markets, airlines have room to grow. Cost has been the biggest barrier to widespread use, and LCCs like Airasia aim to drive costs down to make air travel accessible for everyone.

Between 1998 and 2019, LCC’s in the Asia Pacific grew from being a negligible component of the airline market to comprising 29%. Going forward, the global market is estimated to experience a 7.2% CAGR in the next 6 years (GLOBALNEWSWIRE), with faster growth in Asian emerging markets.

LCC’s use different combinations of techniques to lower costs while preserving a certain level of service. They aim to simplify operations, often using one kind of aircraft or offering a single class of ticket. Other techniques involve collaborating with airports to reduce costs per passenger and offering additional “ancillary” services like meals or iPads for a fee. The success of an individual company depends on how intelligently they can combine these techniques while maintaining an attractive product.

External forces are generally positive for the industry. Low-cost travel is good for the wider economy, and politicians and governments encourage growth. Airlines help to satisfy our deep human need to explore, and while COVID restricted flights, the demand for travel is ever strong. The global connection to information provided by the internet further exposes the world’s population to air travel.

A trend that may negatively impact the industry is the growth of remote work. Many airlines depend on high-margin business bookings for their profits, and this source of revenue is expected to decline significantly. LCC’s are like Airasia are less exposed to business travel than full-service airlines.

Competition among LCC’s is fierce. Airlines are common target for entrepreneurs, and entrants can lease aircraft and offer very low fares at launch to generate exposure. Upon exiting, leases have a predictable, transferrable value, dependent on present industry conditions.

Consumers generally trust that new airlines have passed all the rigorous safety standards and will purchase the cheapest ticket available. Aggressive marketing techniques are an industry theme and developing a strong brand can attract ticket sales and improve the subjective elements of the customer experience.

Once established, the strongest competitive advantage is having the most profitable mixture of cost-saving techniques while avoiding damage to the airline brand. This feat requires a precise operating model and an intimate knowledge of the target consumers.

Management

|

Average tenure |

11.5 years |

|

Relevant experience |

2 directors served since re-launch in ’01 |

|

Notable other experience |

Portfolio management, senior management of large enterprises |

|

Total shares held |

Direct: 4.9m Indirect: 2.05b |

|

Remuneration |

Co-founders receive large salaries, RM4.8m. Other directors are paid fees appropriate to the size of the company. Cash or share bonuses are available for high performance, with none awarded past FY. |

Three current directors were acquirers of Airasia in 2001. Kamarudin Meranun and Tony Fernandes are co-founders who managed the group through their rapid growth period to the present day. Investing and entrepreneurship are common themes in executive management, although there is a lack of special experience in aviation or customer-service.

The acquirers’ strategy for Airasia proved wildly successful. They achieved operational excellence and high returns on their investment, which is a strong endorsement of their profit generating abilities.

Non-executive director Stuart Dean is a highly accomplished manager, previously ASEAN president of the global enterprise General Electric. Other non-executives fill the roles of accounting and law.

Key management have mixed levels of experience, with some beginning near the airline’s re-launch in the early 2000’s, but many being recruited within the past 5 years. There is a technology theme in key management’s experience, and a clear aim to bolster Airasia’s digital platform.

Management’s overarching strategy is to incorporate a leading digital travel and lifestyle platform: the Airasia super app. This platform provides straightforward access to company owned and third-party goods and services. Fintech and rapid delivery operations are additional developing streams of revenue.

These new lines of business were in the making before 2019, but COVID inspired a faster and harder pivot. They provide an attractive long-term focus for the company, and somewhat distract from the group’s immediate concerns. The future focus may play a key role in attracting the support necessary to survive the next few years.

The strategy to survive the past year was based on cost cutting and fund raising. Staff costs were reduced by 38%, and total fixed costs by 52%. Businesses have been sold off or reduced- Airasia Japan was shut down and the companies stake in Airasia India was cut by a third. Some lease payments have been deferred. The company raised RM336m through private placements and aim to raise a further RM2-2.5b.

As the pandemic subsides, Airasia hope to recover airline revenue and maintain their competitive advantage, allowing them to offer the best value for money for most travelers while still turning a profit. By most estimates, Airasia will need some additional level of outside relief to avoid breaking their financial obligations. Their history of contributing positively to society, including the employment of over 18 thousand people, increases the chance of this happening.

Financial Strength

A few important asset and liability values as of last audited report FY’20:

|

Owned aircraft, land and building assets |

RM1.4b |

|

Cash and investment securities |

RM1b |

|

Borrowings and lease liabilities |

(RM13.7b) |

|

total |

(RM11.3b) |

|

Total other liabilities |

(RM9.51b) |

|

total |

(RM20.1b) |

|

Inventory, receivable, and pre-payment assets |

RM4.15b |

|

total |

(RM16.7b) |

|

Reported total assets-liabilities |

(RM3.57b) |

The first accrued total in this table represents the net value of Airasia’s most reliable assets minus their debts and lease liabilities. 99% of these liabilities are for aircraft leases, representing an agreed upon payment for future use of the aircraft. While there is a contractual obligation, the lessor may be flexible as the aircraft can be returned or terms re-negotiated.

The second total includes all other liabilities. It represents the maximum amount of money Airasia owes, minus their most reliable assets. This amount is roughly twice their annual revenue at full capacity.

The third total supposes that the company can carry on doing business and realize the value of more of their assets. The “reported total assess-liabilities” assumes the full value of all assets. This number has decreased further in the last quarter, to (RM5b).

Payments on leased aircraft are a regular part of Airasia’s cost of doing business. While their obligations are high, they are less worrying than borrowings due. Negotiation of leases is ongoing, and the outcome is uncertain.

They may be forced to return the aircraft and pay the lessor for the breach of contract, but it is also possible that payments are deferred until Airasia can return to profitability. Raised funds and other financing options may allow the business to continue, although it may result in dilution or accrual of more debt.

If Airasia are unable to return to profitability and are forced to liquidate, there is no net value available for shareholders. If they can continue, the company should be able to realize the full value of their assets and leases and generate profits as they have in the past.

Capital allocation

Airasia have made a median return on equity of 16.2% over the past 10-years. The driver of these returns has been consistent performance in the difficult airline business. Growth in the ASEAN LCC market is expected to resume with post-COVID tailwinds, and if their digital businesses succeed, returns on equity are expected to be higher.

Airasia’s primary investing activity is increasing their core capacity with additional aircraft and related infrastructure. This has included adding international operations in 24 countries. They aim to strategically increase their seat capacity and available routes.

They have been investing in digitization for most of the 2010’s. This increased drastically in 2018 through to the present day, as Airasia have built out their platform capabilities, and added the digital education subsidiary Redbeat in partnership with Google.

They have acquired a list of controlling and non-controlling interests over the years. Targets for acquisitions are digital platforms as well as food, delivery, and freight related businesses.

Airasia’s investments target airline synergy (super-app platform, fintech flight reward points, on-board meals, and freight on commercial flights), but can also stand alone as profitable segments. The investments represent an ongoing effort on behalf of the acquirers Kamarudin Meranun and Tony Fernandes to generate substantial returns on invested capital. They also make the airline appear more attractive to long-term investors.

Airasia do not employ buybacks- rather, they have engaged in activities that substantially diluted shares in both 2017 and 2021. They pay out dividends according to company performance, yielding up to 8.08% in 2018, though none in the years since.

Quality of earnings

About 80% of revenue comes from flights sold to customers. Airasia are the preferred choice in Malaysia, where they have the highest market share and cheapest price of any airline. The trend of growing revenue was intact between 2008 and 2019, backed by a fleet of aircraft growing in the same way. Revenue decreased by 74% in 2020.

Many LCC’s differentiate their brand by offering things like more legroom or a higher baggage allowance. Airasia offer no unique free extras but find a competitive advantage in their intelligent evaluation of the customer’s desires. They have determined the most important operating factors are and provided nothing beyond that. Highly effective marketing has helped them to build a trusted brand, and customers are generally happy with this minimum level of service, evidenced by a satisfactory net promoter score of 52.

Ancillary services comprise the second highest revenue contributor, generally a little under 20%. A growing theme among LCC’s is to charge exorbitantly for these extras. Airasia’s ancillary prices are comparatively fair. Airasia do not outsource wherever possible, helping them to earn a worthwhile margin. Management’s decision to abstain from profiteering on ancillary services has been positive for their brand and ticket sales.

The third major contributor of revenue is freight. Freight is broadly standardized but capitalizes on the unoccupied weight on commercial aircraft. Airasia have branched into owning a freight service, Teleport, that allows them to control the operation. Teleport aims to differentiate its brand by delivering packages with ASEAN in under 24 hours.

Digital revenue is loss-making, although provided 42% of total revenue in the COVID affected Q4’20. Revenue comes through partnerships with products and services sold through the app, and personalized advertising. Digital capabilities are also credited with the ability to boost performance in their other businesses through data collection and analysis.

Airasia have an excellent touchpoint to expand the use of their digital services as passengers install the super-app to book flights and order ancillary services. There is a clear path for growth, and a precedent of similar apps generating high margins. The app is rated 4.5/5 (20k ratings) on the Apple Store and 3.7/5 (200k reviews) on Google Play.

There are a few factors that threaten Airasia’s major income streams. The cost of fuel is a key driver of airline margin fluctuations. The company attempt to minimize this with hedging strategies, but fuel prices have been especially damaging lately. COVID has been blamed for the unpredictable nature of prices.

COVID has also led to reduced ticket sales, which not only impaired revenue but had a secondary effect causing significant brand damage. The demand for customer service increased, and poorer outcomes have resulted. Flights have been cancelled and rescheduled regularly, and the company have refused refunds as much as possible. This created an ongoing, highly visible sense of customer dissatisfaction toward Airasia on social media.

Risks and threats

· The highest risk is that lessors do not renegotiate favorable terms with Airasia, and rights of aircraft use are withdrawn. They may be unable to source aircraft elsewhere, permanently halting operations.

· The airline may negotiate a deal with lessors or other sponsors, but the terms could be excessively dilutive. This would be a repetition of previous dilutive events.

· The effect of catastrophe is especially high in airlines. An adverse event would result in company destroying financial and brand damage. A COVID spreading event would be similarly damaging.

· The ongoing service disruption has already damaged their brand. As it continues, more customers are dissatisfied, which could lead to materially reduced ticket sales into the future.

· Competition is fierce, and new entrants appear periodically. They often launch with loss-making fares, taking customers from existing airlines. If an entrant were to develop a sustainably cheaper operation, it would remove Airasia’s advantage as the first-choice airline.

· The fuel price is currently trending higher. Should it continue to climb, Airasia would be disproportionately affected due to their weak balance sheet. Competitors could take advantage of this, offering cheaper flights and pricing Airasia out of the market.

These risks are amplified by Airasia’s poor financial position. If any were to materialize before Airaisa can recover from COVID, it would likely result in total company failure.

Company advantages

· Experienced management with a track record of making excellent investing decisions

· Imminent COVID recovery with expectations of further growth in the ASEAN LCC market

· Provide impactful benefits to society by allowing everyone to fly

· Favorable economic, political, and social external forces

· Proven business model

· Synergistic digital, food, and freight ventures

· Highly integrated into the community, with 18k employees and the largest market share in Malaysia

· Revenue from multiple sources and countries

· Less exposed to predicted decline in business-related travel than full-service airlines

These advantages increase the likelihood of favorable lease negotiations or financial relief from their current situation. Airasia can make a strong case that they will ultimately succeed and offer outsiders an opportunity to be a part of that success.

Valuation

Airasia’s valuation is purely speculative of future earnings- there is no tangible value in the company. Their market cap is RM4.36b, and if they can return to previous earnings of about RM2b, the resulting PE is 2.2. Before COVID, they traded at a PE of around 4.

Their liabilities can be paid off during the regular course of business, although borrowings and placement activities will negatively impact the value of each share.

If the business survives, they appear capable of returning to their pre-covid earnings and may be valued higher with their potentially successful digital business. A scenario where shares more than double in the next few years is plausible.

The market, therefor, is placing a high chance of failure upon the business. This may be increased by visible negative consumer sentiment online, coupled with poor COVID recovery sentiments in Malaysia. In my opinion, their chance of failure is lower than what the share price indicates. Importantly, if the business does fail, shares will go to zero.

Conclusion

Airasia was a success story for Kamarudin Meranun and Tony Fernandes, who acquired the airline in 2001. They manage the company to this day, maintaining its strong brand and operational capabilities to serve customers with the cheapest flights in the ASEAN region.

The airline is a key driver of societal development within Malaysia and the surrounding region. Long-term industry growth is expected for the foreseeable future, although the rate of growth has become limited.

In response to slower growth, the acquirers shifted their focus to the digital space, with the creation of a travel and lifestyle super app. With this and other ventures, they aim to build on the Airasia brand and operations, creating synergistic value and diverse revenue.

This digital focus was accelerated when COVID halted flights around the world. Management appears certain that their digital ventures will succeed, but for this to occur, the business must survive short-term.

Airasia have cut costs wherever possible. Their borrowings are manageable, but their airline has a distinct lack of tangible assets. Aircraft leases are the most worrying liability for the company, with obligations worth more than their best year’s revenue. They have raised substantial capital through dilutive placements and sales of assets, but a renegotiation of their leases is essential.

They have a proven ability to provide value to both shareholders and society in general. There is a good chance that management can negotiate further financial aid and lease terms that will allow them to continue, though it may involve a substantial sacrifice of value. If they cannot, the company will fail.

Such a binary outcome is generally unfavorable for investors. However, in this case, I believe the likelihood of failure is lower than the current price implies. If they survive and return to profit, the share price would double based on historical valuations.

Improving macroeconomic conditions could allow Airasia to further expand the airline business, and there is a genuine possibility of further success in the digital space. These conditions are not so improbable, and should they materialize, Airasia’s valuation should increase many times over in the next few years.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Gregorythe2 writing

Created by gregorythe2 | Jan 03, 2022

Discussions

Thanks for that information. I had no idea; it looks like the report was quite impactful. It is not a very honest way of doing business, although from what I understand the money was still earned under the airasia brand and transferred to the group in an unconventional way. It appears to no longer be an issue for the last few years, and may further explain the group's pivot to digital, seeking those high returns, since they have failed to turn a good profit since they stopped making those leases.

I really appreciate your reply and I'll be sure to dive a bit further back on my quality of earnings evaluation- I had only looked at the recent years, but I obviously need to evaluate the years that they were performing the best if I want to assert that they may do so again.

Thankyou again!

2021-11-11 18:58

Sslee

https://klse.i3investor.com/blogs/PilosopoCapital/2020-08-30-story-h1512605220-_CHOIVO_CAPITAL_Airasia_Group_Berhad_5099_The_RM6_Billion_Baggage_Fee.jsp

Read carefully (revenue from 2000 to 2019) and know where the Profit come from?

Aircraft Operating Lease Income

With the purchase of these huge purchase planes to fund their regional ambitions, as stated previously, Airasia, the Group Company now had a new income stream that would grow far more profitable than expected.

It would not be unreasonable to say that by 2016, this has grown to be their second largest revenue and largest profit contributor.

Without it, the Airasia Group would be lossmaking.

Externally, this also caused huge headaches with accusations by GMT Research that Airasia was only profitable due to the leasing of these planes resulting in profit transfers from unprofitable regional Joint Ventures, to the group holding.

2021-11-10 20:55